Form 10F helps non-residents avoid double taxation on their Indian income. Non-resident taxpayers earning money in India can use this vital document to claim benefits under the Double Taxation Avoidance Agreement (DTAA). The agreement ensures they don't pay taxes twice on the same income.

The document works as a self-declaration tax form created specifically for non-resident individuals, Hindu Undivided Families (HUFs), and foreign corporations with Indian income. You must file this mandatory form when your Tax Residency Certificate (TRC) lacks certain details. Filing should happen before any payments to prevent excess tax deductions. The form lets you self-declare your home country's tax treaty with India through the Indian Central Board of Direct Taxes' (CBDT) eFiling income tax portal. This allows you to follow DTAA rules instead of paying higher taxes under Indian laws.

This article will help you understand Form 10F's purpose, filing requirements, process details, and the most important tax benefits available to non-residents earning income in India.

What is Form 10F and Why It Matters for NRIs

Understanding Form 10F is everything you need to know if you earn income in India as a non-resident. This document helps you get tax benefits and stay compliant with Indian tax regulations.

Definition of Form 10F under Indian Income Tax Act

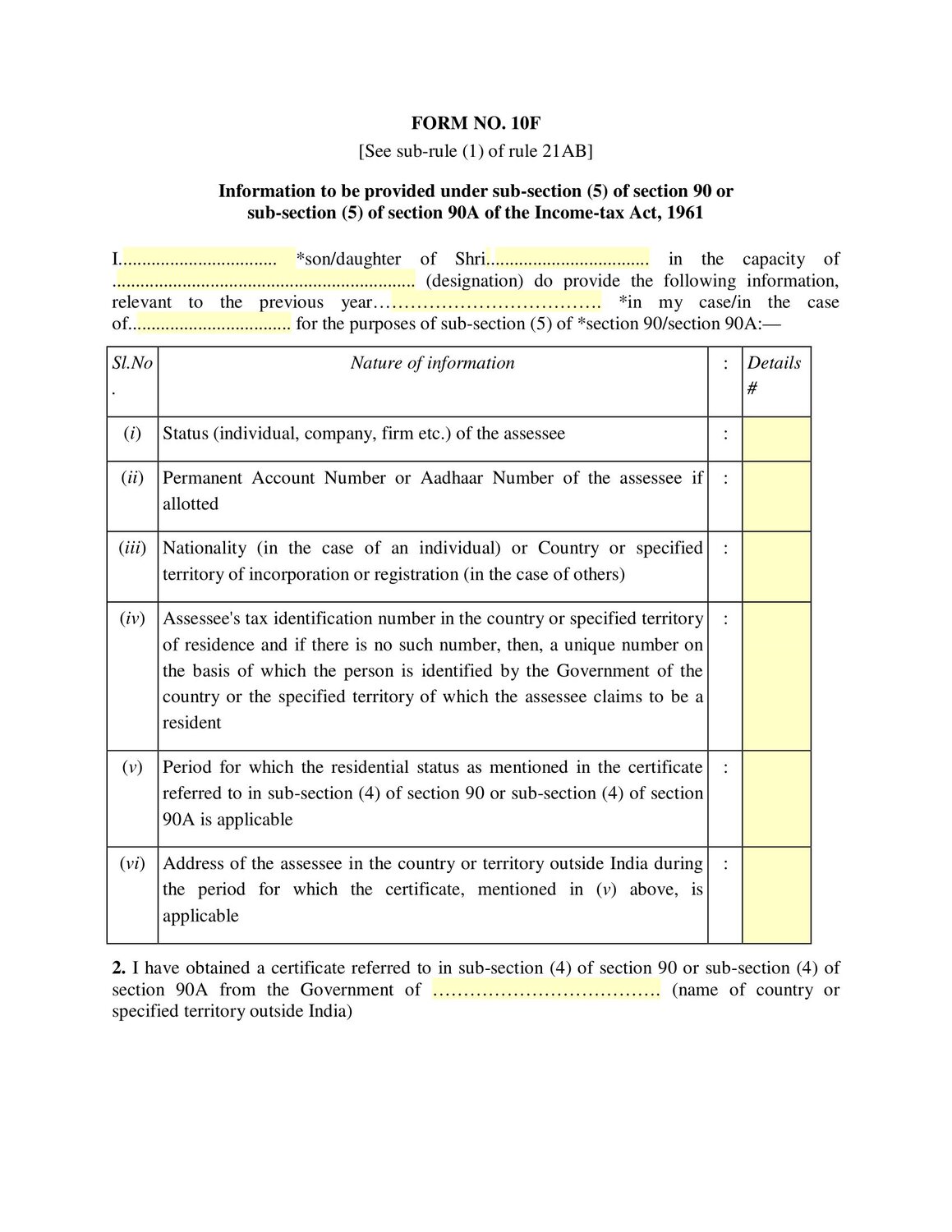

Form 10F works as a self-declaration document under Section 90(5) of the Income Tax Act, 1961, read with rule 21AB of the Income-tax Rules, 1962. Non-resident taxpayers can claim benefits under Double Taxation Avoidance Agreements (DTAAs) with this form if their Tax Residency Certificate (TRC) doesn't have vital details.

You need to provide specific details in the form including your status (individual, company, firm), nationality or country of incorporation, tax identification number in your country of residence, period of residential status, and address outside India. Form 10F acts as an official declaration that confirms your tax status and shows you're eligible for treaty benefits with India.

The form became more important after July 16, 2022. Indian tax authorities made electronic filing a must for non-resident taxpayers who want treaty benefits. The legal framework makes Form 10F a vital part of international taxation if you have financial connections to India while living abroad.

You can download the Form 10F from the official Indian Income tax Website - Download Form 10F

Purpose of Form 10F in DTAA compliance

Form 10F's main goal is to help with DTAA compliance. India has DTAAs with many countries including the USA, UK, Germany, Spain, Australia, China, and Mauritius. These agreements want to stop the same income from being taxed twice - in India and your country of residence.

You prove your tax residency status with Indian authorities through Form 10F. This document becomes vital proof to determine your tax liability in India. Filing this form lets you:

- Get reduced tax deduction at source (TDS) rates under treaty provisions

- Avoid being labeled as a defaulting assessee in India, which could lead to penalties

- Back up claims for tax exemptions or deductions under the Indian Income Tax Act

- Use the tax credit in your country of residence, with proof of taxes paid in India

To cite an instance, if you get royalty payments from India, a DTAA might give you a lower tax rate compared to the standard rate for non-residents. This can save you money.

When Form 10F is required despite having a TRC

A Tax Residency Certificate (TRC) from your country of residence is enough to claim DTAA benefits. But you must file Form 10F if your TRC doesn't have vital information.

Rule 21AB says you don't need Form 10F if your TRC already has all these details:

- Your status (individual, company, firm)

- Nationality (for individuals) or country of incorporation (for others)

- Tax Identification Number or unique identification in your country

- Period for which the residential status applies

- Address in your country during the applicable period

Notwithstanding that, Form 10F becomes necessary if any details are missing from your certificate. This happens often with TRCs from certain countries that don't include all information Indian tax authorities need.

Non-residents without a Permanent Account Number (PAN) used to have trouble filing Form 10F. The Central Board of Direct Taxes (CBDT) now lets non-residents register and file Form 10F electronically without a PAN on the Income Tax Portal. CBDT gave one-time relief to taxpayers without PAN until September 2023 for the financial year 2023.

Keep in mind that a TRC works for one fiscal year only. You need to submit it every year to keep getting DTAA benefits. Filing both your TRC and Form 10F (when needed) properly will give you the best tax efficiency for your Indian income.

Who Needs to File Form 10F in India

Form 10F filing rules apply to non-residents who earn income from Indian sources and want to claim benefits under Double Taxation Avoidance Agreements (DTAAs). This form works with the Tax Residency Certificate (TRC) to help people claim reduced tax rates or exemptions.

Non-Resident Individuals (NRIs)

NRIs need to file Form 10F if they earn taxable income from India but live somewhere else. These people include:

- Foreign citizens with temporary work in India

- Remote freelancers or consultants working for Indian companies

- People getting passive income like dividends, interest, or rent from Indian assets

- NRIs who have capital gains from Indian investments

NRIs should know that Form 10F becomes mandatory when their TRC doesn't have specific details that Indian tax authorities need. The form helps verify tax residency status to avoid paying tax twice on the same income for those earning from countries that have DTAA arrangements with India.

NRIs without a Permanent Account Number (PAN) can now sign up on the Income Tax Portal and file Form 10F online since PAN requirements are more relaxed. This change has made it easier for non-resident individuals who couldn't file electronically before.

Foreign Companies and LLPs

Foreign companies doing business in India need Form 10F to get DTAA benefits. This applies to:

- Multinational corporations earning royalties or technical fees from India

- Companies operating in India without a permanent establishment

- Foreign businesses getting interest payments from Indian entities

- Corporate entities with investments in Indian markets

Foreign companies don't technically have to file Form 10F, but it's a smart move since it lets them pay lower tax rates under DTAAs. Without this form, they'd pay standard withholding tax rates in India that are much higher than treaty rates.

Foreign Limited Liability Partnerships (LLPs) also need to file Form 10F when they get income from Indian sources. They need to get their Tax Identification Number (TIN) from their home country before filing.

Trusts, HUFs, and Other Non-Resident Entities

Form 10F rules cover all other non-resident entities that earn income from India, such as:

- Foreign trusts with Indian beneficiaries or investments

- Partnerships set up outside but working in India

- Non-resident Hindu Undivided Families (HUFs) earning from India

- Foreign associations getting payments from Indian entities

- Investment funds and financial institutions exposed to Indian markets

The rules stay the same no matter what type of entity you are - you need the form to claim DTAA benefits on Indian income. These entities must provide details about their status, tax identification, and where they live in their home country.

Businesses or individuals with a Permanent Establishment (PE) in India can't claim DTAA benefits through Form 10F. This includes those with a fixed business place, dependent agents, or significant presence in India.

Not filing Form 10F electronically could mean losing treaty benefits for all non-resident taxpayers. Indian resident payors might face tax penalties if they deduct less or no tax when non-residents use reduced treaty rates without proper papers.

Recent updates show that non-residents who don't need PAN under Income Tax Act rules can file Form 10F manually until September 30, 2023.

Documents Required to Submit Form 10F

You need the right documentation to submit Form 10F and claim Double Taxation Avoidance Agreement (DTAA) benefits. Indian tax authorities ask for specific supporting documents to verify your non-resident status and tax benefit eligibility.

Tax Residency Certificate (TRC) Requirements

The Tax Residency Certificate is the foundation of your Form 10F filing. Your country's tax authority must issue this certificate as the main proof of your tax status. The TRC should be valid for the fiscal year you want DTAA benefits. You need a new certificate each year because TRCs expire annually.

Your TRC goes with Form 10F, and its format can differ between countries. Indian tax authorities accept these different formats as long as they show your tax status details. Form 10F becomes necessary if your TRC misses some information. On top of that, it needs PDF or ZIP format attachments. Each file should stay under 5MB, with everything together not exceeding 50MB.

Tax Identification Number (TIN) and Nationality Proof

Your country's Tax Identification Number sets you apart as a unique taxpayer. This number must appear in your Form 10F submission. You need proof of nationality through government ID or passport if you're filing as an individual. Companies must show incorporation or registration proof from their home country.

Different documents are needed based on who you are:

- For individuals: Your identity proof should show birth date, TIN details, and address from your country

- For companies: You need incorporation certificates, address proof, company email ID, and tax details

PAN Card Requirement and Exceptions

The Permanent Account Number (PAN) used to be necessary for online Form 10F filing because the income tax e-filing portal needed PAN details to log in. This created problems for non-residents without an Indian PAN. Recent changes have made things easier.

The Central Board of Direct Taxes (CBDT) gave one-time relief for the financial year 2023. Non-resident taxpayers could submit Form 10F by hand without a PAN until September 2023. Now, non-residents can sign up on the Income Tax Portal without a PAN. They can file Form 10F electronically by providing simple details like name, birth date/incorporation, TIN, and country.

Some non-residents don't need a PAN. To cite an instance, see those who invest in specified funds or eligible foreign investors making capital asset transactions under specific conditions.

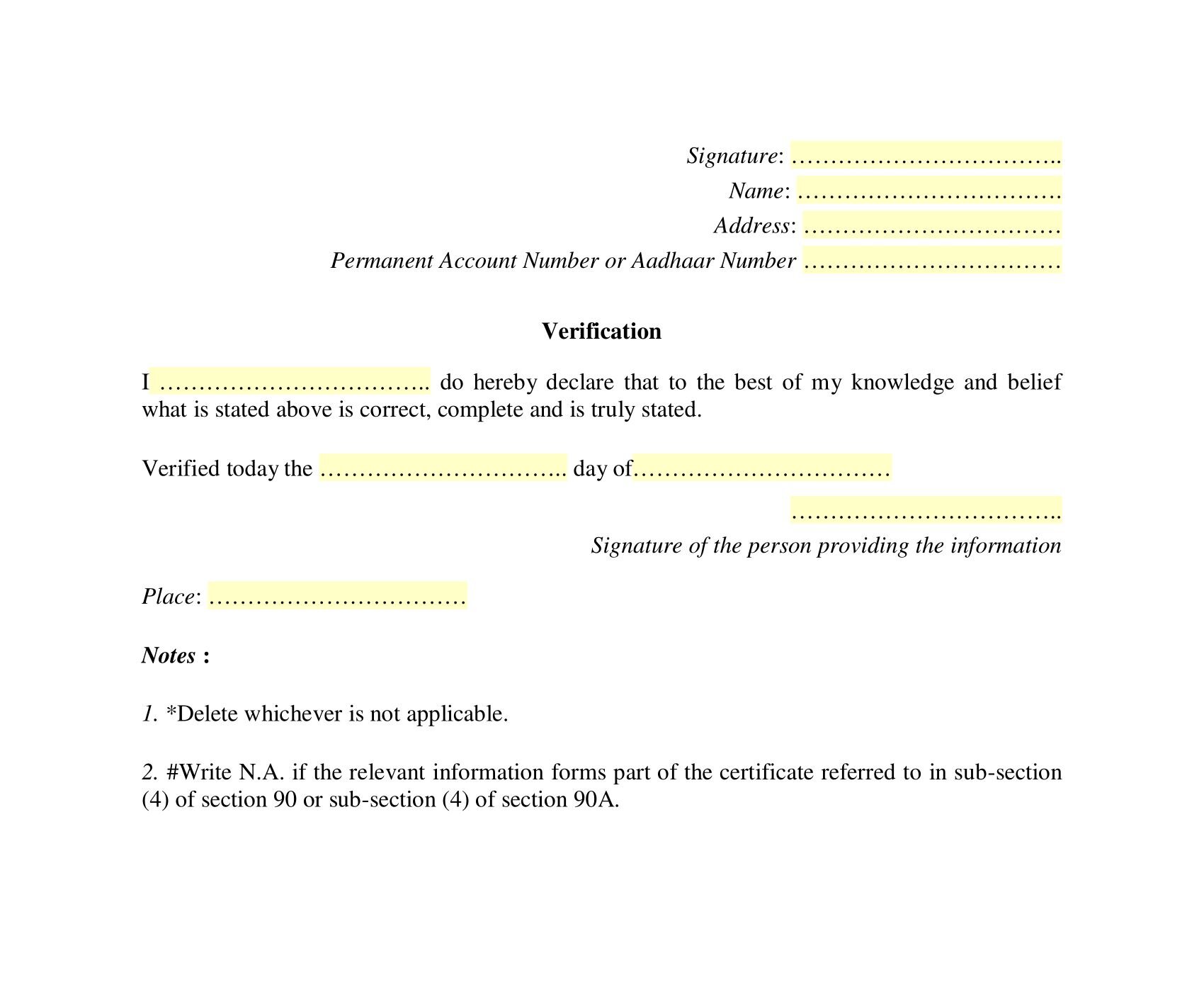

Digital Signature Certificate (DSC) for e-filing

A Digital Signature Certificate proves your Form 10F submission is authentic. The DSC works like a physical signature in the digital world. You need a valid Class 2 or Class 3 DSC that hasn't expired or been revoked.

The DSC requirement applies to:

- Companies and political parties

- Individuals who need account audits under the Income Tax Act

- Authorized signatories who submit for non-resident entities

Your existing Class 2 or 3 DSC works for e-filing Form 10F if it's still valid. New users must register their DSC with the e-Filing system before signing or verifying portal documents.

Step-by-Step Guide to File Form 10F Online

Filing Form 10F electronically is now required to claim DTAA benefits in India. The Central Board of Direct Taxes (CBDT) made this change in July 2022. You need to understand how to file this form online.

Registering on the Income Tax e-Filing Portal

The registration steps are different based on whether you have an Indian Permanent Account Number (PAN):

For PAN holders:

- Visit the official - income tax e-filing portal.

- Log in using your PAN and password

- New users must complete registration by providing required details

For non-PAN holders (introduced after March 2023):

- Access the - portal registration page

- Under the 'others' category, select "non-residents not holding and not required to have PAN"

- Enter simple details including name, date of incorporation, tax identification number, status, and country of residence

- Add the core team's details such as name and date of birth

- Submit contact information (email and mobile number) for OTP verification

- Upload documents including TRC, address proof, and identification proof

The income tax portal accepts foreign mobile numbers but might not send OTP passwords to them. You may need an Indian mobile number for verification.

Filling Form 10F with Section 90/90A Details

After logging in:

- Go to the "E-file" tab and select "Income Tax Forms"

- Click on "File Income Tax Forms"

- Select the tab labeled "Person not dependent on any source of Income (Source of Income not relevant)"

- Choose Form 10F from the available options

- Select the assessment year (2025-26, to name just one example) and click "Continue"

- Review instructions and click "Let's get started"

- Choose whether you're filing under Section 90 or Section 90A from the dropdown

- Enter your status (individual, company, etc.) - this field may be pre-filled

- Add your country of incorporation/registration

- Enter your Tax Identification Number (TIN) or equivalent unique identifier from your country

Uploading TRC and Supporting Documents

Next steps include:

- Enter your TRC's valid period (typically one fiscal year)

- Add your complete address in your country of residence

- Attach your Tax Residency Certificate in PDF format

- Each attachment should not exceed 5MB, and all attachments together must stay under 50MB

The portal didn't deal very well with foreign users without PAN at first. CBDT allowed manual submissions until September 30, 2023. Electronic filing became mandatory for everyone after this date.

Verifying and Submitting Form 10F

Complete these final steps:

- Review all entered information through the preview option

- Verify the form using one of these methods:

- Digital Signature Certificate (DSC) - most common for companies and required for non-residents

- Electronic Verification Code (EVC) - available for some users

- Click "Submit" after verification

- Save the acknowledgment number for future reference

DSC users must register their certificate with the e-Filing system before using it for verification. Companies and most non-resident entities use DSC as their main verification method.

Consequences of Not Filing Form 10F

Not filing Form 10F creates serious money problems and legal risks for non-residents who earn income from Indian sources. The problems go beyond just paperwork and can affect your tax payments and legal position.

Higher TDS Deduction on Indian Income

Missing Form 10F submission forces Indian payers to deduct tax at source (TDS) at much higher domestic rates. They can't use the better rates available under DTAAs. Here's what this means:

- Your Indian income faces standard domestic TDS rates of about 20.8% instead of lower DTAA rates

- To cite an instance, an Indian client paying you USD 50,000 must deduct the full 20.8% (USD 10,400) right away from your payment

- Money from interest, royalties, and dividends from India might get taxed up to 20% instead of lower rates like 15% under India-USA DTAA

These higher tax deductions create immediate cash flow problems that disrupt your business operations and financial plans.

Loss of DTAA Benefits

Missing Form 10F leads to complete loss of DTAA benefits. The government notification dated July 16, 2022 states that failing to meet Form 10F requirements results in:

- Complete removal of all DTAA benefits that taxpayers previously received

- Your income gets taxed twice - in India and your home country

- You can't claim lower tax rates or exemptions on various types of Indian income

- You pay extra taxes that proper documentation could have helped you avoid

Right now, missing Form 10F means you lose access to better tax rates, exemptions, and special provisions that India and your country agreed upon. This affects your total tax bill by a lot.

Classification as Assessee in Default

The legal problems go beyond money when you skip filing Form 10F. Indian tax law may label you an "assessee in default" if:

- You try to get reduced tax rates or claim zero tax without Form 10F [241]

- Your Indian payer uses treaty benefits without proper papers

This creates real headaches:

- Problems sending money from India to overseas bank accounts

- Tax notices under Section 143(1)(a) for wrong income tax return claims

- More hassles during tax checks and audits

- Extra tax penalties and interest on unpaid taxes

- Legal notices that can hurt your business relationships

Indian tax authorities won't accept lack of knowledge as an excuse. About 80% of DTAA claim rejections happen because of documentation mistakes, including wrong Form 10F submissions.

Tax Benefits of Filing Form 10F for NRIs

Form 10F offers significant tax benefits to Non-Resident Indians who earn income from India. This important document helps you get better tax rates on your Indian income sources.

Lower TDS Rates on Royalties, Interest, and Dividends

Form 10F helps you get reduced tax deduction rates on income streams of all types. DTAAs typically offer TDS rates of 10-15% instead of the standard 20% domestic rate for non-residents. Your royalty payments from India could qualify for a 10% tax rate rather than 20% under applicable treaties. Without Form 10F, you would pay 20% tax on dividend income instead of the reduced 15% available under agreements like the India-USA DTAA.

Avoidance of Double Taxation under DTAA

Form 10F ensures you don't pay taxes twice on the same income. This documentation helps you:

- Balance your tax responsibilities between countries

- Pay taxes in just one jurisdiction

- Get relief on your Indian income that's already taxed in your resident country

- Use Foreign Tax Credit mechanisms to offset Indian taxes against your residential country's tax liability

Faster Refund Processing and Tax Credit Claims

Form 10F strengthens your documentation for tax authorities in India and your country of residence. A better paper trail reduces the time needed to receive refund claims and prepares you better for tax audits. The form also proves your tax residency status with Indian authorities, which is crucial to determine your correct tax liability.

Conclusion

Form 10F is a vital document you need if you're a non-resident taxpayer earning income from India. This self-declaration helps you claim benefits under Double Taxation Avoidance Agreements. You won't have to pay tax twice on the same income. Without proper filing, you might end up paying tax rates that are by a lot higher and lose valuable DTAA benefits.

You need to know what's required to file correctly. Get your Tax Residency Certificate, Tax Identification Number, and Digital Signature Certificate ready before you start the electronic submission process. The tax system has improved. Non-PAN holders can now register on the Income Tax Portal, which makes everything more available to many non-residents.

Filing Form 10F does more than just keep you compliant. You get access to lower tax deduction rates on royalties, interest, and dividends from Indian sources. On top of that, it makes your tax position stronger both in India and your country of residence. You might even get your refunds processed faster.

Not submitting Form 10F has serious implications. Indian payers must deduct tax at higher domestic rates instead of beneficial DTAA rates. This creates immediate cash flow problems. Then, you might be labeled an "assessee in default" and face legal issues within the Indian tax system.

Form 10F ended up being your key to optimizing tax on Indian income. The filing process might look complex at first, but the financial benefits are way beyond the reach and influence of the administrative work needed. India keeps refining its tax framework for non-residents. Staying updated about Form 10F requirements is vital if you have financial connections to India while living abroad.

Frequently Asked Questions

What is Form 10F of Income Tax Act?

Form 10F is a self-declaration form that non-resident taxpayers file to claim benefits under Double Taxation Avoidance Agreements (DTAA) between India and their country of residence. It's required when your Tax Residency Certificate (TRC) doesn't include all mandatory details like taxpayer status, nationality, Tax Identification Number (TIN), residency period, or address. The form was introduced under Rule 21AB of the Income Tax Rules to supplement TRC information and help Indian tax authorities verify your eligibility for treaty benefits. Since July 2022, Form 10F must be filed electronically through the Income Tax e-filing portal, making it easier for NRIs and foreign entities to claim their rightful tax relief.

What is Form 10F used for?

Form 10F serves two primary purposes - it helps you avoid double taxation on the same income and allows you to claim reduced tax rates on Indian income sources like dividends, interest, royalties, and capital gains.

For example, if you're a US-based NRI earning dividend income from Indian stocks, the standard tax rate might be 20%, but under the India-US DTAA, this could reduce to 15% when you submit Form 10F with your TRC. The form also prevents you from being classified as an "assessee in default" by Indian tax authorities, which can complicate remittances and lead to penalties. Without Form 10F, you'll face higher Tax Deducted at Source (TDS) rates on all your Indian income.

How to file Form 10F without PAN?

Since October 2023, non-residents can file Form 10F without a PAN by registering on the Income Tax Portal under the category "Non-residents not holding and not required to have PAN." During registration, you'll provide basic details like name, date of incorporation (for entities), Tax Identification Number from your home country, country of residence, and contact information including email and mobile number.

You'll need to upload supporting documents like your Certificate of Incorporation, TIN, Tax Residency Certificate, and address proof from your country of residence. After registration, you can access the e-filing portal and submit Form 10F using a Digital Signature Certificate or Electronic Verification Code, though the portal may not deliver OTP to foreign mobile numbers, requiring alternative verification methods.

Is Form 10F mandatory?

Form 10F is mandatory if you want to claim DTAA benefits and your TRC doesn't contain all the required information specified under Rule 21AB. While technically you might not need it if your TRC includes status, nationality, TIN, residency period, and address, most Indian tax deductors and payers insist on an e-filed Form 10F before applying reduced tax rates.

If you claim reduced tax rates or exemptions without filing Form 10F, you'll be treated as an "assessee in default," face higher TDS deductions at domestic rates (up to 30%), and may encounter difficulties with remittances from India. Understanding how DTAA works can help you determine when Form 10F filing becomes essential for your situation.

Is DSC compulsory for Form 10F?

Digital Signature Certificate (DSC) is not the only option for Form 10F verification. You can also use Electronic Verification Code (EVC) sent to your registered mobile number and email address on the Income Tax Portal. However, DSC is strongly recommended for non-residents because it provides more robust authentication and reduces the chances of form rejection by tax authorities. If you choose DSC, note that it must be obtained in India, which means you'll need an authorized representative to acquire it on your behalf.

The choice between DSC and EVC depends on your specific situation, but having a DSC makes the process smoother for ongoing compliance needs.

How to download Form 10F?

Click here to download the Form 10F from official Income Tax portal - Download Form 10F

Does Form 10F help reduce withholding tax via tax treaty benefits?

Yes, Form 10F is specifically designed to help you access reduced withholding tax rates available under DTAA provisions.

For instance, under the India-USA treaty, interest income typically taxed at 30% can be reduced to 15%, dividends can drop from 20% to 15%, and royalties from 10-15% depending on the type. When you submit Form 10F along with your TRC to the Indian payer before receiving income, they deduct TDS at the beneficial treaty rate instead of higher domestic rates.

This means you keep more money upfront rather than waiting months for a refund after filing your Income Tax Return. You can also explore Form 13 for additional TDS reduction if you meet certain criteria for lower or nil TDS deduction.

Does Form 10F help reduce withholding tax via tax treaty benefits?

Yes, Form 10F is specifically designed to help you access reduced withholding tax rates available under DTAA provisions.

For instance, under the India-USA treaty, interest income typically taxed at 30% can be reduced to 15%, dividends can drop from 20% to 15%, and royalties from 10-15% depending on the type. When you submit Form 10F along with your TRC to the Indian payer before receiving income, they deduct TDS at the beneficial treaty rate instead of higher domestic rates.

This means you keep more money upfront rather than waiting months for a refund after filing your Income Tax Return. You can also explore Form 13 for additional TDS reduction if you meet certain criteria for lower or nil TDS deduction.

How do I correct errors in a previously submitted Form 10F?

Unfortunately, you cannot edit or revise a Form 10F once it's been submitted on the Income Tax Portal. If you discover errors in your submitted form, you'll need to file a fresh Form 10F with the correct information for the same assessment year. Make sure all details in the new submission exactly match your Tax Residency Certificate, including name spelling, address format, TIN, and residency period. Keep documentation of both submissions (the incorrect one and the corrected one) to explain the correction if questioned by tax authorities or your Indian payer.

To avoid this situation, always double-check all entries against your TRC before hitting submit, and preview the form carefully during the filing process.

What additional forms are typically required alongside Form 10F?

Besides Form 10F, you'll need to submit your Tax Residency Certificate (TRC) obtained from your home country's tax authority, which proves you're a tax resident there for the relevant financial year. If you're claiming Foreign Tax Credit for taxes paid in India while filing your Indian ITR, you'll also need to submit Form 67, which provides details of foreign income and taxes paid abroad.

For companies and consultants, a "No Permanent Establishment (PE) Declaration" on company letterhead may be required to certify you don't have a fixed business presence in India. Additionally, having your PAN card (if applicable), proof of residential address in your home country, and passport or incorporation documents ready will make the filing process smoother and faster.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.