Do you know NRIs can repatriate up to USD 1,000,000 per financial year from a Non-Resident Ordinary (NRO) account after tax.

This guide shows how to repatriate money from india to usa or any other country as an NRI, which account to use, what forms you need, and the exact steps to move funds cleanly and fast.

Key Takeaway

- Pick the path: NRE/FCNR are fully repatriable, NRO needs taxes and docs.

- Know the cap: From NRO you can remit up to USD 1,000,000 per year; current income after tax is outside the cap.

- File the forms: Submit Form 15CA; add Form 15CB when your bank or Rule 37BB requires it.

- Prep paperwork: PAN, passport, bank statements, TDS proofs, and source docs.

- Budget costs: bank fee, GST, SWIFT charge, and FX spread.

What is Repatriation of Funds?

Repatriation of funds means transferring money from Indian bank accounts to accounts in your country of residence. The process involves converting Indian Rupees (INR) to foreign currencies like USD, GBP, or EUR. The Foreign Exchange Management Act (FEMA) regulates this process to ensure only legitimate and taxed funds move across international borders.

You can repatriate several types of assets and income sources:

- Funds held in India before your move abroad

- Assets received through inheritance in India

- Income earned from Indian investments

- Rental income from Indian properties

- Funds previously transferred to India as overseas remittances

To name just one example, see how selling property in India that you bought with foreign currency works. You can repatriate the sale proceeds up to the amount you paid through banking channels.

The Reserve Bank of India also lets you repatriate refunded application or earnest money for canceled property deals if the original payment came from NRE/FCNR accounts.

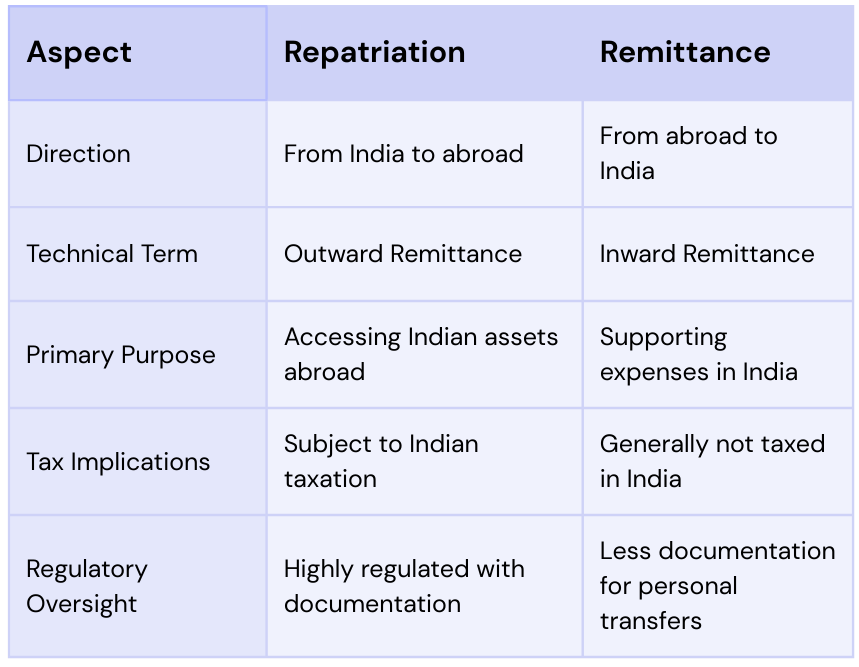

Difference between repatriation and remittance

People often mix up repatriation and remittance, but they represent two different directions of fund movement:

NRI fund repatriation makes shared movement of funds possible between Indian and overseas accounts, giving you more flexibility in global finance management. Each account type offers different repatriation benefits - NRE and FCNR accounts allow unlimited repatriation, while NRO accounts have stricter limits.

Common reasons NRIs repatriate funds

NRIs send funds from India back home for many personal and financial reasons:

- Manage global finances: Consolidate assets across countries for a single view, better control, and access to new opportunities.

- Buy property abroad and handle emergencies: Large transfers fund down payments and closing costs. In medical emergencies, the Reserve Bank of India (RBI) may permit special remittances above standard limits.

- Education and family support: Pay overseas tuition and living costs for yourself or dependents, and support family members settling with you abroad.

- Retirement planning: Gradually shift Indian assets to your country of residence if you plan to settle there.

The way you repatriate money changes based on where the funds come from. NRE accounts give you complete freedom to transfer both principal and interest without limits.

NRO accounts, however, let you transfer up to USD 1 million per financial year after tax deductions.

Make sure you know what documents you need for your account type before starting any transfers. NRO accounts usually need Form 15CA (self-declaration) and Form 15CB (chartered accountant certificate) to prove tax compliance.

Types of NRI Accounts and What’s Repatriable

Picking the right type of NRI account is a vital part of getting your repatriation of funds from India right. Each account comes with its own set of repatriation benefits, tax advantages, and currency choices. Let's get into these differences.

NRE account: full repatriation

Non-Resident External (NRE) accounts help NRIs deposit their foreign earnings in Indian Rupees. These accounts give you complete freedom to repatriate funds anytime you want. Yes, it is possible to move both your principal amount and interest earned abroad without RBI approval.

NRE accounts shine because of their tax-exempt status. Your interest earnings and principal amount stay free from Indian taxation. These accounts work only in Indian Rupees, and your foreign currency converts automatically when you make deposits.

You can pick from savings, current, recurring deposit, or fixed deposit options with an NRE account. Fixed deposits give you interest rates between 5-7% per year, based on your bank and tenure choice.

Your money stays safe from exchange rate changes since you can repatriate it fully, even though it's in INR.

NRO account: limited repatriation

Non-Resident Ordinary (NRO) accounts hold your India-generated income like rent, dividends, or pension payments. These accounts are nowhere near as flexible as NRE accounts when it comes to repatriation of funds.

The Reserve Bank of India lets you repatriate up to USD 1 million each financial year from NRO accounts after paying your taxes. This cap covers all your repatriations during the financial year, whatever the reason might be.

Your NRO account interest gets fully taxed in India. Banks automatically cut Tax Deducted at Source (TDS) at 30% (plus surcharge and cess) from your interest earnings. Before you can repatriate money from NRO accounts, you need:

- Form 15CA (self-declaration about the remittance)

- Form 15CB (chartered accountant certificate verifying tax compliance)

- A declaration that proves your repatriated funds are legitimate

Moving more than USD 1 million in a year needs special RBI approval, which they give only in rare cases.

FCNR account: foreign currency deposits

Foreign Currency Non-Resident (FCNR) accounts are a chance to keep deposits in major foreign currencies like USD, GBP, EUR, CAD, and AUD. Your money stays in the same foreign currency for deposits and withdrawals, which removes currency conversion risks.

FCNR accounts work like NRE accounts - you can repatriate funds without any limits. Moving your principal and interest abroad is hassle-free. FCNR accounts only come as term deposits lasting 1 to 5 years.

These deposits stay completely tax-free in India, making them perfect for tax-conscious NRIs. You can expect interest rates between 2-4% yearly, depending on your chosen currency and tenure.

Your source of funds and repatriation needs should guide your account choice. NRE or FCNR accounts work best for foreign earnings you might want to move later. NRO accounts are your only option for India-generated income, despite their repatriation limits.

Smart NRIs often keep multiple account types. This helps them get the best tax benefits while making sure their funds stay available to repatriate from India to USA or wherever they live.

Repatriable vs Non-Repatriable Funds Explained

The difference between repatriable and non-repatriable funds plays a crucial role in your financial planning as an NRI. This key aspect determines if you can freely move your money back to your country of residence or face limitations when transferring assets out of India.

What is a repatriable title?

A repatriable title means you can legally transfer your funds or assets from India to your country of residence. Your investments get repatriable status when laws from both India and your home country allow cross-border transfers without any roadblocks.

The Foreign Exchange Management Act (FEMA) of India sets these rules. NRIs can make investments that are either repatriable or non-repatriable. Any investments you make using your NRE account automatically become repatriable. This lets you send both your initial investment and any profits back to your foreign bank account freely.

Your investments must go through proper channels to stay repatriable. To name just one example, NRIs who want to invest in Indian equities on a repatriable basis must use the Portfolio Investment Scheme (PIS). This Reserve Bank of India scheme lets NRIs trade Indian company shares through their NRE savings accounts.

What makes funds non-repatriable?

Non-repatriable funds stay locked within India. Your NRO account funds usually fall into this category, though some exceptions exist.

NRO account investments typically become non-repatriable. These match resident Indian investments in terms of treatment. The RBI does allow some flexibility with these restrictions:

- You can send up to USD 1 million per financial year from NRO accounts after tax compliance

- RBI must approve amounts above this limit specially

- NRO account interest becomes repatriable after tax deductions

- The annual limit covers income from rent, dividends, pensions, and other domestic sources

- The rules strictly forbid repatriation from NRO accounts to third-party accounts

NRO accounts had stricter rules before 2012, with no transfers allowed to NRE accounts. The situation improved on May 7, 2012. The RBI started allowing transfers from NRO to NRE accounts, subject to the USD 1 million yearly limit and applicable taxes.

NRE vs NRO vs FCNR Comparison

| Attribute | Non-Resident External (NRE) | Non-Resident Ordinary (NRO) | Foreign Currency Non-Resident (FCNR) |

|---|---|---|---|

| Purpose / source | Hold foreign earnings in India | Hold India-source income and assets | Hold foreign earnings as term deposits in foreign currency |

| Currency held | INR | INR | USD, GBP, EUR, etc. |

| Repatriation (principal + interest) | Fully repatriable via bank process | Current income repatriable after tax; other eligible funds up to USD 1,000,000 per FY with documents | Fully repatriable at maturity or breakage per bank rules |

| Tax on interest in India | Tax-exempt | Taxable; TDS generally applies | Tax-exempt |

| Typical inflows | Salary abroad, transfers from overseas accounts | Rent, dividends, sale proceeds, Indian pensions | Overseas funds placed as FCNR deposits |

| Key forms / docs | Bank outward remittance form, purpose code; 15CA/CB usually not needed when no tax applies | Form 15CA + Form 15CB as applicable, PAN, TDS proofs, source documents | Bank discharge form at withdrawal; 15CA/CB usually not needed when no tax applies |

| Annual limit | No RBI cap (subject to bank checks) | USD 1,000,000 per financial year for non-current funds after tax | No RBI cap (subject to bank checks) |

| NRO → NRE transfer | Not applicable | Allowed after paying taxes; counts within the USD 1M limit | Not applicable |

| FX exposure | INR exposure | INR exposure | Minimal INR exposure (held in foreign currency) |

| Best for | Moving overseas savings in and out of India | Managing Indian income and exits from Indian assets | Parking foreign funds while avoiding INR volatility |

| Gotchas | INR conversion risk on entry/exit | More paperwork, tax proofs, and CA certificate often needed | Premature closure may reduce interest |

Limits and Schemes You Should Know

NRIs need to know how repatriation schemes work, along with their limits and requirements. The Reserve Bank of India oversees these schemes, each with its unique rules and purposes.

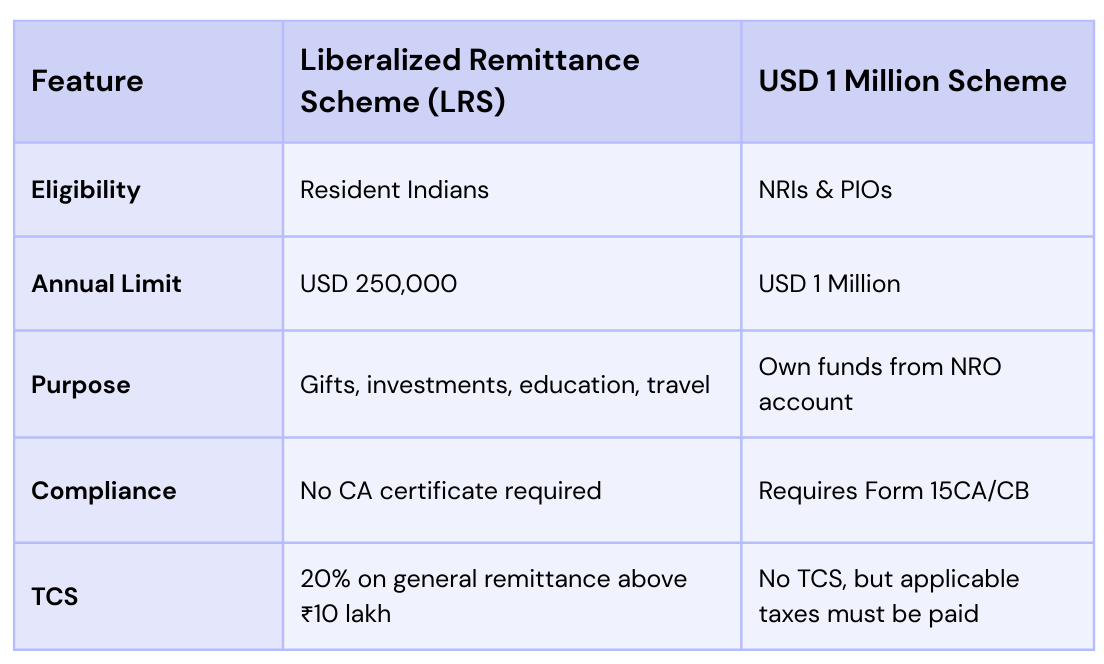

USD 1 million facility explained

The USD 1 million facility lets NRIs and Persons of Indian Origin (PIOs) send up to USD 1 million each financial year from their NRO accounts. This amount includes both principal and interest after tax payments. This facility helps you transfer money you've earned or received in India.

Your bank needs several documents when you want to use this facility through your NRO account:

- Form 15CA/CB with a Chartered Accountant's certification

- A statement confirming your funds are legitimate

- Documents that prove where the money came from

You won't pay extra tax or Tax Collected at Source (TCS) on these transfers if you've already paid taxes on your income.

Keep in mind that unused portions of the USD 1 million limit don't roll over to the next financial year. You should plan your transfers within each financial year.

Liberalized Remittance Scheme (LRS)

The Liberalized Remittance Scheme (LRS) started in 2004 with USD 25,000 as the limit. Now it allows residents to send up to USD 250,000 yearly for approved transactions. LRS is different from the USD 1 million facility in who can use it and why.

Difference between Liberalized Remittance Scheme & USD 1 million scheme

LRS covers several types of transactions:

- Foreign travel

- Gifts or donations to NRI/PIO relatives

- Education or medical care overseas

- Buying foreign shares, properties, or opening international bank accounts

Once you've sent USD 250,000 in a financial year, you can't make more transfers even if you bring back your investment money.

Special cases requiring RBI approval

The Reserve Bank of India must approve certain repatriation of funds cases that exceed normal limits:

- Transfers above USD 1 million from an NRO account in one financial year

- Money from selling more than two residential properties in your lifetime

- Proceeds from agricultural land sales, which have restrictions

Foreign nationals who retire from Indian jobs, inherit assets from Indians, or are widows of Indian citizens can transfer up to USD 1 million yearly with proper documentation.

Your bank (Authorized Dealer) handles special approval requests. You'll need complete documentation explaining why you need to exceed standard limits. Banks review and forward these applications to the RBI with their input.

Foreign company employees on Indian assignments can keep foreign currency accounts outside India for their salaries. They must pay income tax on their entire Indian earnings.

These special cases need more paperwork and take longer than regular transfers. Plan ahead to successfully move your funds from India.

Taxes and Compliance in India

Tax compliance is the life-blood of successful repatriation of funds from India. You must understand tax implications and documentation requirements to ensure your transfers process smoothly.

TDS and tax implications

Your account type determines how taxes apply. NRO accounts face Tax Deducted at Source (TDS) at 30% plus applicable surcharge and cess. This tax applies to several income sources:

- Rental income from Indian properties

- Interest earned on NRO deposits (banks deduct TDS automatically)

- Capital gains from property sales (30% for short-term, 20% with indexation for long-term)

- Dividends and other income earned within India

NRE and FCNR accounts provide great tax benefits since interest earned remains completely tax-exempt in India. Many NRIs take advantage of this by maintaining both types of accounts.

A Double Taxation Avoidance Agreement (DTAA) between India and your country of residence helps you avoid paying taxes twice on the same income. This can reduce your tax burden on repatriated funds.

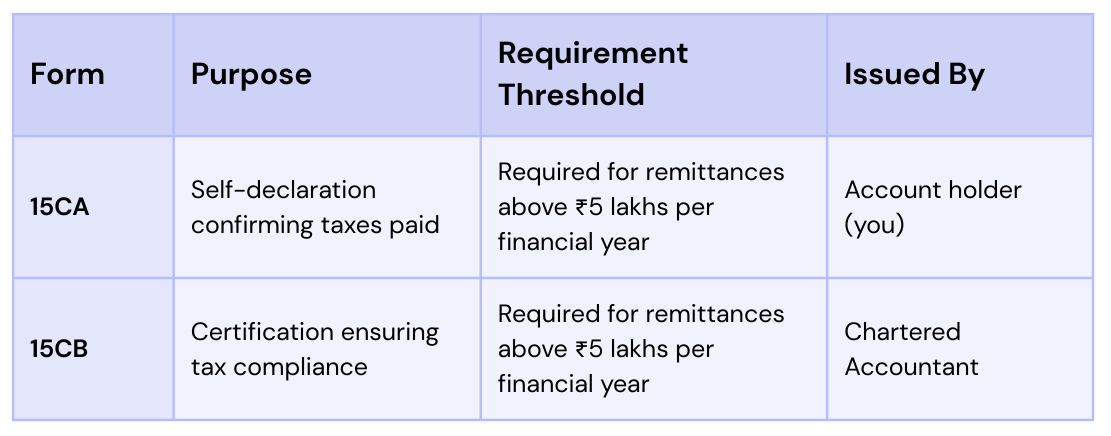

Form 15CA and 15CB explained

NRO account repatriation requires specific documentation to prove tax compliance:

Form 15CA contains four parts based on your situation:

- Part A: For remittances under ₹5 lakhs annually

- Part B: For remittances with tax order/certificate from Assessing Officer

- Part C: For remittances above ₹5 lakhs with Form 15CB

- Part D: For non-taxable remittances

Missing these form submissions can result in penalties up to ₹1 lakh. You must submit these forms online through the Income Tax Department portal before starting the transfer.

FEMA rules and purpose codes

The Foreign Exchange Management Act (FEMA) controls all cross-border transfers and specifies fund repatriation rules. FEMA guidelines require Form A2, which confirms compliance with legal requirements.

Your funds may face rejection without the proper purpose code. The Reserve Bank of India assigns specific codes to different types of transfers that show the transaction's nature.

Banks must follow strict RBI guidelines to repatriate funds only after tax payment verification. This verification safeguards against financial malpractices but might increase your transfer processing time.

Eligibility Checklist Before You Start

Before you start your repatriation of funds trip, make sure you meet the Reserve Bank of India's eligibility criteria. A quick check of your eligibility will save time and help you avoid rejection of your repatriation request.

NRI status and KYC

You must verify your Non-Resident Indian status under the Foreign Exchange Management Act (FEMA) to qualify for NRI repatriation. Indian passport holders need to show proof of a valid visa (employment/residence/student/dependent) or work/residence permit.

Foreign passport holders should present their Overseas Citizen of India (OCI) card or Person of Indian Origin (PIO) card.

You need to complete a fresh Know Your Customer (KYC) process when you change to NRI status. You'll need to submit:

- Self-attested passport copy

- Valid visa or OCI/PIO card

- Recent photograph

- Overseas address proof

Seafarers must provide specific documents including their passport, visa, and an employment contract that shows NRI status.

PAN and tax paid proof

Your Permanent Account Number (PAN) is required for all transactions under the Liberalized Remittance Scheme. You must submit Form 60 as an alternative if you don't have a PAN.

To repatriate funds from NRO accounts, you need these tax compliance documents:

- Form 15CA (self-declaration regarding remittance)

- Form 15CB (CA certificate that verifies tax payment)

These forms prove that you've paid all applicable taxes on the funds you want to repatriate.

Step-by-Step Process to Repatriate Funds

Starting the repatriation of funds needs careful planning and precise execution. This five-step guide will help streamline your fund transfer process from India to your country of residence.

Step 1: Choose the right account

The right account type should match your specific needs. Your NRE account or FCNR account allows unlimited repatriation with smooth transfers. Your NRO account works best to transfer income earned in India, with repatriation limits of USD 1 million per financial year.

Step 2: Gather required documents

These account-specific documents are needed:

For NRE/FCNR accounts:

- Request application form

- Form A2 (FEMA declaration form)

For NRO accounts:

- Request application form

- Form A2

- Documentary evidence of source of funds (rent receipts, dividend proofs, sale deeds)

Step 3: File tax forms and declarations

NRO accounts need this tax documentation:

- File Form 15CA online through the Income Tax portal (self-declaration of payment details)

- Get Form 15CB from a Chartered Accountant confirming tax payment

- Form 15CB must have a valid UDIN (Unique Document Identification Number)

Step 4: Submit request to bank

The transfer process requires:

- Log into your Net Banking account with your Customer ID and password

- Go to "Fund Transfer" tab

- Pick "Repatriation of Funds" under transactions

- Select transaction type based on your account

- Choose beneficiary and complete the transaction

You can also visit your bank branch with completed forms and supporting documents.

Step 5: Track and confirm transfer

Keep track of your transfer by:

- Using the provided transaction reference number

- Looking up status updates on your online banking portal

- Reaching out to your bank if funds don't appear in 7 days

Your beneficiary's account should receive the funds within 1-3 working days after processing.

Conclusion

Moving money out of India through fund repatriation needs a solid grasp of different account types and their rules. This piece shows how NRE accounts and FCNR accounts let you move unlimited funds without tax, while NRO accounts cap transfers at USD 1 million each financial year after tax cuts.

Your choice of account type is a vital part of planning your finances long-term. Putting your money in NRE or FCNR accounts from the start gives you more freedom to move it later.

The right paperwork is key to moving funds from India. NRO account holders must file Form 15CA and Form 15CB to show they've paid their taxes, especially if the amount goes over ₹5 lakhs per year.

Without doubt, the tax implications change by a lot between accounts. NRE and FCNR accounts don't get taxed in India, but NRO accounts face a 30% tax plus extra charges. So knowing these differences helps you plan your taxes better.

Note that FEMA regulations control all money transfers across borders, and you must follow them whatever the amount. Your bank checks all your documents as an authorized dealer before sending your money.

The five steps we've covered make the whole process much clearer. Each step connects to the next one, from picking your account to watching your transfer go through.

You might need special RBI approval if you want to send more than the usual limits. This often applies to medical emergencies, education costs, or buying property in your home country.

Moving your money from India becomes simple once you know the rules and get ready ahead of time. Good planning and the right papers help you transfer your money quickly while following all Indian rules.

Frequently Asked Questions

How much money can be repatriated from India to the USA?

From NRE/FCNR, balances are generally fully repatriable via bank procedure. From NRO, you can remit up to USD 1,000,000 per financial year for non-current funds after tax, while current income (rent, dividends, interest, pension) is remittable after tax and doesn’t use this cap.

What is the difference between NRI repatriable and non-repatriable?

Repatriable funds can legally be sent out of India (subject to tax and documentation). Non-repatriable funds must stay in India or can only be moved under restricted routes set by FEMA or the original investment terms.

What is repatriable in an NRE account?

Both principal and interest in an NRE (Non-Resident External) account are freely repatriable through your bank’s outward remittance process. Interest on NRE is generally tax-exempt in India, which makes exits cleaner.

What is the $1 million repatriation scheme for NRIs?

It’s an RBI facility allowing NRIs to remit up to USD 1 million per financial year from NRO for eligible assets like balances, sale proceeds, gifts, or inheritances, after paying applicable taxes. You’ll typically provide source proofs and file Form 15CA/15CB where required.

Who is eligible for repatriation?

NRIs with eligible funds, valid KYC/PAN, and tax paid proofs can repatriate through an authorized dealer bank. Banks may also require Form 15CA/15CB, account statements, and documents proving the source of funds.

How much money can an NRI transfer out of India?

From NRE/FCNR, there’s effectively no RBI cap beyond normal bank checks; from NRO, the USD 1M/FY limit applies to non-current funds after tax. Current income from NRO is remittable after tax without using that limit.

Can I sell my property in India and bring money to the USA?

Yes - after computing and paying capital gains tax/TDS, submit the sale deed, purchase deed, and tax proofs, then remit via your bank. Most cases use the USD 1M/FY NRO facility; if the property was bought with foreign funds, repatriation may be simpler subject to conditions.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.