Filing taxes as an NRI in India can feel complex, but it’s crucial if your Indian income crosses ₹2.5 lakh in a financial year. From salary and rent to capital gains and investments, every Indian-source income has its own tax rules.

The right knowledge and approach can help you manage your NRI taxes better and save more money. This piece explains everything about filing taxes as an NRI in India. You'll learn to avoid penalties and save thousands of rupees along the way.

Key Takeaway

Understanding NRI tax obligations in India can save you thousands of rupees through proper planning and compliance. Here are the essential insights every NRI should know:

- Determine your residential status first: You're an NRI if you stay less than 182 days in India during the financial year - this directly impacts your tax liability.

- Only Indian income is taxable for NRIs: Salary, rent, capital gains, and NRO interest are taxable, while NRE/FCNR account interest remains tax-free.

- Claim DTAA benefits to reduce tax rates: Submit Tax Residency Certificate and Form 10F to lower TDS from 30% to 10-15% under treaty provisions.

- Use ITR-2 form and avoid common mistakes: Never use ITR-1 (for residents only), ensure PAN-Aadhaar linking, and don't ignore Indian income while abroad.

- Plan advance tax payments strategically: Pay advance tax if liability exceeds ₹10,000 to avoid interest charges, and claim TDS refunds through timely ITR filing.

Proper documentation, choosing the right tax regime, and understanding available deductions under Sections 80C and 80D can significantly optimize your tax burden while ensuring full compliance with Indian tax laws

Understanding NRI Taxation in India

Who Qualifies as an NRI Under the Income Tax Act?

A 'Non-Resident Indian' is someone who holds Indian citizenship or has Indian origin but doesn't qualify as an Indian resident for tax purposes. Your tax residency status depends on how long you stay in India during the financial year, whatever your citizenship or reason for staying.

The Income Tax Act requires you to fail the residency criteria specified in Section 6 to qualify as an NRI. You need to determine your residential status each financial year since your status might change based on your travel patterns or living arrangements.

The terms NRI, PIO (Person of Indian Origin), and OCI (Overseas Citizen of India) mean different things in various contexts, though people often use them interchangeably. All the same, your physical presence in India determines your residential status for tax purposes, not your citizenship status.

Difference Between Resident, RNOR, and NRI

The Income Tax Act defines three residential statuses with different tax implications:

Non-Resident Indian (NRI):

Only Indian-earned or received income faces taxation. Foreign income stays completely exempt from Indian taxes.

Resident but Not Ordinarily Resident (RNOR):

This intermediate category offers partial tax benefits. You become an RNOR if you meet any of these conditions:

- NRI status in 9 out of the 10 previous financial years

- Less than 729 days of physical presence in India during the preceding 7 financial years

- Indian citizen or PIO with Indian income over ₹15 lakh, staying in India for 120-182 days

- Deemed resident status without tax liability in other countries

RNORs, like NRIs, pay taxes only on their Indian income, not global earnings.

Resident and Ordinarily Resident (ROR):

This applies if you don't qualify as NRI or RNOR. RORs must pay tax on their worldwide income in India.

People new to India usually remain NRI or RNOR for their first two to three tax years. This helps them transition their finances smoothly.

Understanding your residential status helps you figure out your tax obligations and save money by properly organizing your investments and income sources according to India's NRI tax filing requirements.

Types of Income Taxable for NRIs

Being an NRI means you need to know which income streams attract tax in India. This knowledge helps you comply with tax laws and save money effectively.

The good news is you pay taxes only on income earned, accrued, or received in India, unlike resident Indians who pay taxes on their global income.

1) Income from Salary in India

Your salary becomes taxable in India under two specific cases. The compensation you get is taxable whatever the payment location if you provide services while physically present in India.

Your salary also attracts tax in India if it goes directly to an Indian bank account, even when earned abroad.

To cite an instance, see this example - you work remotely from Dubai for an Indian company but handle all services outside India and receive payment outside India.

This income stays non-taxable in India. But any salary earned during your India visits falls under Indian tax rules.

NRI salary income follows standard income tax slab rates. Your employers usually deduct TDS before paying your salary.

2) Income from House Property

Any property you own in India creates taxable income, whether you rent it out or keep it vacant. Rental income attracts full tax at your applicable slab rate. You can reduce your tax burden through several deductions:

- Standard deduction of 30% on the annual rental value

- Municipal taxes paid during the financial year

- Interest paid on home loans (fully deductible for rented properties)

The concept of "deemed rent" applies if you own more than two residential properties that stay vacant. You must show a notional rental income from the third property onwards in your ITR, even without actual rent.

Your tenant must deduct 30% TDS (plus applicable cess and surcharge) from rent payments under Section 195 of the Income Tax Act. This responsibility lies with your tenant. You must pay advance tax or self-assessment tax with interest if they skip TDS deduction.

3) Income from Capital Gains

Selling assets located in India means paying full tax on capital gains. Tax rates change based on asset type and how long you held them:

Short-Term Capital Gains (STCG):

- Listed shares and equity-oriented mutual funds (held < 12 months): 20%

- Property (held < 24 months): Taxed at slab rates

- Unlisted shares, debt funds, gold (held < 24 months): Slab rates

Long-Term Capital Gains (LTCG):

- Listed shares and equity-oriented mutual funds (held > 12 months): 12.5% on gains exceeding ₹1.25 lakh

- Property (held > 24 months): 12.5% without indexation

- Unlisted shares (held > 24 months): 12.5%

- Debt mutual funds (held > 24 months): 12.5% without indexation

Property sales require buyers to deduct TDS at specific rates - 12.5% for long-term gains and slab rates for short-term gains.

4) Income from Investments (FDs, Mutual Funds, Shares)

NRIs face specific tax rules on investment income in India:

Fixed Deposits: NRO account FDs' interest attracts full tax with 30% TDS. NRE and FCNR accounts' interest stays completely tax-free.

Mutual Funds: Tax rates depend on fund type and holding period:

- Equity funds held > 1 year: 12.5% tax on gains exceeding ₹1.25 lakh

- Equity funds held ≤ 1 year: 20% tax

- Debt funds held > 2 years: 12.5% without indexation benefits

Dividends: Indian companies' dividends attract tax at your income tax slab rate. A 20% TDS applies unless DTAA offers lower rates.

Most investment income sees TDS deduction before reaching your account. You still need to file ITR to claim applicable refunds.

5) Other Taxable Income Sources

NRIs must pay tax on several other income streams in India:

- Freelance or professional fees from Indian clients

- Royalty income from intellectual property in India

- Interest earned on savings accounts with Indian banks

- Business income from operations controlled or set up in India

- Gifts received from non-relatives exceeding specified limits

Indian-source income must go to your NRE/NRO accounts for proper repatriation. This income remains taxable and needs reporting in your ITR.

Smart NRIs learn about these tax implications to manage their finances better. DTAA benefits prove especially valuable if India has agreements with your country, preventing double taxation on the same income.

Exemptions and Deductions Available to NRIs

You can maximize your tax savings by understanding specific deductions and exemptions in the Indian tax code for NRIs.

Your global income stays outside India's tax net, but you can still lower your Indian tax liability through various provisions designed for non-resident taxpayers.

1) Section 80C Deductions (Investments Eligible for NRIs)

Just like resident Indians, you can claim deductions up to ₹1.5 lakh each year under Section 80C. These deductions will substantially reduce your taxable income in India through several investment options:

- Life Insurance Premiums: You can claim deductions for policies in your name or your spouse's and children's names. The premium should be less than 10% of the sum assured.

- Children's Tuition Fees: Payments to Indian educational institutions for full-time education of up to two children qualify for deduction.

- Home Loan Principal Repayment: The principal part of EMIs for residential property in India qualifies, along with stamp duty and registration charges[162].

- ELSS Mutual Funds: These investments come with the shortest lock-in period (3 years) among tax-saving options.

- ULIPs: Unit Linked Insurance Plans combine insurance with investment benefits[162].

Many NRIs miss out on these deductions even though they're eligible, which leads to paying more tax than needed. You can optimize your tax liability by making strategic investments before the financial year ends.

2) Section 80D: Medical Insurance Benefits Explained

Section 80D of the Income Tax Act provides tax deductions for health insurance premiums paid for yourself and your family. Here's a breakdown of the key details:

Deduction Limits Based on Age

- For Self, Spouse & Dependent Children (under 60 years): Up to ₹25,000

- For Parents (under 60 years): Additional ₹25,000

- For Parents (60 years & above): Additional ₹50,000

- For Self, Spouse & Children (60 years & above): Up to ₹50,000

Maximum Possible Deductions

- If both you and your parents are under 60: Up to ₹50,000

- If you're under 60, but parents are above 60: Up to ₹75,000

- If both you and your parents are senior citizens: Up to ₹1,00,000

3) Other Available Exemptions

You can reduce your tax burden even more through several other deductions:

- Section 80E: Get full deduction on education loan interest without any upper limit for up to 8 years.

- Section 80G: Claim deductions between 50% to 100% on donations to eligible Indian charitable institutions.

- Section 80TTA: Get up to ₹10,000 deduction on savings account interest.

- Section 24(b): Claim up to ₹2 lakh on home loan interest for self-occupied properties.

- Section 80CCD(1B): Get an extra ₹50,000 deduction for National Pension System contributions, beyond the ₹1.5 lakh limit under Section 80C.

Some capital gains transactions are tax-exempt when reinvested properly.

To name just one example, see property sale proceeds used to buy another house within the specified timeframe, or long-term capital gains invested in government-authorized bonds.

What Deductions NRIs Cannot Claim

Despite many available deductions, some tax benefits remain out of reach for NRIs:

- Investment restrictions: You can't claim deductions for investments in Public Provident Fund (new accounts), National Savings Certificates, Post Office 5-Year Deposit Scheme, or Senior Citizen Savings Scheme.

- Disability-related deductions: Sections 80U, 80DD, and 80DDB benefits for differently-abled individuals aren't available to NRIs.

- Investments under Section 80CCG: The Rajiv Gandhi Equity Savings Scheme stays off-limits for non-residents.

The new tax regime introduced by Finance Act 2024 has eliminated most Chapter VIA deductions, including Section 80D.

This means you'll need to choose your tax regime carefully based on your financial situation.

Step-by-Step Guide to Filing NRI Tax in India

Step 1: Determine Residential Status

Your residential classification depends on your stay duration in India during the financial year. You qualify as an NRI if you've spent less than 182 days in India during the financial year or less than 60/120 days (based on your Indian income level) with fewer than 365 days in the preceding four years.

Your travel history needs careful documentation because landing and take-off days count as stay in India.

Step 2: Collect Required Documents

These documents are essential before you start filing:

- PAN Card (mandatory) and Aadhaar (if available)

- Passport with entry/exit stamps to verify days spent in India

- Form 16/16A for TDS deductions

- Bank statements from NRO, NRE, and FCNR accounts

- Investment statements and capital gains computations

- Rent receipts and property documents (if applicable)

- Tax Residency Certificate if claiming DTAA benefits

Step 3: Choose the Correct ITR Form (ITR-2 / ITR-3)

Your income sources determine which form you need:

- ITR-2: For salaried income, rental income, capital gains, and investment income

- ITR-3: For business income or professional services income from India

Note that ITR-1 is no longer available for NRIs as per income tax regulations.

Step 4: Log in to the Income Tax e-Filing Portal

The official Income Tax Department website requires your PAN and password to log in. New users must register with their basic details and a mobile number for verification.

Make sure your personal information stays current, especially your overseas address and contact details.

Step 5: Report Your Income Accurately

Each ITR form section needs precise input of your Indian income sources. Different schedules exist for each income type – salary, house property, capital gains, and other sources.

Your reported income should match Form 26AS to ensure all TDS deductions align.

You must include all income sources even if TDS has been deducted because underreporting might trigger notices.

Step 6: Claim Deductions and DTAA Benefits

Your investments and expenses in India might qualify for deductions under Sections 80C, 80D, and other provisions. DTAA benefits require selecting your treaty country and providing your TRC and electronically filed Form 10F details.

Proper documentation can reduce your tax liability substantially.

Step 7: Verify Tax Credits with Form 26AS & AIS

The portal's Form 26AS and Annual Information Statement (AIS) show your tax credit details.

Form 26AS lists your tax deducted at source, advance tax paid, and high-value transactions linked to your PAN. Form 26AS takes precedence over any discrepancies with AIS currently.

Step 8: E-Verify and Submit Return

Your return needs verification within 30 days of submission to remain valid. You can e-verify through:

- Aadhaar OTP (if your mobile is linked to Aadhaar)

- Net Banking

- Digital Signature Certificate

- EVC from pre-validated bank account

Net banking works best for NRIs abroad since it doesn't need Indian mobile numbers.

A confirmation email and SMS will arrive once verification completes, marking the end of your tax filing obligation.

Advance Tax & TDS Rules for NRIs

Tax regulations require NRIs to understand specific advance tax obligations and TDS rules that differ from resident requirements. These rules help collect taxes properly without creating unnecessary financial burden.

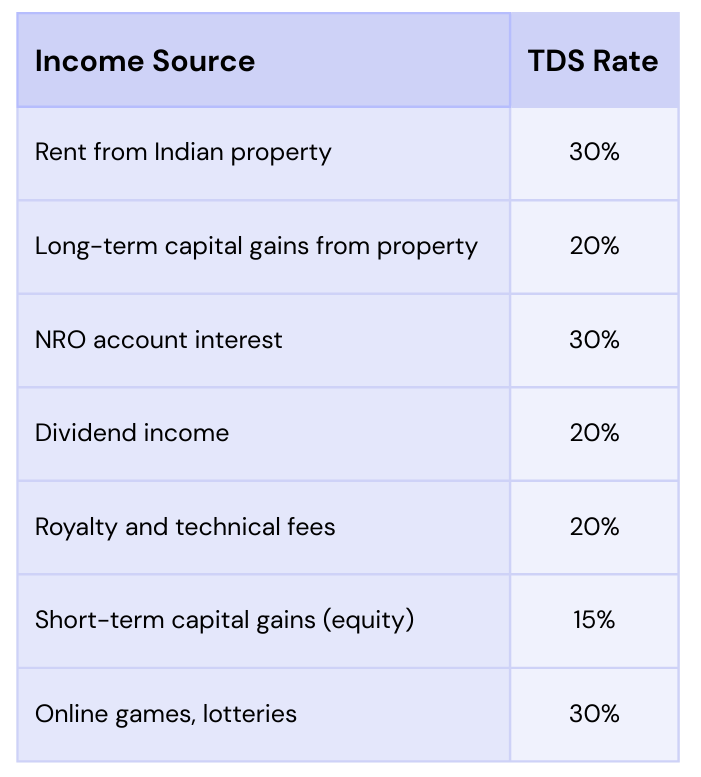

TDS Deductions on Different Income Sources

The Tax Deducted at Source (TDS) is mandatory for most NRI income types. The payer must deduct appropriate amounts before making payments. NRIs face higher TDS rates compared to residents:

Section 195 of the Income Tax Act requires anyone making payments to NRIs to deduct TDS whatever the threshold limits. You can reduce these rates under DTAA provisions by submitting a Tax Residency Certificate and Form 10F.

Getting Your Excess TDS Refund

TDS deductions often happen at flat rates without considering exemptions or actual tax liability, leading to excessive deductions for many NRIs. You'll need to file your Income Tax Return for the relevant financial year to claim refunds.

Let's say your total Indian income falls below the simple exemption threshold of ₹2.5 lakh (old regime) or ₹3 lakh (new regime), but TDS was deducted from your NRO interest income. You can claim a complete refund in this case.

The refund process has these steps:

- File the appropriate ITR form (typically ITR-2)

- Verify TDS deductions through Form 26AS

- Calculate actual tax liability based on applicable rates

- E-verify your return within 30 days of submission

The refund usually takes about six months to process, and you'll earn 6% annual interest calculated from the financial year's end.

Common Mistakes NRIs Should Avoid

Tax filing in India can be tricky even for seasoned NRIs. You can avoid penalties and optimize your tax benefits by learning about these common mistakes.

Ignoring Indian Income While Abroad

NRIs often think living abroad frees them from Indian tax obligations. The truth is that all income from India remains taxable whatever your residence status - this includes NRO account interest, rental income, capital gains, and dividends.

You need to report your Indian income if you've deposited over ₹1 crore in a financial year or spent more than ₹2 lakhs on foreign travel.

Using Wrong ITR Form

NRIs make a common mistake by filing ITR-1 (Sahaj), which only resident Indians can use. This mistake can make your return invalid and create processing issues. You must file ITR-2 for salary, house property, capital gains, or investment income.

Business income requires ITR-3. The wrong form choice can lead to defective notices under Section 139(9), and you might lose refunds or face penalties.

Not Linking PAN with Aadhaar

Your PAN becomes inoperative without a PAN-Aadhaar link, which leads to higher TDS rates under Section 206AA. NRIs don't need to get Aadhaar, but they must update their residential status with the Income Tax department.

Missing DTAA Benefits

The cost of skipping DTAA documentation - Tax Residency Certificate (TRC) and Form 10F - can hit your wallet hard. You'll pay standard tax rates of 20-30% instead of lower DTAA rates if you don't have the right documents.

Conclusion

Tax filing as an NRI is simpler than you might think. Your residential status forms the foundation to determine your tax liability in India. The time you spend in India will determine if you qualify as an NRI, RNOR, or resident for tax purposes.

You'll find tax planning easier once you learn which income sources are taxable in India. The Indian tax net covers your rental income, capital gains, interest from NRO accounts, and dividends. NRE and FCNR accounts give you tax-free interest benefits.

NRIs can still get substantial tax breaks under Sections 80C and 80D despite some restrictions on deductions. DTAA benefits can save you thousands of rupees by stopping double taxation on income across countries.

The right documentation makes tax filing smooth. Your PAN card, travel records, TRC (for DTAA benefits), and accurate financial statements help you stay compliant and get maximum deductions. Most NRIs need to file ITR-2 to avoid notices and penalties.

TDS rates are higher for NRIs than residents, so tax planning is vital. You can claim refunds of excess TDS by filing returns on time with proper documentation.

Don't make common mistakes like ignoring Indian income while abroad, using wrong ITR forms, or missing out on DTAA benefits. These errors often result in penalties and higher taxes.

Managing NRI taxes well needs attention to detail and knowledge of changing rules. Smart planning, proper documentation, and timely filing will help you meet tax obligations while keeping your tax liability low in India.

Frequently Asked Questions

When is the deadline for NRIs to file income tax returns in India for the 2025-26 assessment year

The deadline for NRIs to file income tax returns in India for the 2025-26 assessment year has been extended to September 15, 2025. This extended deadline applies to salaried individuals, pensioners, NRIs, and other taxpayers whose accounts are not required to be audited.

What are the new residency rules for NRIs in India?

Under the new rules, an NRI or Person of Indian Origin (PIO) earning over INR 1.5 million in India will be classified as Resident but Not Ordinarily Resident (RNOR) if they stay in India for 120 days or more in a tax year and have stayed in India for 365 days or more in the past four years.

How can an NRI file their income tax return in India?

To file an income tax return as an NRI, log in to the income tax portal. verify your details, select the assessment year and filing mode, choose the appropriate ITR form (typically ITR-2 or ITR-3 for NRIs), fill in your income details, claim applicable deductions, and e-verify your return within 30 days of submission.

Which ITR forms should NRIs use for filing taxes in India?

NRIs should use ITR-2 for reporting salary, house property, capital gains, or investment income.

If reporting business income, NRIs should use ITR-3. It's important to note that ITR-1 (Sahaj) is not applicable for NRIs and using it can lead to processing errors or invalid returns.

What are some common mistakes NRIs should avoid when filing taxes in India?

Common mistakes NRIs should avoid include ignoring Indian income while abroad, using the wrong ITR form (such as ITR-1), failing to link PAN with Aadhaar or update residential status, and missing out on Double Taxation Avoidance Agreement (DTAA) benefits.

These errors can result in higher tax liability, penalties, or processing issues.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.