Financial Planning for NRIs Across India and the US

A centralized financial planning app helping NRIs monitor goals, align savings strategies, and adapt plans as life and markets change - without relying on manual calculations or fragmented tools. Plan, track, and achieve your financial goals across borders with clarity and confidence.

50K+ NRIs track financial goals with InvestMates

NRI Financial Planning Shouldn't Be This Hard

When your money lives in two countries, tracking NRI financial goals becomes complicated. A finance planning tool can help with different tax rules, currency changes, and scattered accounts - here's what makes cross-border financial planning so hard:

Accounts Scattered Across Countries

Your 401(k) in the US, EPF in India, NRE accounts, mutual funds - managing multi-country finances means impossible to see the complete picture of your wealth.

No Idea If You're On Track

You're saving for retirement, a home, emergency fund across borders - but are your NRI financial goals on track? Saving enough? Too much? With fragmented accounts, there's no way to know.

Manual Tracking is Exhausting

Personal finance tracking across borders means updating spreadsheets, converting currencies, checking balances in multiple apps, calculating progress manually - it takes hours and is always outdated.

How It Works

Four simple steps to complete financial clarity

Connect Accounts

Link your 401(k), IRA, EPF, NPS, and savings accounts from India and US in just 2 minutes. Securely connect all your financial accounts across borders using our personal finance management tool to get a unified view of your NRI financial planning, no manual data entry needed.

Set Your Goals

Define your retirement targets, emergency funds, home down payment, whatever matters to you. InvestMates automatically analyzes your income, expenses, investments, and savings across both countries to show exactly where you stand with your cross-border financial goals.

Track Automatically

InvestMates pulls balances daily and shows if you're on track across all goals. Instantly identify gaps in savings, spot underperforming investments, and see if your financial goals are aligned, all updated automatically across both countries.

Get Smart Alerts

Behind schedule? Market changes? We'll tell you what to adjust and by how much. Receive personalized financial planning recommendations tailored for NRIs, whether it's increasing contributions, rebalancing investments, or adjusting timelines.

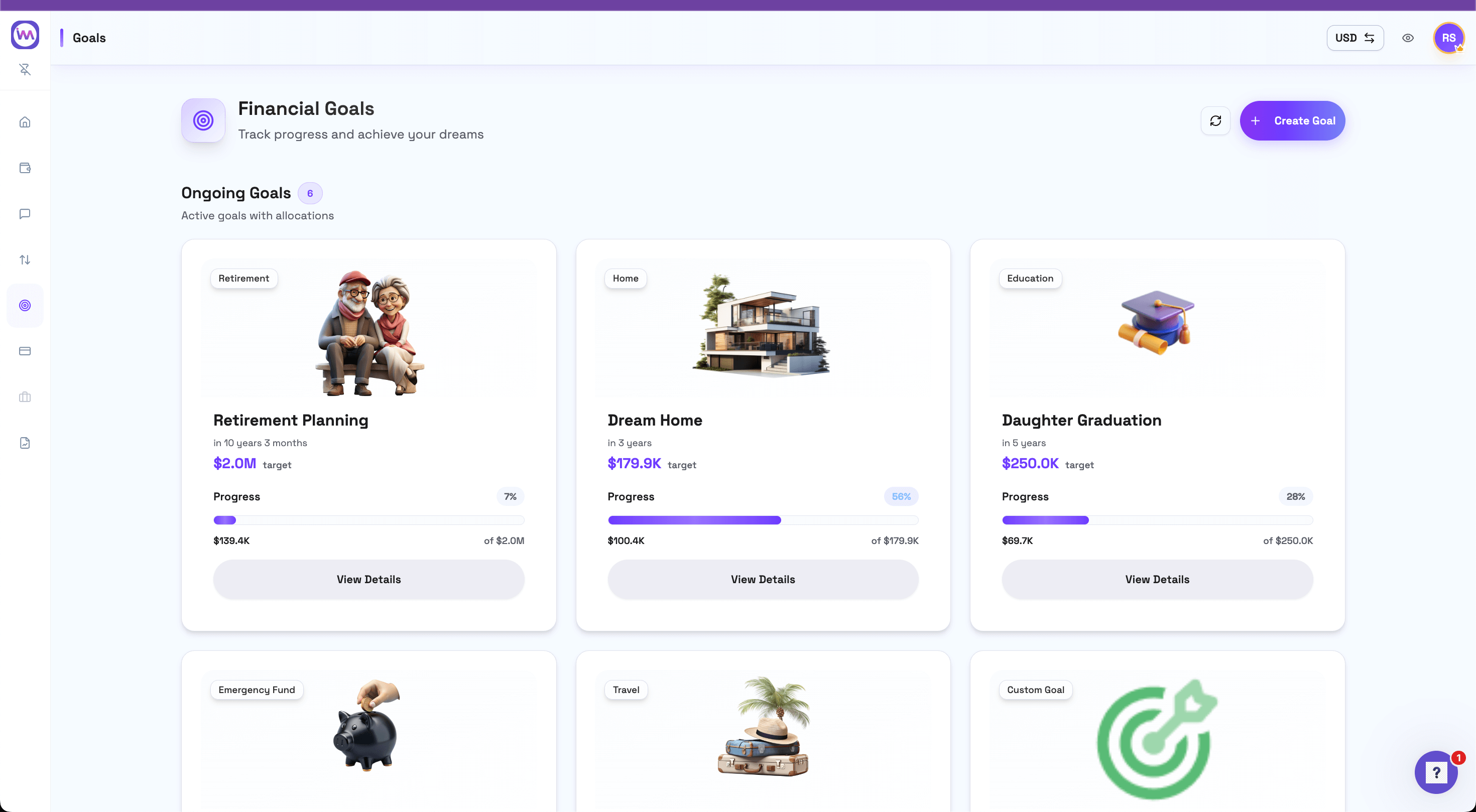

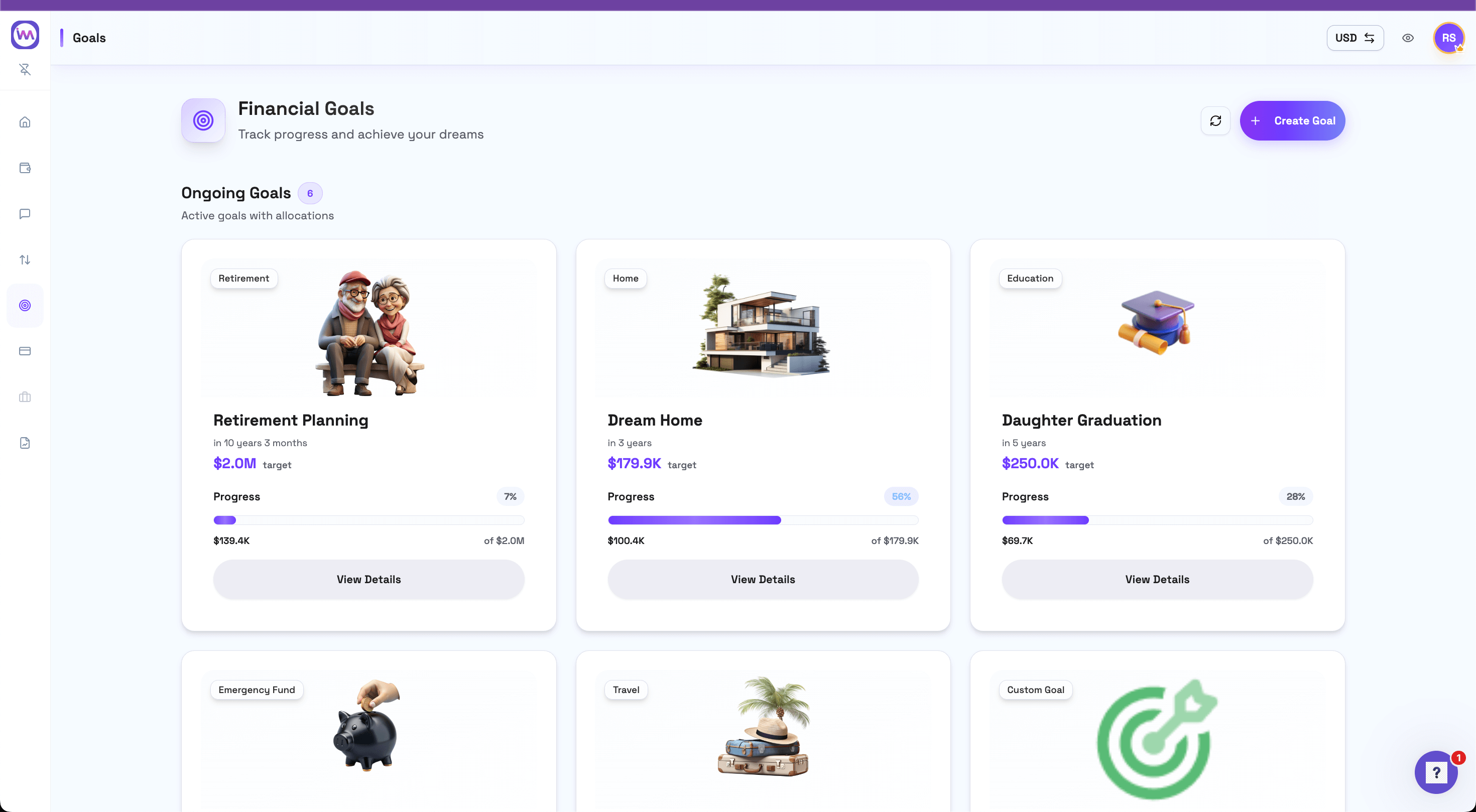

Track Any Financial Goal

Use a personal finance management app to track retirement, emergency funds, home purchases, education, and any financial goal that matters to you across India and the US, all in one place.

Emergency Fund Tracking

Maintain 3-6 months expenses across multiple accounts with automatic monitoring. Emergency fund planning for NRIs means tracking savings in both countries, ensuring you're protected no matter where life takes you.

Cross-Border Retirement

Combine US 401(k), IRA with India EPF, NPS for a complete retirement picture. NRI retirement planning across India and the US in one dashboard, so you know exactly when you can retire and with how much.

Home Purchase Goals

Track down payment savings with timeline projections and adjustment alerts. Property planning in India for NRIs made simple, whether you're buying your first home or investing in real estate back home.

Education Planning

529 plans, mutual funds, savings accounts, all tracked toward college costs. Education planning for children of NRIs across borders, so you're ready when tuition bills arrive, no matter which country they study in.

Debt Payoff Tracking

Monitor loan balances and visualize your path to becoming debt-free. Track student loans, mortgages, and personal debt across both countries to stay on top of your financial obligations.

Custom Goals

Sabbatical, wedding, business launch, track any financial goal that matters to you. Set custom timelines and amounts for life goals that don't fit traditional categories.

See Your Goals in Action

See how financial planning scenarios adapt in real time as income, goals, and market conditions change—giving NRIs complete control over their financial future.

Frequently asked questions

Everything you need to know about NRI Financial Planning & Goal Tracking

Yes, goal-based planning is especially valuable for NRIs because it brings clarity to complex cross-border finances. Instead of just accumulating savings without direction, you define specific targets like retiring at 55, saving $100,000 for a home down payment in India, or building a 6-month emergency fund, and then track progress toward each goal individually.

This approach helps you prioritize where money should go, whether it's maximizing 401(k) contributions in the US, investing in mutual funds in India, or building liquid savings for near-term needs. As life changes (job switch, family expansion, relocation plans), you can adjust goals and see immediately how it impacts your overall financial picture.

Start Planning Your Financial Future

Connect accounts in 2 minutes. Set goals in 30 seconds. Track automatically forever.

Free forever. No credit card required. 2-minute setup.