GIFT City, India's first International Financial Services Centre, offers you tax advantages that can save thousands annually. You get 100% tax exemption on derivative income, zero transaction taxes, and capital gains rates as low as 9%. The Finance Bill 2025 expanded these benefits further, with changes effective April 2026.

Through the right investment route, you can completely avoid filing tax returns in India, eliminate currency conversion costs, and keep more of your returns. This guide shows you the exact tax rates, compares routes, and helps you maximize benefits while staying compliant.

Key Takeaway

GIFT City's tax structure can save you between 10% to 30% on investment taxes compared to mainland India investments.

Here's what you'll learn:

- How Section 10(4E) provides 100% tax exemption on derivative income and OTC transactions

- Exact tax rates for FPI, AIF, and PMS routes with real savings calculations

- When Category I and II AIF investors avoid filing tax returns completely

- Smart strategies combining DTAA benefits with GIFT City for zero-tax jurisdictions

- Budget 2025 changes including P-notes expansion and April 2026 ETF relocation benefits

GIFT City functions as foreign territory under the Foreign Exchange Management Act. This special status changes everything about how your investments get taxed. When you invest through GIFT City's International Financial Services Centre, you're technically making offshore transactions even though the physical location is in India.

Regular Indian investments require you to convert currency to rupees, pay Securities Transaction Tax on equity trades, and navigate complex repatriation procedures. GIFT City eliminates these hassles completely. Your investments remain in foreign currencies like USD, EUR, or GBP without forced conversion.

The biggest difference shows up in transaction costs. Your GIFT City investments are exempt from Securities Transaction Tax, Commodity Transaction Tax, stamp duty, and GST. If you trade ₹10 lakh in Mumbai equities, you pay ₹1,000 in STT. In GIFT City, you pay zero.

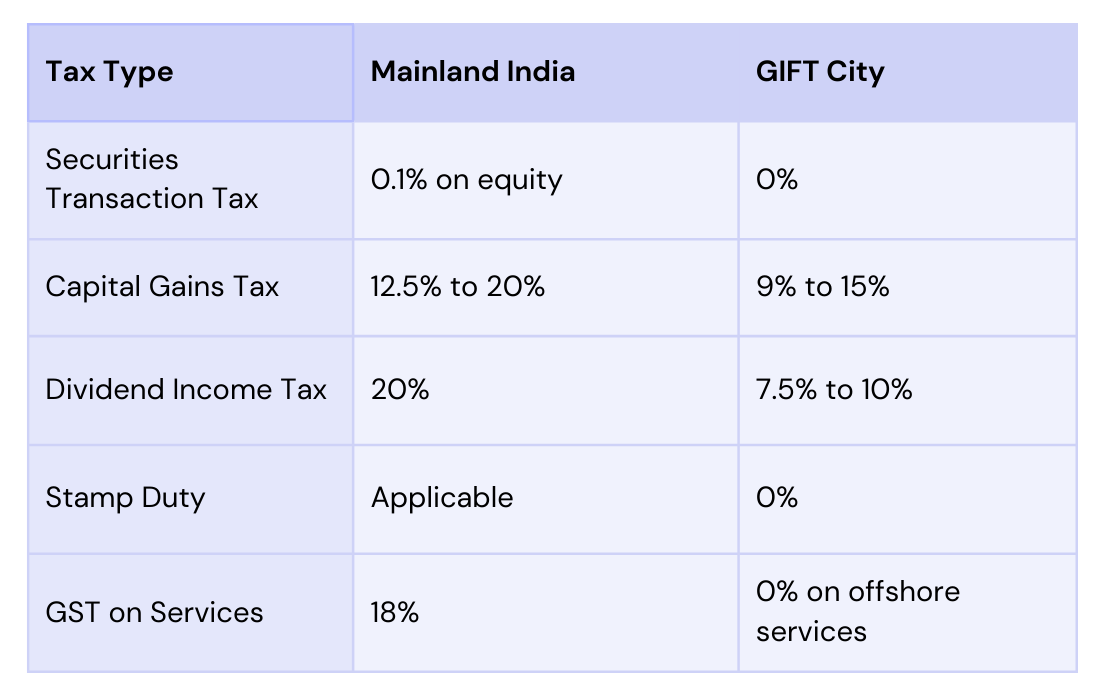

Here's the tax comparison that matters to you:

The International Financial Services Centres Authority regulates GIFT City with global standards. This regulatory framework ensures your investments meet international compliance while you enjoy India's tax advantages.

Understanding Section 10(4E): The Foundation of GIFT City Tax Benefits

Section 10(4E) of the Income Tax Act stands as the cornerstone provision for your tax benefits in GIFT City. This section provides you with complete tax exemption on income from non-deliverable forward contracts, offshore derivative instruments, and over-the-counter derivatives.

Before Finance Bill 2025, these exemptions applied only to your transactions with offshore banking units. The scope was limited and many of you couldn't access the benefits. Now, the game has changed completely.

The Finance Bill 2025 expanded Section 10(4E) to include your transactions with Foreign Portfolio Investors operating in GIFT City. This expansion allows you as a non-resident to interact with FPIs within GIFT City while enjoying full tax exemption on your derivative transaction income. You can now trade derivatives through FPIs and pay zero tax on those gains.

Which instruments qualify for this exemption? The list includes non-deliverable forwards (NDFs), offshore derivative instruments (ODIs also called participatory notes), and over-the-counter derivatives entered with GIFT City banking units or FPIs. Interest you earn from money lent to businesses in GIFT City is fully tax-free.

Budget 2025 also extended tax exemption on participatory notes to include those issued by non-banking FPIs based in GIFT City. This change takes effect from April 1, 2026. Previously, only banking units could issue P-notes with tax benefits.

The practical impact for you? If you're earning derivative income through GIFT City fund routes, you enjoy complete tax exemption. There's no percentage to calculate, no forms to file for this specific income. It's entirely tax-free in India.

Ready to explore tax-efficient investment options? Download the InvestMates app to track your GIFT City portfolio alongside your other investments, all in one secure dashboard.

How Much Tax Do You Actually Pay on Different GIFT City Investments?

Your tax rates vary significantly based on the investment type and when the instrument was listed. Understanding these specifics helps you plan better.

Capital gains on IFSC-listed shares and derivatives are taxed at 9%, considerably lower than the 20-30% rates elsewhere in India. However, timing matters for you. Bonds listed on IFSC exchanges before July 1, 2023 enjoy a concessional 4% tax rate. Those listed after this date face a 9% rate.

Your dividend income from IFSC units gets taxed at just 10% plus applicable surcharge and cess. This is half the 20% rate applied to mainland India investments. For your investments through the FPI route specifically, dividend income faces an even lower 7.5% effective tax rate.

Interest income tells an even better story for you. Foreign currency deposits you hold in GIFT City International Banking Units are completely tax-free in India. You earn 2.5% to 5% annual interest without any Indian tax deduction. If you're based in UAE or other zero-tax jurisdictions, you keep 100% of these returns.

Your capital gains through the FPI route are taxed at an effective 15% rate. Category III Alternative Investment Funds that invest in specified securities can transfer these without any capital gains tax in India for you as a non-resident investor.

Here's what these rates mean in real money for you. Suppose you invest $100,000 through GIFT City and earn $10,000 in capital gains. At the 9% IFSC rate, you pay $900 in tax. The same investment in mainland India at 20% costs you $2,000. You save $1,100 just from the lower rate.

For you as a UAE-based NRI, GIFT City's advantages compound. India doesn't tax your GIFT City income, and UAE doesn't tax it either. You face zero taxation on qualifying investments.

Which Investment Route Offers the Best Tax Benefits for Your Situation?

GIFT City offers you four main investment routes, each with distinct tax treatment. Your choice depends on your investment size, control preferences, and tax optimization goals.

The Foreign Portfolio Investment (FPI) route caps your individual participation at 25%, with a maximum 50% aggregate NRI investment limit per scheme. Your capital gains face a 15% effective tax rate, while your dividends are taxed at 7.5%. You don't need a PAN card for this route, which simplifies your compliance significantly.

Alternative Investment Funds deliver superior tax efficiency for you. Category I and II AIFs provide you with a tax pass-through structure with all taxation handled at the fund level, freeing you from individual tax planning concerns. The minimum investment you need dropped to $75,000 in February 2025, down from $150,000.

The biggest advantage for you? If you invest exclusively through Category I or II AIFs, you're completely exempt from filing tax returns in India, provided the AIFs have already deducted appropriate taxes. You also don't need to obtain a PAN card. This exemption simplifies your compliance dramatically.

Portfolio Management Services calculates capital gains in your individual name. You need a PAN card and must manage your own taxation. Budget 2024 increased PMS tax rates significantly for you. Your short-term capital gains now face a 24% effective rate, up from 15%. Your long-term capital gains are taxed at 15%, up from 10%. Dividends you receive carry a 20% base rate, rising to an effective 24% with surcharges.

Despite higher rates, if you're from countries with Double Taxation Avoidance Agreements, you can claim tax rebates to avoid double taxation.

GIFT City mutual funds offer you unique currency flexibility. You invest and withdraw in your foreign currency, protecting your returns from rupee depreciation. These funds eliminate TDS deductions that apply to your traditional Indian mutual fund investments. Most currently operate through the AIF structure with a $75,000 minimum you need to meet.

Which route fits you? If you want long-term capital appreciation with minimal tax hassles, choose the AIF route. For active portfolio management with ready access, PMS works better for you despite higher taxes. Looking for derivative exposure? Your derivative income through GIFT City fund routes enjoys complete tax exemption unlike the FPI route with its participation caps.

When Can You Completely Avoid Filing Tax Returns in India?

This is the question that excites most of you. The answer depends entirely on your investment structure.

If you invest exclusively through Category I or II Alternative Investment Funds located in GIFT City's IFSC, you don't need to file tax returns in India if the AIFs have already deducted tax on distributions. This exemption also removes the PAN card requirement for you.

Category I AIFs typically invest in startups, early-stage ventures, and infrastructure projects. Category II AIFs include private equity funds and real estate funds. Both categories handle all taxation at the fund level, not at your individual investor level.

The mechanics work like this for you. When the AIF earns income or realizes gains, it pays applicable taxes before distributing remaining amounts to you. Since the fund already handled taxation, you're exempt from additional filing obligations. Your distributions arrive net of tax.

Category III AIFs operate differently for you. These hedge fund-style vehicles tax you individually on attributable income. However, as a non-resident investor in Category III AIFs, you receive tax exemptions on income from transfers of specified securities, income from non-resident securities (excluding PE), and certain securitization trust income.

What about your other investment routes? You don't need PANs as an FPI investor, but you may have filing obligations depending on your total Indian income. If you're a PMS investor, you must obtain PANs and file returns individually since your gains are calculated in your personal name.

The exemption only applies if your sole Indian income comes from Category I or II AIFs in GIFT City. If you have rental income from Indian property or interest from mainland bank accounts, you still need to file returns for that income. Understanding your complete NRI tax filing requirements helps you stay compliant.

For services provided to you as an offshore individual through GIFT City investments, no GST applies. Management fees and carry portions from AIFs face just 18% tax, but these are fund-level costs that don't create filing obligations for you.

How to Maximize Tax Savings Through Strategic Planning?

Smart tax planning combines the right investment route for you with proper documentation and timing. Here's how to optimize your GIFT City tax benefits.

Start by aligning your route choice with your financial goals. For long-term wealth building without tax complications, AIFs make the most sense for you. All taxation occurs at the fund level, eliminating your individual tax planning. If you prioritize active management and ready liquidity, PMS suits you better despite individual taxation requirements.

Your residency country matters enormously. India has Double Taxation Avoidance Agreements with over 90 countries. These agreements become particularly advantageous for you if you reside in zero capital gains tax jurisdictions like UAE, Singapore, and the Netherlands.

To utilize DTAA benefits, you need to obtain a Tax Residency Certificate from your country of residence. This document officially verifies your tax status. Additionally, you should prepare Form 10F and Form 67 for submission to Indian tax authorities when you claim treaty benefits. The combination of GIFT City's low rates with DTAA provisions can effectively reduce your tax to zero in many cases.

Your investment timing impacts tax efficiency too. As mentioned earlier, bonds listed before July 1, 2023 face a 4% tax rate while those listed after carry 9% tax. If you're choosing between similar bond investments, opt for the one with the earlier listing date when possible.

For you as a UAE-based NRI specifically, GIFT City aligns perfectly with your zero-tax environment. India doesn't tax your GIFT City income and your residence country has zero tax, so you keep 100% of returns. This makes GIFT City far more attractive for you than traditional Indian investments that deduct 20% on capital gains.

Currency matching provides another strategic advantage for you. If you earn in USD or AED, holding your GIFT City investments in matching currencies protects you from rupee depreciation. You avoid conversion costs and currency risk.

Track your global portfolio effortlessly - InvestMates lets you link 100+ Indian and US institutions, monitor real-time prices, and access AI-powered insights for smarter wealth management across borders.

What Changed in Budget 2025 and What Takes Effect in April 2026?

Budget 2025 delivered several game-changing announcements for you as a GIFT City investor. Understanding these helps you plan ahead.

The tax holiday for IFSC businesses got extended until March 2030. Previously, sunset clauses created uncertainty for you with frequent two-year extensions. The five-year extension provides you with much-needed policy certainty. Companies operating in GIFT City continue enjoying 100% income tax exemption for any 10 consecutive years within a 15-year block.

The participatory notes (P-notes) expansion represents a major shift for you. Budget 2025 extended tax exemption on P-notes to include those issued by non-banking Foreign Portfolio Investors based in GIFT City. Previously, only banking units in the IFSC could issue P-notes with tax exemptions for you as a holder. This change takes effect from April 1, 2026.

Why does this matter to you? P-notes allow you as an overseas investor to invest in Indian securities without SEBI registration, maintaining confidentiality. The tax exemption makes GIFT City more competitive for you than Singapore and Mauritius for issuing these instruments. Your dividend income on P-notes from GIFT City faces just 10% tax compared to 15% under Singapore's tax treaty.

The biggest April 2026 change for you covers ETF and mutual fund relocations. Many offshore funds tracking Indian indices were traditionally set up in low-tax jurisdictions like Singapore and Mauritius. Budget 2025 introduced a relocation regime allowing fund managers to shift these funds to GIFT City without you incurring capital gains tax.

This tax-neutral relocation encourages funds to move their base to India. For you as an NRI investor, this means more fund options at GIFT City with better tax treatment than offshore alternatives.

Life insurance policies you purchase from GIFT City received enhanced benefits too. Full tax exemption now applies on maturity proceeds when your premium doesn't exceed 10% of the sum assured. Previous restrictions based on absolute premium amounts (₹2.5 lakh for ULIPs, ₹5 lakh for other policies) no longer apply to you.

Ship leasing businesses received capital gains tax exemption under Section 10(4H). This positions GIFT City as a maritime finance hub. While this primarily benefits businesses, it attracts more companies to GIFT City, expanding your investment ecosystem.

How Do Transaction Tax Exemptions Save You Money?

The zero transaction tax environment creates compounding savings for you over time. Every trade you make avoids costs that mainland investors must pay.

Securities Transaction Tax typically costs 0.1% on equity delivery transactions in mainland India. It sounds small until you calculate your actual amounts. On a ₹50 lakh equity purchase, you save ₹5,000 in STT by using GIFT City. Make ten such trades annually and you've saved ₹50,000.

For your derivative transactions, mainland India STT ranges from 0.0125% to 0.05% depending on the instrument. If you're an active trader executing frequent derivatives strategies, you accumulate significant STT over a year. GIFT City eliminates this completely for you.

Goods and Services Tax on financial services typically runs 18% in mainland India. Your fund management fees, advisory charges, and other services attract GST. In GIFT City, services provided to you as an offshore individual are not under the GST purview and are exempted from GST applicability.

Stamp duty on your securities transactions exists in mainland India but not in GIFT City. Different states charge different stamp duty rates, typically 0.015% to 0.03% on your equity transactions. Again, you pay zero in GIFT City.

Let's calculate your total savings as a typical NRI investor. Assume you invest $100,000 (approximately ₹83 lakh) initially and trade actively through the year with your total transaction value of $300,000.

Your mainland India costs: STT of ₹30,000, stamp duty of ₹15,000, GST on management fees (₹10,000). Your total transaction taxes: ₹55,000.

Your GIFT City costs: Zero. You save ₹55,000 annually just on transaction taxes, not counting the lower capital gains and dividend tax rates available to you.

Over your 10-year investment horizon, these transaction tax savings compound. The money you don't pay in taxes remains invested for you, generating returns. This compounds your wealth significantly beyond just the initial tax saving.

Understanding FEMA rules for NRIs helps you ensure compliance while maximizing these tax advantages within the regulatory framework.

What Are the Tax Implications in Your Home Country?

GIFT City's Indian tax benefits are clear, but your home country's taxation determines your final tax bill. This varies dramatically based on where you live.

If you're a USA-based NRI, you face complexity due to PFIC (Passive Foreign Investment Company) rules. Most GIFT City mutual funds likely qualify as PFICs under US tax law for you. You'll need Form 8621 filings annually and face taxation on notional unrealized gains. This makes GIFT City mutual funds tax-inefficient for you despite Indian benefits.

However, some AIFs structured as partnerships might avoid PFIC classification for you. Your direct equity investments or US-based India ETFs may work better despite less favorable Indian tax treatment. Consult a US-India tax specialist before you invest.

If you're a UAE or GCC-based NRI, you enjoy the perfect scenario. UAE, Bahrain, Oman, Qatar, and Kuwait offer you tax-free environments with zero capital gains tax. GIFT City aligns perfectly since India doesn't tax your GIFT City income on qualifying investments and your residence country has zero tax. You keep 100% of your returns.

Currency matching benefits you if you're earning in AED or USD. You can hold your GIFT City investments in USD without conversion, and repatriation is seamless for you with no RBI approvals needed.

If you're a Singapore-based NRI, you face nuanced rules. Singapore taxes your foreign-sourced income only if you remit it to Singapore. Your GIFT City income kept outside Singapore remains untaxed there. Capital gains generally aren't taxed for you in Singapore, but your dividend and interest income may be taxed depending on specific circumstances.

If you're a UK-based NRI, you benefit from remittance-based taxation if you're not UK-domiciled. Your income not brought to the UK avoids taxation there. However, as a UK resident you pay tax on worldwide income. The India-UK DTAA provides you with relief mechanisms including foreign tax credit.

For most countries, you need to obtain a Tax Residency Certificate and file Form 10F with Indian payers to claim treaty benefits. This ensures proper withholding rates apply to you and helps you avoid double taxation issues.

The key principle for you: research your specific country's rules or consult tax experts in both jurisdictions. GIFT City's Indian tax benefits remain valuable for you, but your home country taxation determines your net advantage.

Are There Any Hidden Tax Costs or Compliance Traps to Avoid?

Tax benefits come with conditions. Understanding limitations prevents unpleasant surprises for you.

Not all your GIFT City income qualifies for exemptions. Section 10(4E) exempts your derivative income and OTC transactions, but this doesn't automatically cover all your investment types. Your regular equity investments still face capital gains tax, albeit at lower IFSC rates. Dividend income from non-specified funds may not qualify for preferential rates.

Documentation requirements matter enormously for you. To claim DTAA benefits, you must provide proper Tax Residency Certificates. Missing or incomplete documentation triggers higher tax withholding for you. For example, your interest income might face 30% TDS without proper certificates instead of the treaty rate of 10-15%.

The foreign tax credit calculation requires precision from you. You must convert foreign tax payments to INR using SBI's telegraphic transfer buying rate on the last day of the month preceding payment. Incorrect conversion rates trigger tax department queries and potential penalties for you.

Policy uncertainty remains a reality you face. GIFT City is barely a decade old with evolving regulations. In 2024, regulators prohibited certain US-based ETF investments, disrupting existing investor plans. Tax benefits you enjoy depend on government policy. While extended to 2030, there's no guarantee beyond that period.

Investment concentration limits changed recently. IFSCA regulations introduced 33.33% limits in single investee companies for certain structures. If you made investments before this change, you need to adjust strategies for compliance.

Currency risk works both ways for you. If you're planning to return to India as a resident and the dollar weakens significantly against the rupee, your rupee returns diminish even though your dollar returns remain strong. Hedging currency risk adds costs that reduce your net returns.

Minimum investment thresholds remain high for many products accessible to you. AIFs now require $75,000, down from $150,000, but this still equals approximately ₹65 lakh. Not all of you can afford this entry point. GIFT City mutual funds offer you lower minimums ($500 to $10,000) but have fewer offerings.

Liquidity constraints affect some instruments available to you. AIFs typically have three-year lock-ins restricting your capital access. Some GIFT City funds have lower daily liquidity than mature market alternatives. Exit loads may apply for your early withdrawals. Physical real estate in GIFT City remains illiquid for you, taking months to sell.

The tax benefits are real and substantial for you. However, combine them with realistic expectations about documentation requirements, regulatory evolution, and product constraints.

What Changed in Budget 2026?

Budget 2026 did not rewrite the GIFT City playbook; instead, it reinforced and built on the powerful concessions introduced earlier. The IFSC tax holiday and concessional rates on capital gains, interest, and dividends remain intact, while the broader tax environment for NRIs has become more favourable through measures like lower TCS on overseas education, medical and travel spends, and a one‑time foreign asset disclosure window that lets you clean up past reporting gaps with defined costs rather than open‑ended penalties. In practice, this means the core GIFT City advantages you’ve been planning around - zero transaction taxes, Section 10(4E) exemptions on eligible derivative income, and fund‑level taxation via AIFs -continue unchanged under Budget 2026, but now sit inside an even more NRI‑friendly overall tax ecosystem.

Conclusion

GIFT City emerges as a compelling tax-efficient destination for you as an NRI investor seeking to minimize tax burdens while maintaining full compliance. The expanded Section 10(4E) exemptions provide you with 100% tax-free derivative income, while zero transaction taxes eliminate costs that erode your returns in mainland India. Capital gains rates of 9% to 15% and dividend taxation at 7.5% to 10% significantly undercut mainland India's 20% to 30% rates you'd otherwise pay.

Your optimal investment route depends on your specific situation. Category I and II AIFs stand out with fund-level taxation and complete exemption from Indian tax filing requirements for you, making them ideal for long-term investors who value simplicity. The $75,000 minimum became more accessible in 2025, though it still limits participation.

Strategic planning multiplies your advantages. Combining GIFT City's preferential rates with DTAA provisions creates zero-tax scenarios for you if you reside in UAE, Singapore, and Netherlands.

The post–Budget 2025 regime, including the extension of IFSC tax holidays until 2030 and the April 2026 rules enabling tax‑neutral ETF relocations and P‑notes expansion, continues under Budget 2026 and significantly strengthens GIFT City’s competitive position versus Singapore and Mauritius.

However, approach with realistic expectations. Policy evolution, currency risks, high minimums for certain products, and home country tax implications require your careful consideration. If you're a US-based NRI, you face PFIC complications that may negate benefits despite India's favorable treatment.

The tax advantages are genuine and substantial for you when properly utilized. Visit InvestMates to explore personalized investment strategies and discover how GIFT City fits within your broader financial planning as an NRI. Download the app to track your global portfolio, access AI-powered insights, and maintain compliance across jurisdictions.

Frequently Asked Questions

Do I need to pay any tax on GIFT City AIF investments if I live in Dubai?

If you live in Dubai (UAE) and invest in GIFT City AIFs, you face zero taxation in most scenarios. India taxes Category I and II AIFs at the fund level, not individually, and exempts you from filing returns. Since UAE has no income tax, you keep 100% of your net distributions. However, confirm your specific AIF category and investment structure with your fund manager. Category III AIFs may have different tax treatment requiring your individual assessment.

What's the difference between tax rates for bonds listed before and after July 1, 2023?

Bonds listed on IFSC exchanges before July 1, 2023 enjoy a preferential 4% tax rate on interest income for you. Those listed on or after July 1, 2023 face a 9% tax rate. This timing makes a significant difference to your net returns. On ₹10 lakh interest income, you save ₹50,000 annually by holding pre-July 2023 bonds. When you're choosing between similar bond investments, prioritize earlier-listed bonds for better tax efficiency. Understanding these distinctions helps you optimize your NRI investment portfolio.

Can I claim both DTAA benefits and GIFT City tax exemptions together?

Yes, you can combine DTAA benefits with GIFT City tax advantages for maximum tax efficiency. GIFT City's preferential tax rates apply first in India for you. Then, your home country's DTAA with India determines your final tax treatment. For example, if you're in Singapore and GIFT City charges 10% on your dividends, Singapore may not tax that income if you keep it offshore, effectively giving you a 10% total tax rate. Obtain a Tax Residency Certificate and file Form 10F to claim treaty benefits properly.

Will I face double taxation if I invest in GIFT City from the US?

You as a US-based NRI face complex tax situations due to PFIC rules, not traditional double taxation. GIFT City mutual funds likely qualify as PFICs under US tax law for you, requiring Form 8621 filings and taxation on unrealized gains. This creates tax inefficiency despite Indian benefits. However, you can claim foreign tax credits for Indian taxes you paid against your US tax liability. Some AIF structures as partnerships might avoid PFIC classification for you. Consult a US-India tax specialist before you invest to understand your specific implications. Learn more about cross-border money management challenges.

Do I need Form 10F and TRC to claim GIFT City tax benefits?

You need Form 10F and Tax Residency Certificate primarily when claiming DTAA treaty benefits, not for basic GIFT City tax rates. If you're investing through Category I or II AIFs, the fund handles taxation and you may not need these forms. However, for FPI or PMS routes where you receive income directly, providing your TRC and Form 10F ensures withholding happens at favorable treaty rates rather than standard rates. Always provide documentation proactively to avoid higher withholding and refund complications later.

How does Category III AIF taxation differ from Category I and II?

Category I and II AIFs handle all taxation at the fund level, exempting you from individual tax filing in India. Category III AIFs, which employ hedge fund strategies, calculate taxes at your investor level. You receive attributable income and must report it individually. However, as a non-resident investor in Category III AIFs investing in specified securities, you enjoy tax exemptions on transfers, making your gains potentially tax-free in India. Category III requires more active tax management from you compared to Category I and II's hands-off approach.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.