Every month, thousands of NRIs lose money to unnecessary taxes on their Indian income. Take Rahul, a software engineer in California, who earned $10,000 in interest from his Indian fixed deposits last year. His bank deducted $3,120 in TDS (31.2%), when he should have only paid $1,000 (10%) under the India-US tax treaty.

The missing piece?

A Tax Residency Certificate (TRC). This simple document could have saved Rahul $2,120 annually, yet many NRIs don't know it exists or how to obtain it. If you're earning income from India while living abroad, understanding TRC isn't optional. It's the key to claiming lower tax rates under Double Taxation Avoidance Agreements and keeping more of your hard-earned money.

Key Takeaway

A Tax Residency Certificate proves your tax residency status in a specific country and unlocks benefits under international tax treaties.

Here's what you'll learn:

- What a Tax Residency Certificate is and why it's mandatory for claiming DTAA benefits

- How TRC can reduce your TDS from 31.2% to 10-15% on interest, dividends, and other income

- Step-by-step application process for NRIs from USA, UK, Canada, UAE, and Singapore

- Required documents, processing timelines, and validity periods across different countries

- How to use Form 10F along with your TRC to successfully claim reduced tax rates

What is a Tax Residency Certificate?

A Tax Residency Certificate is an official document issued by your country's tax authority that certifies you as a tax resident for a specific financial year. This certificate serves as proof that you pay taxes in that country and establishes your eligibility to claim benefits under Double Taxation Avoidance Agreements.

The TRC contains critical information including your name, nationality, tax identification number, residential address, and the period for which you're considered a tax resident. Tax authorities worldwide recognize this document as the gold standard for proving residency status in cross-border tax matters.

Information Contained in a TRC

Your TRC typically includes your full legal name exactly as it appears on your tax returns, your taxpayer status (individual, company, partnership), and your unique tax identification number. The certificate also specifies your residential address during the relevant financial year and clearly states the validity period.

Most importantly, the TRC confirms that you're recognized as a tax resident under the laws of that specific country. Some countries issue TRCs in their local language, so you may need an English translation when submitting it to Indian authorities.

TRC vs PAN Card: Understanding the Difference

Many NRIs confuse PAN cards with Tax Residency Certificates, but they serve entirely different purposes. Your PAN is simply a unique identification number for tracking your financial transactions in India. It doesn't prove where you pay taxes or establish your residential status.

A TRC, on the other hand, is official proof from a foreign government that you're their tax resident. While your PAN helps you file returns in India, only a TRC allows you to claim reduced tax rates under DTAA. Think of PAN as your identity and TRC as your passport to tax benefits.

Validity Period of TRC

Tax Residency Certificates are valid for one financial year only. If you're a US resident, your TRC covers the calendar year (January-December). For Indian residents, it follows India's financial year (April-March).

This means you must apply for a fresh TRC every year if you want to continue claiming DTAA benefits. Don't wait until your current certificate expires. Start the renewal process at least 60 days before the end of your financial year to avoid any gaps in coverage.

Why Do NRIs Need a Tax Residency Certificate?

Without a TRC, you're essentially leaving money on the table every time income is paid from India. The Indian Income Tax Act mandates that anyone claiming benefits under international tax treaties must furnish proof of their tax residency abroad.

Mandatory Requirement Under Income Tax Act

Section 90(4) and Section 90A(4) of the Income Tax Act make TRC submission mandatory for claiming DTAA benefits. If you earn income from India, such as rent, dividends, or interest, the payer must deduct Tax Deducted at Source (TDS) before releasing the payment to you.

Without a valid TRC, the payer has no choice but to apply standard Indian tax rates, which can be as high as 30-31.2%. The law doesn't allow them to apply beneficial DTAA rates unless you provide documented proof of your foreign tax residency.

Gateway to DTAA Benefits

India has signed comprehensive DTAAs with over 90 countries, including the USA, UK, Canada, UAE, and Singapore. These agreements specify reduced tax rates for various types of income to prevent you from being taxed twice on the same earnings.

For example, under the India-US DTAA, interest income faces only 10-15% tax instead of the standard 30%. Dividend income from Indian companies gets taxed at 15% rather than 20%. But here's the catch: you can't access these preferential rates without submitting a valid TRC to your bank or the entity paying you.

Real Example: Tax Savings Without vs With TRC

Let's see exactly how much a TRC saves you. Priya, an NRI in Dubai, earns ₹8 lakh (approximately $10,000) annually from her Indian fixed deposits. Here's her tax situation:

Without TRC:

- Interest earned: ₹8,00,000

- TDS deducted at 30%: ₹2,40,000

- Add 4% cess: ₹9,600

- Total tax paid: ₹2,49,600 ($3,120)

With TRC (India-UAE DTAA):

- Interest earned: ₹8,00,000

- TDS under DTAA at 12.5%: ₹1,00,000

- Add 4% cess: ₹4,000

- Total tax paid: ₹1,04,000 ($1,300)

Annual savings with TRC: ₹1,45,600 ($1,820)

Over five years, Priya saves over ₹7 lakh simply by having a valid TRC. This isn't a loophole—it's your legal right under international tax agreements.

What are the Benefits of a Tax Residency Certificate for NRIs?

A TRC delivers tangible financial benefits that compound over time, especially if you have significant investments or income sources in India.

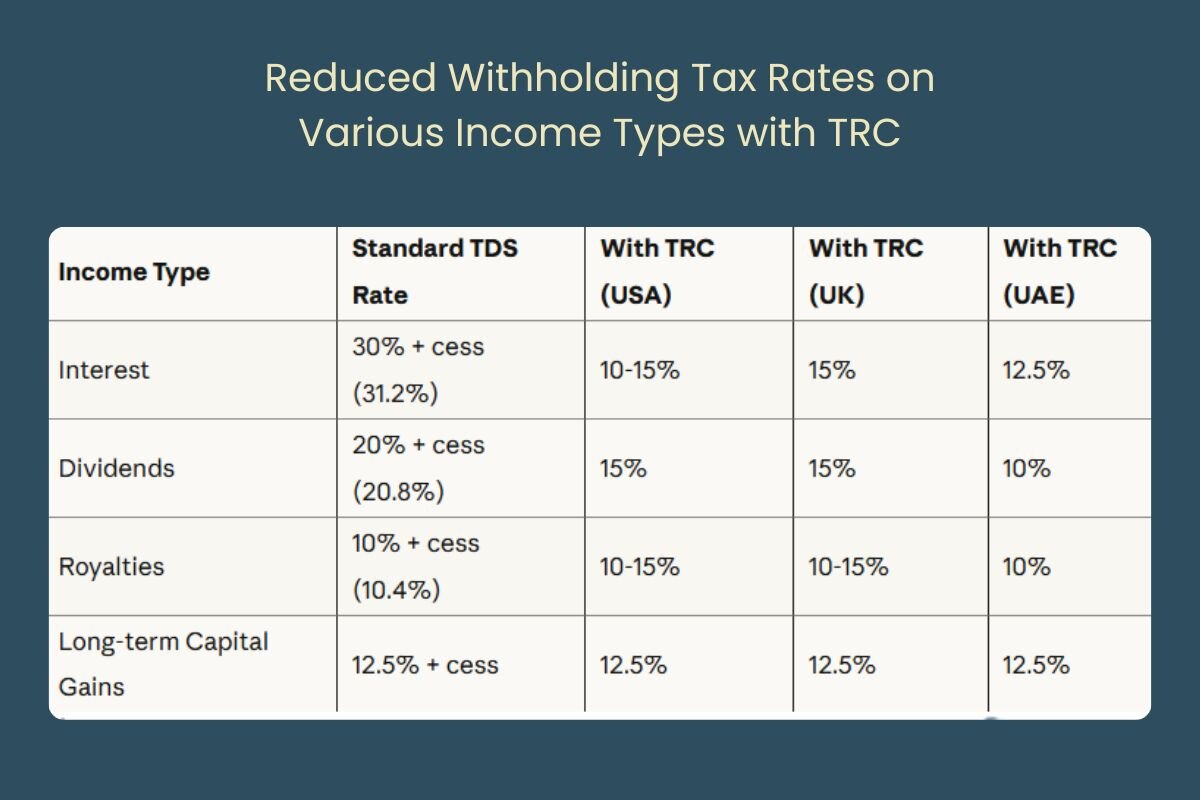

Reduced Withholding Tax Rates on Various Income Types

Different types of income attract different TDS rates in India. With a TRC, you access substantially lower rates on multiple income streams:

These reduced rates apply immediately when you submit your TRC and Form 10F to the payer before they release your payment. For tax planning when returning to India, having a TRC during your transition period is crucial.

Avoiding Double Taxation on the Same Income

Double taxation happens when both your country of residence and India claim the right to tax your income. Without DTAA protection, you'd pay full taxes in India and then again in your home country on the same earnings.

Your TRC activates the DTAA provisions that determine which country gets primary taxing rights and at what rate. Most treaties allow you to claim foreign tax credits in your home country for taxes paid in India, ensuring you're never taxed twice on the same rupee.

Official Proof of Tax Residency Status

Beyond tax benefits, your TRC serves as universally accepted proof of your residential status for various financial transactions. International banks require it when opening certain types of accounts. Investment platforms need it to determine your tax treatment.

Real estate transactions, business contracts, and inheritance matters often require documented proof of where you're a tax resident. Your TRC provides this credibility instantly, eliminating lengthy verification processes.

Simplified Tax Compliance Across Borders

Managing tax obligations as an NRI becomes significantly easier with a valid TRC. You can confidently claim deductions and credits on your returns in both countries, knowing you have the documentation to support your claims.

During tax assessments or audits, your TRC serves as primary evidence of your residential status. It prevents disputes with tax authorities who might otherwise question where you truly reside and owe taxes.

Understanding Form 10F and Its Role with TRC

Many NRIs get confused about whether they need a TRC, Form 10F, or both. Let's clear up this confusion once and for all.

What is Form 10F?

Form 10F is a self-declaration form that provides detailed information about your tax residency when your TRC doesn't contain all required details. You file it electronically through the Income Tax e-filing portal to supplement your TRC submission.

The form captures your nationality, tax identification number from your resident country, period of residency, taxpayer status (individual, company, etc.), and your permanent address. Think of it as a detailed questionnaire that fills in any gaps your TRC might have.

When is Form 10F Required?

Form 10F becomes mandatory in two situations. First, if your TRC lacks specific details required under Indian tax law, such as your TIN or precise residential period. Second, when you don't have a PAN card but still need to claim DTAA benefits on income from India.

As of 2022, Form 10F must be filed electronically before or at the time of claiming DTAA benefits. You cannot submit it manually or via email. Your bank or the entity paying you will ask for both your TRC and the acknowledgment of Form 10F filing.

Key Difference Between TRC and Form 10F

Your TRC is issued by your country's tax authority and serves as official government proof of residency. Form 10F is your self-declaration filed with Indian authorities providing additional details. You can't replace one with the other—both are typically required together.

The TRC proves "where" you're a tax resident. Form 10F provides the "what, when, and how" details that Indian tax authorities need to process your DTAA claim. Together, they create a complete picture of your tax residency status.

How Can NRIs Obtain a Tax Residency Certificate?

The TRC application process depends on which direction you're going—are you an NRI needing a certificate from your foreign country of residence, or an Indian resident earning abroad who needs a TRC from India?

Scenario 1: NRIs Need TRC from Their Country of Residence

If you're an NRI living in the USA, UK, Canada, UAE, or Singapore and earning income from India, you need to obtain a TRC from your country of residence. This certificate proves to Indian authorities that you pay taxes in that foreign country.

Each country has its own application process, forms, and requirements. You'll need to apply to your local tax authority, such as the IRS in the USA or HMRC in the UK. We'll cover country-specific processes in the next section.

Scenario 2: Indian Residents Need TRC from India

If you're a resident of India earning income from foreign countries with which India has a DTAA, you need to obtain a TRC from the Indian Income Tax Department. You'll use this certificate to claim treaty benefits in the foreign country where your income arises.

The application process involves filing Form 10FA with your jurisdictional Assessing Officer. Upon verification and satisfaction, the officer issues your TRC in Form 10FB. This is a manual process requiring physical submission to your AO's office.

Eligibility Criteria for Obtaining TRC

To qualify for a TRC from any country, you must meet that country's definition of tax residency. Most countries use physical presence tests—typically, you must be present in the country for at least 183 days during the financial year.

Some countries also consider factors like your center of vital interests, where your permanent home is located, and where you have stronger economic ties. You must have filed or be required to file tax returns in that country for the year you're requesting certification.

TRC Application Process for NRIs by Country

Here's a comprehensive comparison of TRC application processes across the five countries where most NRIs reside:

TRC Application Process for NRIs by Country

| Country | Form Required | Processing Time | Fee (2025) | Submission Method |

|---|---|---|---|---|

| USA | Form 8802 → Form 6166 | 30–45 days | $85 (individuals), $185 (entities) | Mail/Fax to IRS Philadelphia |

| UK | HMRC online application | 15–30 days | Free | Online via HMRC portal |

| Canada | Form NR73 | 60–90 days | Free | Mail to CRA International Tax |

| UAE | FTA online application | 7–14 days | AED 50 | Online via FTA portal |

| Singapore | Letter request to IRAS | 14–21 days | Free | Email or online submission |

United States (Form 8802 → Form 6166)

If you're a US tax resident, you need to file Form 8802 (Application for United States Residency Certification) with the IRS. The IRS will then issue Form 6166, which is your official TRC.

Start by completing Form 8802 with your name, US Taxpayer Identification Number (SSN or EIN), address, and the tax year for which you need certification. You can request certificates for multiple years on a single application. Pay the $85 fee through Pay.gov and note the confirmation number on your form.

Upload your application to Pay.gov (maximum 15MB PDF), then mail or fax the signed form with all attachments to the IRS Philadelphia office. The IRS recommends applying at least 45 days before you need the certificate. Processing typically takes 30-45 days.

Important: You cannot apply for a current year TRC before December 1 of the previous year. The IRS requires that you've filed a US tax return for the year you're requesting certification, or at least be required to file one.

United Kingdom (HMRC Application)

UK tax residents can apply for a TRC through the HMRC online portal. The process is straightforward and typically faster than most other countries.

Log into your Government Gateway account and navigate to the "Apply for a certificate of residence" section. Provide details about the income you're receiving, the country where it arises, and the relevant tax year. You'll need your National Insurance number and details of any foreign tax identification numbers.

HMRC usually processes applications within 15-30 working days and issues the certificate electronically. There's no fee for this service. If you need TRCs for multiple countries, you must submit separate applications for each.

Canada (Form NR73 via CRA)

Canadian residents use Form NR73 (Determination of Residency Status – Leaving Canada) to establish their residency status and obtain certification from the Canada Revenue Agency. Note that processing times can be longer than other countries.

Complete Form NR73 providing detailed information about your residential ties to Canada, including property ownership, family location, and economic connections. Mail the form to the International Tax Services Office in Ottawa along with supporting documents like copies of tax returns and proof of address.

The CRA typically takes 60-90 days to process residency determination requests. Once approved, they issue a letter confirming your Canadian tax residency that serves as your TRC. There's no fee, but patience is required.

UAE (FTA Application)

UAE residents benefit from one of the fastest TRC application processes globally. The Federal Tax Authority offers an efficient online system that issues certificates within 7-14 days.

Register on the FTA portal using your Emirates ID. Navigate to the Tax Residency Certificate section and complete the online application form. You'll need to provide your TRN (Tax Registration Number), Emirates ID, residency visa details, and information about your UAE-based income or business.

Upload supporting documents including copies of your residency visa, Emirates ID, and proof of UAE tax registration if applicable. Pay the AED 50 fee online. The FTA reviews your application digitally and issues the TRC electronically, making it one of the most streamlined processes available.

Singapore (IRAS Application)

Singapore tax residents can request a TRC from the Inland Revenue Authority of Singapore through a letter-based application process. While not as formalized as other countries, it's efficient and free.

Prepare a formal letter addressed to IRAS requesting a Certificate of Residence. Include your full name, NRIC/FIN number, tax reference number, residential address in Singapore, the country where you need to use the certificate, and the relevant Year of Assessment.

Email your request to the IRAS International Branch or submit through their online contact form. Attach copies of your Singapore tax assessment notice and passport. IRAS typically responds within 14-21 days with your TRC. Follow up if you don't receive a response within three weeks.

How Indian Residents Can Obtain TRC from India

If you're based in India but earning income from countries with which India has a DTAA, you'll need a TRC from the Indian Income Tax Department. This section covers the complete process for Indian residents managing cross-border income.

Step 1: Determine Your Eligibility

You must qualify as a tax resident of India under Section 6 of the Income Tax Act. This means you've been in India for at least 182 days during the financial year, or 60 days in the current year plus 365 days over the preceding four years.

Additionally, you must have filed or be required to file Indian income tax returns for the relevant financial year. The TRC certifies your residency for tax purposes, so you need an established tax presence in India.

Step 2: Prepare Required Documents

Gather the following documents before visiting your Assessing Officer: completed Form 10FA (downloadable from the Income Tax Department website), copy of your PAN card, passport with all entry and exit stamps clearly visible, proof of residential address in India (Aadhaar card, utility bills, rental agreement), and copies of filed income tax returns for the relevant year.

Additionally, prepare a detailed statement showing your physical presence in India throughout the financial year. Calculate exact days spent in India using passport stamps, boarding passes, or hotel records if needed.

Step 3: Fill Form 10FA Application

Download Form 10FA from the Income Tax Department's official website. This form is your formal application for a Certificate of Residence for purposes of agreements under Section 90 and 90A.

Fill in your complete details including name, PAN, status (individual, company, etc.), and residential address during the relevant period. Clearly state the financial year for which you're requesting the certificate and the foreign country where you intend to use it. Mention the reason you need the TRC, such as claiming benefits under India-USA DTAA for consulting income.

Step 4: Submit to Assessing Officer

Form 10FA cannot be filed online—you must physically submit it to your jurisdictional Assessing Officer. You can find your AO's contact details on the e-filing portal under "Know Your AO."

Schedule an appointment if possible or visit during office hours. Submit your completed Form 10FA along with all supporting documents. The AO may ask questions about your residency status, income sources, or reason for needing the certificate. Be prepared to explain your situation clearly.

Step 5: Receive Form 10FB Certificate

After reviewing your application and verifying your documents, the Assessing Officer will issue your TRC in Form 10FB. This is the official Certificate of Residence that you can use in foreign countries to claim DTAA benefits.

Processing time varies by jurisdiction but typically takes 15-30 working days. The certificate will bear the AO's official stamp and signature. It's valid only for the financial year mentioned, so you'll need to apply again next year if you continue earning foreign income.

What Documents Are Required for TRC Application?

Document requirements vary slightly depending on whether you're applying to a foreign tax authority or the Indian Income Tax Department. Here's what you need for each scenario.

For NRIs Applying to Foreign Tax Authorities

Most countries require proof of your tax filing history, so keep copies of your tax returns for at least the past two years. You'll need government-issued photo identification (passport is universally accepted) and your taxpayer identification number from that country (SSN in USA, NI number in UK, etc.).

Proof of residency is crucial—this can include utility bills in your name, bank statements showing your local address, rental or property ownership documents, and your residency visa or permit. Some countries also ask for employment contracts or business registration documents proving your economic ties to that country.

If you're applying for TRC related to specific income from India, prepare documentation of that income source. For example, if claiming DTAA benefits on Indian property rent, carry copies of your rental agreement and rent receipts.

For Indian Residents Applying via Form 10FA

Your passport is the most critical document—it must show clear entry and exit stamps from all countries you've visited during the relevant financial year. If you use automated immigration gates that don't stamp passports, keep boarding passes, hotel bookings, and credit card statements as alternative proof.

Submit self-attested copies of your PAN card, Aadhaar card, and voter ID. Include your latest income tax return acknowledgment (ITR-V) for the financial year in question. If you have foreign income or assets, bring bank statements or investment documents showing these holdings.

A covering letter explaining why you need the TRC helps speed up processing. Mention the specific foreign country, type of income (salary, business, professional fees), and relevant DTAA article you're claiming benefits under.

Supporting Documentation Checklist

Before submitting your TRC application anywhere, verify you have: valid passport with at least 6 months remaining validity, tax returns filed for the year you're requesting certification, proof of physical address in the country issuing the TRC, and taxpayer identification number documentation.

Additionally, keep ready: any correspondence from foreign tax authorities requesting your TRC, details of foreign income you'll earn or have earned, and payment proof for application fees (where applicable). Missing even one document can delay your application by weeks.

Common Mistakes to Avoid When Applying for TRC

Small errors in your TRC application can lead to rejections, delays, or certificates that don't serve your purpose. Here are the most frequent mistakes NRIs make and how to avoid them.

Incomplete or Incorrect Application Forms

Leaving fields blank or providing inconsistent information is the top reason for TRC application rejections. Double-check that your name appears exactly as it does on your tax returns and passport—even middle name variations can cause issues.

Ensure dates are in the correct format (MM/DD/YYYY for USA, DD/MM/YYYY for UK and India). If requesting TRC for multiple years, clearly specify each year. Don't rush through the form; one typo in your taxpayer identification number could invalidate the entire certificate.

Missing Supporting Documents

Tax authorities reject applications outright if you don't submit all required documents. Create a checklist specific to your country's requirements and tick off each item as you prepare it. Make sure all photocopies are clear and legible—blurry passport stamps won't be accepted.

If any documents are in a foreign language, get them officially translated to English before submission. Notarization or apostille may be required for certain documents when applying across international borders. Check specific requirements for the country you're applying to.

Not Applying Early Enough

Processing times vary significantly by country and can extend even longer during peak tax season (January-April in most countries). If you need your TRC by a specific date—say, to submit to your Indian bank before they process your interest payment—apply at least 60-75 days in advance.

Remember that incomplete applications get returned, restarting your processing timeline. Build in buffer time for potential requests for additional information. Don't wait until you've already earned the income to apply; get your TRC in hand before the financial year begins if possible.

Assuming Self-Certification Suffices

Some NRIs mistakenly believe they can simply declare their residency status without official certification. Self-declarations or statements from accountants don't replace a government-issued TRC. Indian tax authorities will not accept anything less than an official certificate from your country's tax department.

Similarly, your country's tax returns alone don't prove residency for DTAA purposes. While tax returns are supporting documents, only a formal TRC issued by the competent tax authority meets the legal requirement for claiming treaty benefits.

Failing to Renew TRC Annually

The biggest mistake is assuming your TRC remains valid indefinitely. Every TRC has a specified validity period, typically one financial year. Mark your calendar to start the renewal process two months before your current certificate expires.

If you let your TRC lapse even by a few days, Indian payers must immediately revert to deducting tax at standard rates. You cannot retroactively apply lower DTAA rates for periods when you had no valid TRC. This can cost you thousands in unnecessary tax deductions that are difficult to recover.

What Happens If You Don't Have a TRC?

Operating without a TRC when you're earning Indian income is expensive. Let's look at the real financial impact and compliance consequences.

Higher TDS Rates Apply (30-31.2%)

Without a valid TRC, Indian payers have no legal authority to apply DTAA rates. They must deduct TDS at the rates specified in the Income Tax Act, which are significantly higher. Interest income from fixed deposits, savings accounts, or bonds faces 30% TDS plus 4% cess, totaling 31.2%.

Dividend income from Indian companies gets taxed at 20% plus cess. Professional or technical fees face 10% TDS. Rental income from Indian property sees 31.2% deduction before you receive a single rupee. These aren't negotiable—the payer breaks the law if they apply lower rates without seeing your TRC.

Double Taxation on Same Income

You'll end up paying tax twice on the same income. First, India deducts full TDS at standard rates. Then, when you file returns in your country of residence, that income is taxable again. Most countries provide foreign tax credits, but the process is complicated and you'll never recover the full excess tax paid.

For example, if you're a US resident earning $20,000 from Indian sources, India might deduct $6,240 in TDS without a TRC. Even after claiming foreign tax credits on your US return, you'll likely pay an additional $2,000-3,000 in US taxes. With a TRC, your total tax burden could have been under $4,000—a savings of $4,000-5,000.

Cannot Claim DTAA Benefits

DTAA provisions specifically require documentary proof of residency. Section 90(5) of the Income Tax Act states this explicitly. Without a TRC and Form 10F, you have zero access to beneficial treaty rates regardless of whether a DTAA exists between India and your country.

This means you can't claim exemptions on certain types of income that might be tax-exempt under the treaty. You can't access provisions that assign exclusive taxing rights to one country. All the carefully negotiated benefits in India's 90+ tax treaties become worthless to you personally.

Calculation Example: Tax Impact Without TRC

Let's calculate the actual cost using Amit's situation. He's an NRI in Singapore earning ₹15 lakh annually from multiple Indian sources:

Indian Income Sources:

- Fixed deposit interest: ₹6 lakh

- Dividend from stocks: ₹4 lakh

- Rental income: ₹5 lakh

- Total: ₹15 lakh

Without TRC (Standard Indian Tax Rates):

- FD Interest TDS (31.2%): ₹1,87,200

- Dividend TDS (20.8%): ₹83,200

- Rent TDS (31.2%): ₹1,56,000

- Total TDS deducted: ₹4,26,400

With TRC (India-Singapore DTAA):

- FD Interest TDS (10%): ₹60,000

- Dividend TDS (10%): ₹40,000

- Rent TDS (10%): ₹50,000

- Total TDS deducted: ₹1,50,000

Amit's annual savings with TRC: ₹2,76,400 (approximately $3,450)

Over ten years of investment, Amit would save ₹27.64 lakh ($34,500) simply by maintaining a valid TRC. These aren't small numbers—this is real money that stays in your pocket instead of going to unnecessary taxes.

Conclusion

A Tax Residency Certificate is your passport to significant tax savings as an NRI earning income from India. By proving your tax residency status abroad, you unlock access to reduced TDS rates that can cut your tax burden by 50-70% on interest, dividends, and other income types. The application process varies by country but generally takes 4-6 weeks with proper documentation. Remember that TRCs are valid for only one financial year and must be renewed annually to maintain your DTAA benefits. Start your application at least 45-60 days before you need it, gather all required documents carefully, and submit both your TRC and Form 10F to claim your rightful treaty benefits.

Start optimizing your NRI tax strategy today.

Track your investments, manage your tax documents, and get AI-powered insights with InvestMates

Frequently Asked Questions

Is Form 10F the same as a Tax Residency Certificate?

No, Form 10F and TRC are two different but complementary documents. A TRC is issued by your country's tax authority proving you're a tax resident there. Form 10F is a self-declaration you file electronically with Indian authorities providing additional details about your residency. You need both documents to successfully claim DTAA benefits - the TRC as proof and Form 10F to provide complete information to Indian tax authorities. Think of TRC as your passport and Form 10F as your visa application form.

How long is a TRC valid and does it need annual renewal?

TRCs are valid for one financial year only. For US residents, this is the calendar year (January-December). For Indian residents, it's the financial year (April-March). You must apply for a new TRC every year if you continue earning income that requires DTAA benefits.

Start your renewal application 60-90 days before your current certificate expires to avoid gaps. Without a valid TRC, payers must immediately revert to standard tax deduction rates. Consider exploring NRI investment options in India that maximize returns while minimizing tax complexity.

Can I claim DTAA benefits without submitting a TRC?

No, submitting a TRC is mandatory under Section 90(4) and 90A(4) of the Income Tax Act for claiming any DTAA benefits. Without a valid TRC, Indian payers cannot apply treaty rates - they must deduct tax at standard Indian rates regardless of whether a DTAA exists. If you've already paid higher taxes because you didn't have a TRC at the time of payment, you can file an Indian tax return and claim a refund. However, this process is time-consuming and may take 6-12 months, making it far better to have your TRC ready before income is paid.

What is the difference between Form 10FA, 10FB, and 10F?

These three forms serve different purposes in the TRC ecosystem. Form 10FA is your application form that Indian residents submit to their Assessing Officer requesting a TRC from India. Form 10FB is the actual TRC certificate issued by the Assessing Officer after approving your Form 10FA application - this is what you use in foreign countries.

Form 10F is a self-declaration filed electronically by NRIs who need to provide additional details along with their foreign TRC when claiming DTAA benefits in India. Remember: 10FA and 10FB are for Indians earning abroad, while 10F is for NRIs earning in India.

How long does it take to get a TRC from the USA (Form 6166)?

The IRS typically processes Form 8802 applications and issues Form 6166 within 30-45 days. However, processing times can extend to 60 days during peak tax season (January-April). The IRS recommends submitting your application at least 45 days before you need the certificate.

You can pay the $85 fee and upload your application through Pay.gov, then mail or fax the signed form with attachments. Important: You cannot apply for a current year TRC before December 1 of the previous year, and you must have filed a US tax return for the year you're requesting certification.

Can I file Form 10F without having a TRC?

Technically yes, the form allows filing without a TRC if your foreign tax authority's certificate lacks certain required details.

However, in practice, you'll still need to submit a TRC to claim DTAA benefits - Form 10F alone won't suffice. The form is designed to supplement your TRC, not replace it. If you're having trouble obtaining a TRC from your country of residence, consider consulting a tax professional for NRI-specific guidance on alternative documentation that might be acceptable.

Never skip the TRC requirement thinking Form 10F is sufficient.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.