The rules on capital gain tax for NRIs in India changed sharply in 2026. Both short-term and long-term tax rates have gone up, and the indexation benefit that once reduced your taxable gains is now gone.

If you’re an NRI investing in Indian property, mutual funds, or shares, these updates can have a direct impact on your returns. Understanding how the new rules work - and which exemptions still apply - can help you plan your exits smartly, claim refunds where eligible, and avoid unnecessary tax leakage.

Whether you’re selling an apartment in India or redeeming mutual funds from abroad, this guide explains the latest capital gain tax NRI rules, TDS rates, and exemption options to help you make informed choices in 2026.

Key Takeaway

New 2026 capital gains rules have reshaped how NRIs are taxed on Indian investments. In this blog, you’ll understand new rates, exemptions, and refund strategies to optimize your taxes.

- Short-term gains taxed at 20%; long-term gains at 12.5% without indexation

- Exemption threshold raised to ₹1.25 lakh for equity investments

- Property held 24+ months taxed at 12.5% plus surcharge and cess

- TDS applies at 10% for long-term, 15% for short-term equity gains

- Use Section 54, 54F, and 54EC exemptions to cut capital gains tax

- Claim TDS refunds and DTAA benefits to avoid double taxation

- Apply for Lower Deduction Certificate (Form 13) to reduce upfront TDS

2: What is Capital Gains Tax for NRIs?

Whenever you sell an asset in India - property, mutual funds, or shares — for more than what you paid, the profit you earn is called a capital gain. The tax you pay on that profit is known as capital gains tax.

For Non-Resident Indians (NRIs), this tax applies even if you live abroad or the money never enters India. As long as the asset is located in India, it’s taxable under the Income Tax Act.

💡 Example

If you bought a flat in Pune for ₹80 lakh and sold it later for ₹1.2 crore, the ₹40 lakh profit is your capital gain. The moment you transfer ownership, it becomes taxable.

Assets That Attract Capital Gain Tax for NRIs

You’re liable to pay capital gain tax NRI on profits from these Indian investments:

- 🏠 Real estate (residential or commercial property)

- 📈 Shares of Indian companies

- 💰 Mutual funds and Exchange-Traded Funds (ETFs)

- 🧾 Debt instruments and unlisted shares

Indian tax law doesn’t consider where you live or which account receives the sale proceeds - it only looks at where the asset is based.

In short: If the asset is in India, the gain is taxable in India, even if you’re an NRI living overseas.

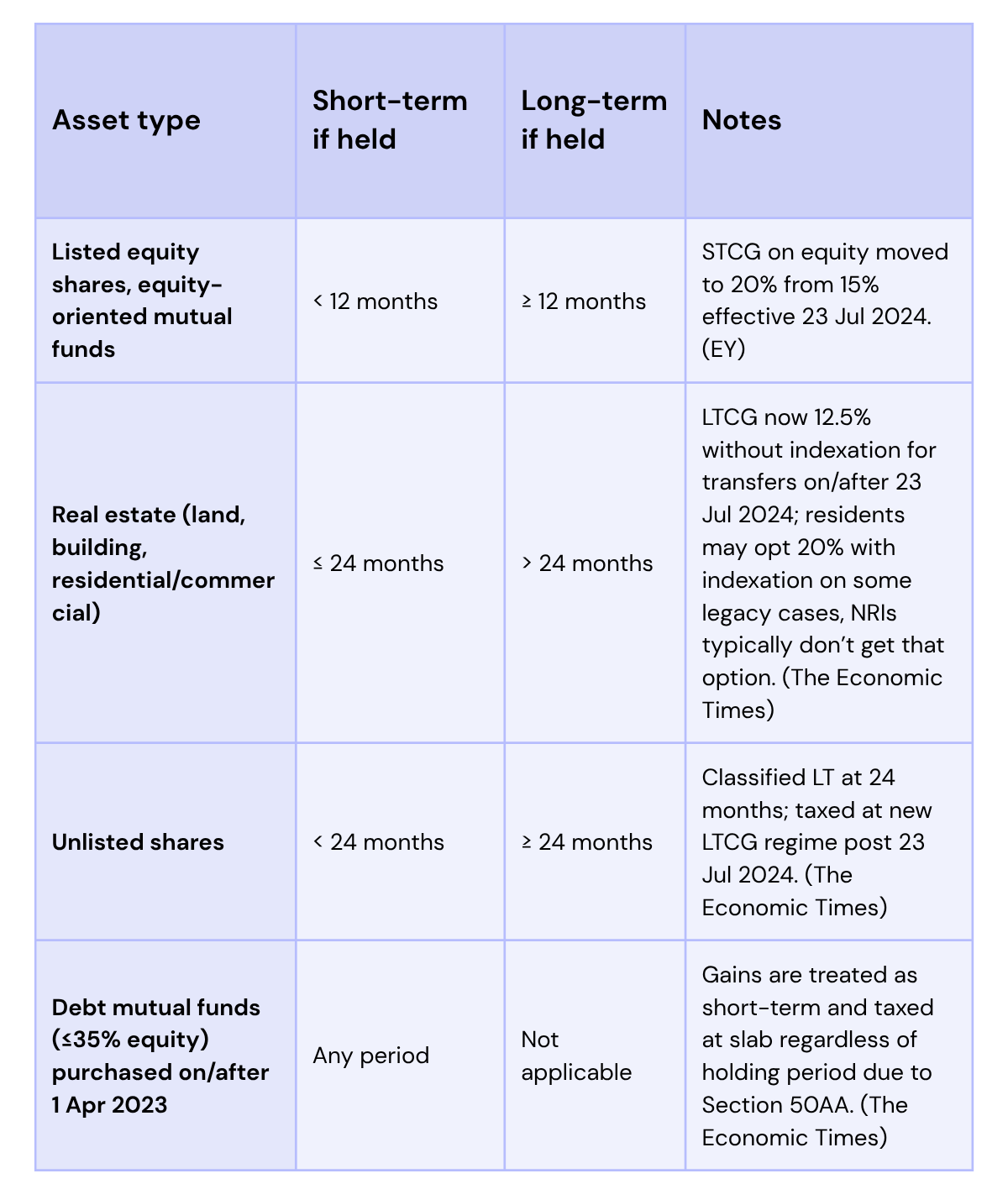

3: Short-Term vs Long-Term Capital Gains for NRIs

Your tax rate depends first on how long you held the asset. This “holding period” is different by asset class. For NRIs, getting this right unlocks the right capital gain tax for NRI in India rules and TDS treatment.

Holding period rules at a glance

Inherited or gifted assets: for holding period, you can include the previous owner’s holding period; cost is the previous owner’s cost. This often tips a sale into long-term treatment.

Why this matters: Getting the clock right decides whether your capital gain for NRI falls into the higher short-term bucket or the 12.5% long-term bucket (for eligible assets). It also drives the capital gain tax NRI TDS that a buyer or broker will withhold at sale.

Quick example

You bought equity mutual funds on 10 Sep 2024 and redeem on 1 Jun 2025 → held < 12 months → short-term.

You sell a flat held since May 2022 on 30 Aug 2025 → held > 24 months → long-term.

Why NRIs face different tax treatment

You're subject to special rules that don't apply to resident Indians. Chapter XII-A (Sections 115C-115I) of the Income Tax Act specifically targets NRIs.

TDS applies immediately:

Unlike residents, you face Tax Deducted at Source on all capital gains, regardless of the amount. Rates vary by asset type and holding period.

Currency conversion benefits:

Section 48 lets you calculate gains by converting acquisition cost, expenses, and sale price into the same foreign currency you used for purchase. This helps when exchange rates work in your favor.

Limited deductions available:

You can't claim deductions under Sections 80C to 80U like resident Indians. However, you can still use capital gains exemptions by reinvesting in qualifying assets.

These rules exist because the tax department treats your Indian investments differently from your global portfolio. Understanding these differences helps you plan better and avoid paying excess tax.

4: Capital Gains Tax Rates and TDS for NRIs (2026)

From 23 July 2024, India changed how capital gain tax for NRI in India works. Rates are higher and indexation is gone on long-term gains for most assets. If you hold Indian property, equity, or funds from abroad, your after-tax return now depends on holding period, asset type, and how you handle TDS.

Updated tax rates in plain English

Listed equity and equity mutual funds

- Short-term, held for less than 12 months: tax at 20%

- Long-term, held for 12 months or more: tax at 12.5% without indexation

- Equity exemption threshold is now ₹1.25 lakh for long-term gains

Real estate

- Short-term, sold within 24 months: taxed at your income slab rate, up to 30%

- Long-term, sold after 24 months: flat 12.5% without indexation

Unlisted shares and debt instruments

- Short-term: taxed at your slab rate

- Long-term: 12.5% without indexation

Add 4% health and education cess to all of the above. Surcharge applies based on total income. That lifts the effective rates at higher income levels.

Why this matters for capital gain for NRI

If you used to rely on indexation for property or certain funds, your taxable gain may now be higher even if the headline rate looks lower. Timing matters. So do exemptions.

TDS on capital gains for NRIs

NRIs face Tax Deducted at Source at the time of sale. This is withheld before money hits your account.

Equity

- Long-term equity gains above ₹1.25 lakh: TDS at 10%

- Short-term equity gains: TDS at 15%

- The broker or AMC deducts it

Property

- Long-term property sale: buyer deducts TDS at 12.5%

- Short-term property sale: buyer deducts at your slab rate, up to 30%

- TDS is often computed on the sale value, not the net gain

Debt funds and unlisted shares

- TDS typically ranges from 20% to 30% depending on holding period and instrument

If you do not quote a valid PAN, Section 206AA can push TDS to 20% or higher. Always provide PAN.

How to reduce or recover TDS

- Apply for a Lower Deduction Certificate using Form 13

- Do this before the sale. The tax office can authorize a lower TDS aligned to your expected tax. This helps a lot on property deals where TDS is otherwise taken on full consideration.

- Claim refunds through your ITR

- If TDS exceeds your actual liability, file ITR-2 or ITR-3 and claim a refund. Keep Form 16A from the buyer or broker as proof.

- Use DTAA relief where eligible

- Check your country’s treaty with India. With a Tax Residency Certificate and Form 10F, you may reduce withholding or get foreign tax credit in your resident country so you are not taxed twice.

Know your holding period, expect TDS at source, and plan ahead. Combine Form 13, exemptions, and DTAA to keep more of your proceeds. Ready for the next section on Exemptions You Can Still Use?

5: Exemptions You Can Still Use

Even with higher tax rates and the removal of indexation, NRIs can still save significantly through capital gains exemptions. These are the legal ways to reduce your capital gain tax in India — provided you follow the timelines and reinvestment conditions correctly.

Section 54 – Sale of Residential Property

If you sell a residential property in India, you can save tax by reinvesting the gains in another property.

Conditions:

- You must buy a new house within one year before or two years after the sale.

- If you’re constructing, finish construction within three years of sale.

- Maximum exemption: ₹10 crore (from Assessment Year 2024–25).

- For gains below ₹2 crore, you can buy two houses once in a lifetime instead of one.

Example:

If you sold your Bengaluru flat for ₹1.5 crore and made ₹40 lakh in long-term gains, buying another property within the allowed window can exempt that entire ₹40 lakh from capital gain tax for NRI in India.

Section 54F – Sale of Any Other Long-Term Asset

If you sold an asset other than a house - say, land, gold, or shares - and reinvested the entire sale proceeds in one residential house in India, you can claim exemption under Section 54F.

Points to remember:

- The new house must be purchased within 1 year before or 2 years after the sale.

- Construction must finish within 3 years.

- You must invest the entire sale value, not just the profit.

- If you invest partially, exemption is allowed proportionately.

- You cannot own more than one other house at the time of sale.

Section 54EC – Investment in Specified Bonds

If you sell a property and don’t want to reinvest in real estate, you can still save tax by investing your gains in government-specified bonds.

Eligible bonds:

- National Highways Authority of India (NHAI)

- Rural Electrification Corporation (REC)

- Power Finance Corporation (PFC)

- Indian Railway Finance Corporation (IRFC)

Rules:

- Invest within 6 months of the sale.

- Maximum limit: ₹50 lakh per financial year.

- Lock-in period: 5 years.

- Interest is taxable, usually around 5.25% per year.

Example:

If you made ₹30 lakh in long-term gains from selling property, investing that amount in REC bonds within 6 months makes you eligible for full exemption from capital gain tax NRI obligations on that sale.

Capital Gains Account Scheme (CGAS)

If you need more time before reinvesting, you can temporarily park your gains in a Capital Gains Account at a public sector bank in India.

Why it helps:

- Keeps your exemption eligibility intact until you reinvest.

- Choose Type A (Savings) for flexibility or Type B (Fixed Deposit) for better interest.

- The amount must be used for property purchase or construction before the exemption deadline.

Important:

If you miss the reinvestment deadline, the unused balance in this account becomes taxable as capital gains in the year the deadline ends.

Quick Summary

Even with higher rates, these sections give NRIs meaningful ways to lower tax:

- Section 54: Reinvest in property you sell.

- Section 54F: Reinvest proceeds from other assets into a house.

- Section 54EC: Invest in bonds instead of property.

- CGAS: Park funds temporarily to preserve exemption benefits.

Plan ahead — all these require action within a fixed window after the sale. Missing the deadline means losing the exemption entirely.

6. How to Reduce or Reclaim Capital Gains Tax

Most NRIs end up paying more tax than they should - often because of excess TDS, missed deductions, or poor timing of sales. The good news: the law gives you several ways to legally reduce or recover that money.

1. File Your ITR and Claim TDS Refunds

TDS on property or fund sales is often deducted on the entire sale value, not just your actual gain. That’s why many NRIs are eligible for refunds when they file their Indian tax return.

What to do:

- File ITR-2 (for investment income) or ITR-3 (if you also have business income).

- Attach Form 16A received from the buyer or broker showing TDS deducted.

- File before July 31 of the assessment year to ensure faster refund processing.

Example:

If your property buyer deducted ₹8 lakh TDS on a ₹1 crore sale, but your real tax liability after exemptions is ₹4 lakh, you can claim a ₹4 lakh refund through your ITR.

2. Apply for a Lower Deduction Certificate (Form 13)

Instead of waiting for a refund, you can reduce TDS before the sale happens. By applying for a Lower Deduction Certificate from the Income Tax Department, the buyer or broker deducts tax at a lower rate — closer to your actual liability.

Why it matters:

- Avoids cash-flow lockup and long refund waits.

- Especially useful for property sales where buyers deduct 12.5% on the entire value.

Apply online on the TRACES portal or through a tax consultant before the transaction date.

3. Use DTAA to Avoid Double Taxation

India has Double Taxation Avoidance Agreements (DTAA) with over 90 countries, including the US, UK, UAE, and Canada. These treaties make sure you’re not taxed twice on the same income.

Steps to claim DTAA relief:

- Obtain a Tax Residency Certificate (TRC) from your country of residence.

- Submit Form 10F along with your Indian ITR.

- If your home country taxes capital gains too, claim a foreign tax credit for tax already paid in India.

This is one of the most overlooked ways for NRIs to cut down their capital gain tax in India.

4. Time Your Sales Strategically

The timing of a sale can change how much tax you owe. Selling an asset a few months later can convert it from short-term to long-term — instantly reducing your rate from 20% or 30% to 12.5%.

Plan smart:

- Check holding period cut-offs before deciding to sell.

- If you’re close to the long-term threshold, waiting could save you several lakhs.

- Use the Capital Gains Account Scheme if you need time to reinvest but don’t want to lose exemption eligibility.

5. Maintain Clear Documentation

Good records are your best defence if you ever need to justify cost or exemptions. Keep copies of:

- Purchase and sale deeds or contract notes

- Expense receipts for renovations or brokerage

- Proof of reinvestment in property or 54EC bonds

- Form 16A and PAN of buyer or broker

Having this ready makes filing, refunds, and DTAA claims much smoother.

7. Smart Planning Tips for NRIs

Taxes can’t be avoided, but they can be managed. The difference between paying too much and paying just enough usually comes down to timing, structure, and paperwork.

Here are a few habits that help you stay ahead of capital gain tax for NRI in India.

1. Review Your Portfolio Before Every Financial Year-End

Each year, look at which investments are nearing long-term status. Selling just before the threshold can cost you a higher tax rate, while waiting a few months may cut it nearly in half.

NRIs often forget that the Indian financial year ends on March 31, so align your portfolio reviews accordingly.

2. Plan Property Sales Around Reinvestment Readiness

If you plan to use Section 54 or 54F benefits, line up your reinvestment or bond purchase before you sell. The exemption clocks start running the day you transfer ownership — not when you receive funds abroad.

Delays in repatriating money can cost you exemption eligibility if you miss the reinvestment window.

3. Use the Capital Gains Account Scheme Wisely

If your sale happens close to the filing deadline and you haven’t decided on a reinvestment, park the amount in a Capital Gains Account. It keeps your exemption alive until you finalize the next move.

Opt for Type A if you want flexibility or Type B if you prefer a fixed return while you decide.

4. Coordinate With Your Overseas Tax Filing

If you’re based in the US, UK, or Canada, capital gains earned in India might also appear in your home-country tax return. Use DTAA provisions and claim foreign tax credits to avoid paying double.

A tax advisor familiar with both jurisdictions can help you synchronize filing timelines and documents.

5. Keep Transactions Transparent

Always use banking channels for sales and repatriations. Record every cost — registration fees, brokerage, improvement expenses — as these can adjust your cost base when calculating capital gain for NRI.

Transparency reduces TDS disputes and makes refunds faster.

6. Monitor Rule Changes

Capital gains rules have changed twice in the past two years alone. Keep an eye on updates to indexation, TDS rates, and exemption limits. Even small rule tweaks can alter how your investments perform after tax.

7. Don’t Wait Till Filing Season

Many NRIs handle Indian taxation reactively — once the sale is done or TDS is deducted. The smarter route is to plan before the transaction: estimate your tax, apply for Form 13 early, and document costs properly.

Good planning avoids surprises and makes your capital gain tax NRI reporting straightforward.

Simple rule: Treat taxation as part of your investment strategy, not an afterthought. You can’t control the rates, but you can control when and how they apply to you.

Final Thoughts

The 2026 changes to capital gain tax for NRI in India have reshaped how NRIs are taxed on their Indian assets. Short-term and long-term rates have gone up, indexation is gone, and TDS now applies more broadly. Still, these updates don’t have to eat into your returns if you plan your moves carefully.

Here’s what to keep in mind:

- Know your rates: Short-term gains are taxed at 20%, long-term at 12.5% without indexation.

- Expect TDS upfront: Provide your PAN to avoid the 20% penal rate. Use Form 13 to lower deduction if your actual liability is less.

- Use exemptions wisely: Sections 54, 54F, and 54EC continue to help offset gains from property or other assets.

- Claim what’s yours: File your Indian tax return to recover excess TDS or apply DTAA relief if you pay tax in both countries.

- Think in timelines: A few months can change your tax category - plan sales strategically to qualify for long-term treatment.

Capital gains tax for NRIs has become less flexible but more predictable. Once you understand your asset type, holding period, and reinvestment options, managing your Indian tax obligations becomes straightforward.

If you’re unsure how the new structure affects your portfolio, it’s worth consulting an NRI-focused tax advisor. A quick review can often uncover refunds, exemptions, or planning opportunities that go unnoticed.

In the end, capital gain tax NRI planning isn’t just about compliance - it’s about keeping more of what you earn and letting your money grow efficiently across borders.

Frequently Asked Questions

What are the current capital gains tax rates for NRIs in India?

As of 2025, short-term capital gains on equity investments are taxed at 20%, while long-term capital gains across all asset classes attract a flat 12.5% rate without indexation. The first ₹1.25 lakhs of long-term gains from equity investments remain exempt.

How does TDS work for NRIs selling property in India?

When an NRI sells property in India, the buyer must deduct 12.5% TDS for properties held over 24 months. For properties held less than 24 months, TDS is deducted at the applicable income tax slab rate, which can go up to 30%. TDS is often applied to the full sale value, not just the capital gains.

What exemptions are available to NRIs to reduce capital gains tax?

NRIs can utilize exemptions under Section 54 for reinvestment in residential property (capped at ₹10 crores), Section 54F for selling assets other than residential property, and Section 54EC for investing up to ₹50 lakhs in specified bonds. These exemptions have specific conditions and timelines that must be followed.

How can NRIs claim TDS refunds on capital gains?

NRIs can claim TDS refunds by filing their income tax return in India using ITR 2 or ITR 3 forms. The return must be submitted by July 31st following the financial year to claim these refunds. This is particularly important when excess TDS has been deducted, such as in property sales.

What is the impact of not having a PAN card for NRIs investing in India?

NRIs without a PAN card face higher tax deduction rates. They may be subject to the higher of the rate specified in relevant provisions, the rate in the Finance Act, or a penal rate of 20%. To avoid this, NRIs should apply for a PAN card, which allows for normal taxation rather than the penal rate.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.