Buying and selling property in India as an NRI can be complex due to tax implications and legal requirements. From understanding TDS rates to claiming exemptions and repatriating sale proceeds, navigating these transactions requires careful planning.

This guide covers everything you need to know for both purchasing and selling property in India, ensuring you minimize taxes and manage the process smoothly, no matter where you live.

Key Takeaway

Thinking of buying or selling property in India as an NRI? Here are the key points to know before you start:

- Emotional & Financial Value: Indian real estate connects you to your roots while offering strong growth, rental income, and currency advantage.

- Easy Ownership: NRIs can freely buy residential or commercial properties under FEMA; agricultural land needs RBI approval.

- Smart Financing: Indian banks offer NRI home loans with tax deductions on both interest and principal.

- Tax & Compliance: Apply for a Lower TDS Certificate, use Forms 15CA/15CB for repatriation, and claim capital gains exemptions.

- Inheritance & Repatriation: No inheritance tax; up to USD 1 million yearly can be repatriated from NRO accounts as per FEMA rules.

Why Property is a Key Asset for NRIs

Property in India means more than numbers on your investment portfolio. You get emotional connections plus financial opportunities that make real estate uniquely valuable.

Emotional and financial value of Indian property

Buying property in India helps you stay connected to your roots. Owning a home in your homeland gives you a physical anchor to your cultural identity and heritage.

This emotional connection drives most property decisions. It matters especially if you have strong ties to your native regions.

Here's what makes Indian real estate financially attractive:

- Consistent growth potential in emerging hotspots beyond metros • Cities like Pune, Kochi, Jaipur, and Hyderabad show strong appreciation

- Rental income provides steady passive income to offset mortgage payments

- Currency advantage for NRIs earning in dollars, euros, or dirhams

The weakening rupee increases your purchasing power. You can acquire more square footage for your foreign currency. This makes Indian real estate accessible compared to Western property markets.

Common reasons NRIs invest in real estate

Your motivations go beyond emotional ties and financial returns. Here's what drives most NRI property investments:

Future settlement plans:

Nearly two-thirds of NRIs want to settle in India after retirement. You'll want to secure property years in advance. About 90% of NRIs are ready to invest in senior housing.

Creating a family legacy:

Property lets you pass down material value and cultural connections to future generations. This matters especially if you're raising children abroad who need connections to their heritage.

Portfolio diversification:

Real estate provides stability through its tangible nature and appreciation potential. The Indian market stayed resilient during global economic downturns.

Hometown connections:

More than 75% of NRIs prefer investing in their hometowns over unfamiliar locations. This extends beyond major metros to tier-2 cities like Vadodara, Nashik, and Ghaziabad.

Contingency planning:

Tightening visa regulations in the US, UK, and Australia prompt many NRIs to create backup plans. Property investment serves as security against stringent immigration policies.

The Indian real estate sector has evolved for NRI investors. Developers now design projects specifically for NRI buyers. They use high-quality materials, superior fixtures, and modern amenities that match global standards.

Online platforms offer 3D virtual tours and specialized services. You can make informed decisions despite geographical distances.

Your investment in Indian real estate strengthens cultural bonds while building financial security for the future.

Buying Property in India as an NRI

Property purchase rules for NRIs are straightforward once you understand the eligibility requirements, documentation needs, and financing options.

What properties can you buy as an NRI?

Under FEMA, you're defined as an NRI if you're an Indian citizen living outside India for work, business, or other reasons for an indefinite period. You can freely buy residential and commercial properties without RBI permission.

You can invest in:

- Residential properties (apartments, houses, villas)

- Commercial properties (offices, shops, retail spaces)

- Industrial properties

You cannot buy agricultural land, farmhouses, or plantation properties unless you inherit them or get special RBI approval. This restriction includes farmhouses attached to agricultural land.

Which documents do you need?

You must have a valid Indian passport. Foreign passport holders need a PIO card or OCI card. A PAN card is absolutely essential for all property transactions.

If you're abroad during purchase, get a Power of Attorney (POA). This document lets a trusted person in India handle the transaction for you. Sign the POA before a consular officer or notary in your country, then get it attested.

The purchase process follows these steps: engage a local solicitor and notary, find a realtor, arrange POA if needed, locate property, conduct due diligence, sign sale deed, and register the property.

How do payments and loans work?

Pay for properties in Indian Rupees through normal banking channels or NRE,NRO,FCNR accounts. You cannot use foreign currency notes or traveler's cheques.

Major banks like SBI, HDFC, ICICI, Axis Bank, and Federal Bank offer specialized home loans for NRIs. These banks typically offer loans up to 80% of property value with 20-year tenures. You need stable overseas employment and must be aged 18-55 years.

Loan documentation includes your Indian passport or OCI/PIO card, overseas address proof, salary certificates, tax returns, and bank statements. Repay loans through NRE/NRO accounts using inward remittance.

You get the same tax benefits as resident Indians - deductions up to ₹1.5 lakh on loan principal under Section 80C and up to ₹2 lakh on interest payments for vacant homes.

Consult a real estate advocate before finalizing your purchase to ensure smooth transactions and regulatory compliance.

Selling Property in India as an NRI

Selling property from abroad involves specific procedures and compliance requirements. You need to understand who can buy from you, how to manage the sale remotely, and the legal steps required.

Who can buy from an NRI?

You can sell residential and commercial properties to Indian residents, other NRIs, or Overseas Citizens of India (OCIs) without restrictions. This gives you a wider buyer pool and potentially better prices.

Here's the catch: If you own agricultural land, farmhouses, or plantation properties, you can only sell to Indian residents. This applies even if you inherited these properties.

How do you sell property from thousands of miles away?

Selling property remotely requires systematic planning. Follow these steps:

- Execute a Power of Attorney (POA) in your current country

- Get POA notarized and attested by the Indian consulate or embassy

- Register the POA at Sub-Registrar's office in India within three months

- Gather required documents:

- Original title deed or sale deed

- PAN card

- Passport and OCI/PIO card (if applicable)

- Encumbrance certificate

- Municipal approvals

- Tax forms (15CA/15CB for repatriation)

- Draft Agreement to Sell once buyer is confirmed

- Ensure buyer deducts TDS - 30% for properties held under two years, 12.5% for longer holdings

What you need to know about Power of Attorney

Your POA acts as your legal proxy in India. The document must clearly specify powers for property sale, document signing, and fund collection.

Choose the right POA type:

- Special POA: Limited to specific transactions

- General POA: Broader powers for multiple activities

- Durable POA: Valid for your lifetime unless canceled

POA processes vary by country. Australia requires notarization with two witnesses plus apostille from Department of Foreign Affairs. The US requires apostille from Secretary of State after notarization.

Critical warning: Choose your POA holder carefully. They'll have significant authority over your transaction. Specify exact powers for sale, document signing, fund collection, and dispute handling.

Always register your POA in India for legal protection against fraud.

Understanding TDS on NRI Property Sale

When an NRI sells property in India, Tax Deducted at Source (TDS) becomes one of the most important parts of the transaction. TDS works like advance tax. The buyer deducts it at the time of payment and deposits it with the Income Tax Department. You get credit for this amount when you file your income tax return.

TDS rates and how they actually apply

TDS for NRIs is higher than the 1 percent rate applicable to resident sellers. Your rate depends on how long you have owned the property:

Short-term sale (held 24 months or less)

TDS is generally 30 percent plus surcharge and cess. This applies because short-term gains for NRIs are taxed at slab rates, and buyers usually withhold at the highest rate to stay compliant.

Long-term sale (held more than 24 months)

- Earlier, long-term TDS was 20 percent plus surcharge and cess.

- After Budget 2024, many tax platforms mention a 12.5 percent LTCG rate (without indexation) for eligible cases.

- During this transition, buyers generally follow the rate confirmed by your CA or the rate specified in your Lower TDS Certificate, to avoid mistakes.

A key rule:

By default, TDS is deducted on the entire sale value, not just the capital gains.

TDS on capital gains applies only if you obtain a Lower or Nil TDS Certificate (Form 13) from the Income Tax Department.

This is the most common misunderstanding among NRIs.

Buyer’s responsibility in TDS deduction

For NRI property sales, the buyer must complete all TDS compliance. Their duties include:

- Obtaining a TAN (Tax Deduction and Collection Account Number)

- Deducting TDS at the correct rate when making payment to you

- Depositing the TDS amount with the Income Tax Department by the 7th of the following month

- Filing a quarterly TDS return using Form 27Q

- Issuing Form 16A to you as proof of TDS deduction

You must clearly inform the buyer about your NRI status. If they mistakenly treat you as a resident and deduct only 1 percent, the entire transaction becomes non-compliant and both of you may face penalties.

Common TDS mistakes that NRIs should avoid

Errors in TDS deduction create delays, penalties and problems during repatriation. These are the issues seen most often:

- Incorrectly deciding whether the sale is short-term or long-term

- Not applying for a Lower or Nil TDS Certificate, which forces TDS on the full sale value

- Using Form 26QB instead of the correct Form 27Q

- Not obtaining a TAN, which is mandatory for NRI transactions

If TDS is deducted incorrectly or not deposited on time, the buyer may face interest and penalties equal to the missed TDS amount. You, the seller, may also face delays when trying to move funds abroad because banks require accurate TDS documentation.

Lower TDS Certificate (Form 13)

Applying for a Lower Tax Deduction Certificate is the best way to reduce unnecessary TDS. You can submit Form 13 online before the sale. If approved, the buyer will deduct TDS only on your calculated capital gains instead of the entire sale value. You will need to provide expected capital gains and details of your total income in India for that financial year.

Form 16A and checking your TDS credit

After filing their TDS return, the buyer must give you Form 16A. Review the details and match them with your Form 26AS to confirm that the TDS has been correctly credited to your PAN. This helps ensure a smooth tax filing and faster clearance for repatriation.

Reducing TDS Burden Legally

You can cut your TDS burden legally when selling property in India as an NRI. Your tax liability stays the same, but you reduce the upfront cash outflow through proper planning and documentation.

Applying for lower/NIL TDS certificate

Section 197 of the Income Tax Act lets you apply for a Lower Deduction Certificate (LDC) or NIL TDS certificate before your property sale. This certificate allows the buyer to deduct tax based on your actual tax liability rather than the entire sale value.

Here's how to get this certificate:

- Register on the TRACES portal and submit Form 13 online to the Jurisdictional Assessing Officer (AO)

- Show your lower tax burden by providing capital gains calculation and estimated total Indian income for the current year

- Apply 30-40 days before the sale, as processing takes 15-20 working days

You'll need your PAN card, property acquisition proof, sale agreement, buyer's TAN (Tax Deduction Account Number), capital gains computation, and previous tax returns.

Form 13, 15CA, and 15CB explained

Form 13 is your application for lower or nil TDS deduction. Log into the TRACES portal and provide details about your responsible TAN, nature of receipt, and requested TDS rate. You must justify the lower rate by showing actual capital gains after considering acquisition costs.

For getting your sale proceeds back abroad, Forms 15CA and 15CB are mandatory:

- Form 15CA: An undertaking about the TDS details that you generate yourself

- Form 15CB: A certificate that must be signed and stamped by a Chartered Accountant

Submit these forms to your bank when transferring funds outside India, declaring that all applicable taxes have been paid. You can repatriate up to USD 1 million per financial year from property sales.

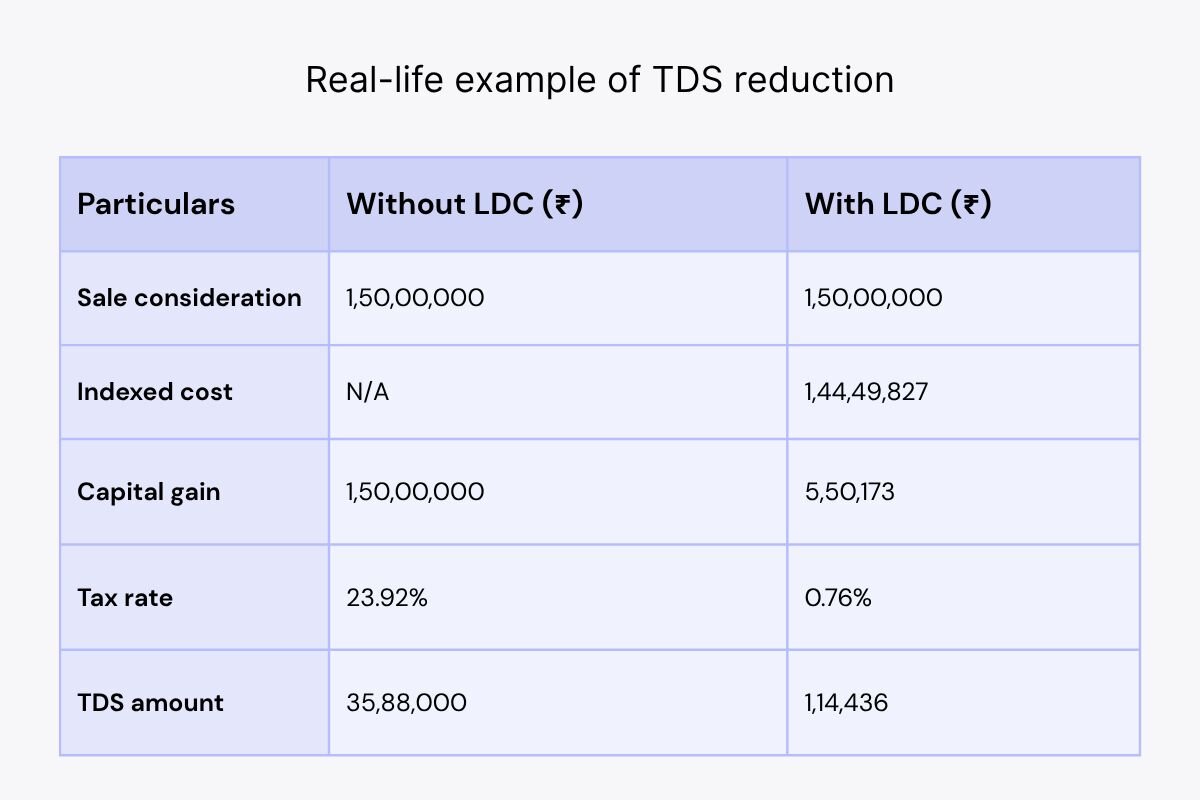

Real-life example of TDS reduction

Here's an actual case showing the financial impact of getting a Lower TDS Certificate:

An NRI sold a Mumbai property for ₹1.5 crore that was purchased in 2020 for ₹1.2 crore. Without an LDC, TDS would be calculated on the entire sale consideration:

The NRI saved ₹34,73,564 in immediate tax outflow by getting an LDC. The final tax liability stayed the same, but this improved cash flow by preventing excess funds from getting locked with tax authorities.

Even if you miss applying for an LDC, you can still claim a refund for excess TDS when filing your income tax return, though after a longer waiting period.

Capital Gains Tax and Exemptions

Understanding how capital gains tax works is essential when you sell property in India as an NRI. Your tax depends on how long you owned the property and whether you qualify for any exemptions.

How does the holding period affect your tax?

Your holding period decides whether your gains are short-term or long-term.

Short-Term Capital Gains (STCG)

If you sell the property within 24 months, your profit is treated as short-term.

For NRIs, STCG is taxed at normal income tax slab rates, which go up to 30 percent plus surcharge and cess.

No indexation benefit applies.

Long-Term Capital Gains (LTCG)

If you hold the property more than 24 months, it becomes long-term.

Due to the July 23, 2024 change in tax rules, the applicable rate depends on the date of transfer, not the purchase date:

- Property sold before July 23, 2024:

- LTCG was taxed at 20 percent with indexation, plus surcharge and cess.

- Property sold on or after July 23, 2024:

- LTCG is taxed at a flat 12.5 percent without indexation, plus surcharge and cess.

- Indexation benefit has been removed for these transactions.

Indexation previously increased your purchase cost based on inflation to lower your taxable gains. This benefit is no longer available for property sales on or after July 23, 2024.

Which exemptions can reduce your tax?

NRIs can still claim the same capital gains exemptions available to resident taxpayers. The main options are:

Section 54

For NRIs selling residential property.

You can claim exemption by investing the capital gains amount in another residential property in India.

Eligible timelines:

- Buy a new property within 1 year before sale

- Buy within 2 years after sale

- Complete construction within 3 years

The exemption is capped at ₹10 crore.

Section 54F

For NRIs selling any property other than residential (for example, land or commercial property).

You must invest the entire sale proceeds in a residential property in India.

If you invest only part of the amount, your exemption will be proportionate.

Also capped at ₹10 crore.

Section 54EC

You can invest up to ₹50 lakh of your capital gains in NHAI or REC bonds within 6 months of the sale.

These bonds have a 5-year lock-in, and the invested amount becomes tax-exempt.

What to do after selling your property

Even if TDS was already deducted by the buyer, you must file your income tax return in India. Filing is mandatory for:

- Reporting actual capital gains

- Claiming exemptions under Sections 54, 54F or 54EC

- Reconciling TDS shown in Form 26AS

- Requesting a refund if TDS was deducted on the full sale value instead of only the gains

Always verify Form 16A issued by the buyer against your Form 26AS before filing.

Even if your total income is below the taxable limit, tax filing is the only way to claim refunds for excess TDS.

Legal and Compliance Aspects for NRIs

Property management from thousands of miles away creates specific challenges. Tenant issues, maintenance problems, and legal compliance requirements demand specialized solutions and proper procedures.

Property management through local agents

You need a trustworthy property management service if you can't regularly visit your properties. These professionals handle property ownership tasks that require physical presence in India.

Property managers offer these services:

- Rent collection and tenant verification

- Repair coordination and regular inspections

- Property tax filing and local regulation compliance

- Record maintenance and document updates

- Property monitoring to prevent unauthorized occupation

Many NRIs hire legal experts who can represent them during disputes. This simplifies asset management and prevents legal complications from neglect.

How do you handle disputes and encroachments?

Property encroachment hits NRIs hard due to physical absence. The Indian legal system provides multiple remedies to protect your property rights.

You can file criminal cases under the Indian Penal Code against trespassers (Section 441) or those creating fraudulent ownership documents.

Civil remedies under the Specific Relief Act, 1963 let you file suits to reclaim possession without proving legal title. RERA protects against fraudulent sales and unauthorized possession.

Your best defense remains prevention:

- Regular property visits (personal or through representatives)

- Boundary walls around empty plots

- CCTV camera installation

- Immediate legal notices or police complaints for potential encroachment

Why proper documentation matters

Documentation forms the foundation of secure property ownership. The Registration Act, 1908 requires mandatory registration for gift deeds and lease agreements exceeding one year.

The Supreme Court mandates that property transfers occur through registered deeds to prevent fraud and establish clear ownership. Registered documents provide authenticity, transparency, and valid court evidence during disputes.

Critical documents for NRI property sales include sale deed, title deed, and encumbrance certificate showing the property is free from legal liabilities. Remote transactions require Power of Attorney properly notarized in your residence country and attested by the Indian Embassy or Consulate.

Thorough documentation provides ownership evidence, prevents disputes, and ensures smooth transactions—crucial when managing real estate from abroad.

Inheritance and Gifting Rules for NRIs

Inheriting or gifting property in India follows different rules for NRIs. Get these regulations right for proper asset planning and tax compliance.

Tax on inherited property

Good news: India does not impose inheritance tax. You pay zero tax on assets acquired through inheritance. This applies to all property types including residential, commercial, and even agricultural land that NRIs typically cannot purchase directly.

Once you inherit property, income from these properties becomes taxable based on how you use them:

- Self-occupied properties: No tax implications

- Rental income: Taxable after standard deductions

- Dividends from inherited shares: Taxed as "income from other sources"

- Interest from fixed deposits: Taxed as "income from other sources"

When you sell inherited property, capital gains calculations use the original purchase price of the previous owner (or fair market value as of April 1, 2001, for older properties). Your holding period includes both your ownership time and that of the previous owner.

Gifting property to family

You can freely gift property to relatives in India without tax implications. Gifts to non-relatives are tax-exempt only if their value doesn't exceed ₹50,000.

You must register a gift deed for documentation. If you later sell gifted property, deposit proceeds in an NRO account with repatriation limited to USD 1 million annually.

What to do next: Consult a tax advisor before gifting high-value properties to understand the complete tax implications for both parties.

Repatriation Rules and DTAA Implications

You've sold your property. Now you need to get your money back home.

The repatriation process follows specific RBI regulations. Most NRIs don't realize the documentation requirements can delay transfers by weeks if done incorrectly.

How to repatriate sale proceeds

All property sale proceeds must first go into your Non-Resident Ordinary (NRO) account. From there, follow these steps:

- Verify proper TDS deduction before any transfer

- Submit required forms to your bank

- Request transfer to your overseas account or NRE account

Here's what many NRIs miss: Properties bought using foreign currency through NRE/FCNR accounts let you repatriate the entire sale proceeds freely. But this privilege applies to only two residential properties in your lifetime.

Properties purchased using NRO accounts face the annual limit.

What are the limits and documentation requirements?

FEMA allows you to repatriate up to USD 1 million per financial year from NRO accounts. Amounts above this need special RBI approval.

Required documents:

- Form 15CA: Online tax payment declaration

- Form 15CB: CA certificate confirming tax compliance

- Sale deed and purchase documents

- Tax clearance certificate

- PAN card and passport copies

Missing any document stops your transfer. Double-check everything before submission.

How do DTAA benefits help US, UK, and UAE residents?

Double Taxation Avoidance Agreements (DTAAs) prevent taxing the same income twice. India has signed DTAAs with over 90 countries, including the US, UK, and UAE.

Your benefits by country:

- US residents: Claim foreign tax credit for Indian taxes paid

- UK residents: Get tax relief on Indian earnings, including dividends

- UAE residents: Enjoy lower TDS rates since UAE has no personal income tax

Get a Tax Residency Certificate (TRC) from your home country to claim these benefits.

Next step: Contact your bank with all documentation ready before initiating any repatriation request.

Conclusion

You now have the complete roadmap for buying and selling property in India as an NRI. Start by understanding your eligibility and required documents before purchasing any property. When selling, apply for a Lower Deduction Certificate through Form 13 at least 30-40 days before your sale to minimize TDS burden. Use Section 54, 54F, or 54EC exemptions to reduce your capital gains tax legally.

For remote transactions, execute a proper Power of Attorney and ensure all documents are notarized and attested correctly. File your income tax returns even if TDS was deducted to claim any excess refunds. Finally, prepare Forms 15CA and 15CB for repatriating your sale proceeds up to USD 1 million annually. Your next step: consult a qualified tax advisor familiar with NRI property transactions and start organizing your documentation today.

Frequently Asked Questions

What are the TDS rates for NRIs selling property in India in 2025?

For NRIs, TDS depends on whether the sale is short-term or long-term:

- Short-term sale (held 24 months or less):

- TDS is generally deducted at 30 percent plus surcharge and cess, since short-term gains are taxed at slab rates for NRIs.

- Long-term sale (held more than 24 months):

- For property sold on or after 23 July 2024, TDS is deducted at a flat 12.5 percent plus surcharge and cess, without indexation.

- (The earlier 20 percent with indexation applied only to sales made before 23 July 2024.)

By default, TDS for NRIs is deducted on the entire sale consideration, not on the capital gains, unless you obtain a Lower or Nil TDS Certificate (Form 13).

How can NRIs reduce their TDS burden when selling property in India?

NRIs can apply for a Lower Deduction Certificate (LDC) or NIL TDS certificate under Section 197 of the Income Tax Act. This allows the buyer to deduct tax at a reduced rate based on the seller's actual tax liability rather than on the entire sale value. The application should be made through Form 13 on the TRACES portal at least 30-40 days before the sale.

What are the capital gains tax exemptions available for NRIs selling property?

NRIs can claim exemptions under Section 54 (for reinvesting in another residential property), Section 54F (for investing the entire sale proceeds in a residential property), and Section 54EC (for investing up to ₹50 lakh in specified bonds). These exemptions can significantly reduce the tax liability on capital gains from property sales.

How much can an NRI repatriate from property sale proceeds annually?

Under FEMA regulations, NRIs can repatriate up to USD 1 million per financial year from their NRO accounts, which includes property sale proceeds. This limit applies to properties purchased using NRO accounts or Indian income. For properties bought with foreign currency through NRE/FCNR accounts, the entire sale proceeds can be repatriated for up to two residential properties in a lifetime.

What documents are required for NRIs to repatriate property sale proceeds?

NRIs need to submit Form 15CA (online declaration of tax payment), Form 15CB (certificate from a Chartered Accountant confirming tax compliance), sale deed, purchase documents, tax clearance certificate, and copies of PAN card and passport to their bank for repatriating property sale proceeds. Proper documentation ensures compliance with tax regulations and facilitates smooth fund transfer.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.