The Public Provident Fund was once a reliable retirement savings option, but if you're an NRI, those doors closed in September 2024. NRIs can't open new accounts, and extended accounts stopped earning interest.

But here's the silver lining: today's alternatives offer better flexibility, higher returns, and tax benefits that PPF never provided. You have options delivering 6.5% to 12% annually, including tax-free deposits and zero capital gains investments.

Key Takeaway

Here's what you'll discover:

- 7 proven investment alternatives with returns from 6.5% to 12% annually

- Tax-free options that beat PPF's 7.1% returns

- GIFT City investments with zero capital gains tax

- Retirement-focused options with market-linked growth

- Which alternatives work best for US-based NRIs

Why NRIs Need PPF Alternatives

The Public Provident Fund has long been a favorite investment for its safety and tax-free returns, but the reality changed dramatically for NRIs in September 2024. If you became an NRI after opening your PPF account, you can no longer extend it beyond the 15-year maturity period, and any extended accounts stopped earning interest from October 1, 2024. More importantly, NRIs cannot open new PPF accounts at all.

With PPF's 7.1% interest rate now out of reach and existing accounts facing mandatory closure, you need alternatives that offer similar safety, tax benefits, and reliable returns. The good news is that several NRI investment options now available to you actually provide better flexibility, higher potential returns, and clearer repatriation rules than PPF ever did.

Here are 7 Best PPF Alternatives for NRIs

1. NRE Fixed Deposits

NRE Fixed Deposits are the closest you'll get to PPF's safety and tax-free status. These deposits let you park foreign earnings in Indian rupees while enjoying complete tax exemption on interest earned in India.

Major banks offer interest rates between 6.5% and 7% on NRE fixed deposits. SBI offers up to 6.6% for 2 to 3-year tenures, while private banks like ICICI and HDFC provide similar rates. Both principal and interest are fully repatriable.

Real Example: ₹10 lakhs invested in an NRE FD at 6.8% for 5 years grows to approximately ₹14.02 lakhs, earning ₹4.02 lakhs in tax-free interest.

Who Should Invest: Conservative investors wanting guaranteed returns with zero risk and complete repatriation flexibility.

How to Invest: Open an NRE account with any Indian bank through their NRI portal and book FDs online.

Pros: Tax-free in India, fully repatriable, government insurance up to ₹5 lakhs, no market risk

Cons: Returns slightly lower than PPF's 7.1%, locked-in tenure, currency risk, may be taxable in your residence country

2. FCNR Fixed Deposits

FCNR Fixed Deposits solve currency fluctuation risk by maintaining deposits in foreign currencies like USD, GBP, EUR, or AUD, protecting you from rupee volatility.

Interest rates range from 4% to 6% depending on currency and tenure. Tamilnad Mercantile Bank offers 6% on 1-year USD deposits, while most banks provide 4% to 5% for longer tenures. You earn in stable foreign currency without conversion risk.

Real Example: $10,000 deposited in an FCNR account at 5% for 3 years grows to $11,576, with all $1,576 in interest staying in dollars.

Who Should Invest: NRIs wanting to park foreign currency in India without rupee conversion, ideal if uncertain about fund usage timing.

How to Invest: Open an FCNR account with banks offering competitive rates and transfer funds in the same currency.

Pros: Zero currency risk, tax-free in India, fully repatriable, hedge against rupee depreciation

Cons: Lower interest than NRE deposits, opportunity cost if rupee appreciates, limited currencies, higher minimum deposits

3. GIFT City Investment Funds

GIFT City, India's first International Financial Services Centre, offers investment opportunities with tax benefits PPF never matched. You get access to mutual funds, AIFs, and fixed deposits with zero capital gains tax on specified structures and dividend income at just 7.5% to 10% versus 20% to 30% on mainland investments.

GIFT City equity funds deliver 8% to 12% returns annually, while FDs offer 6% to 7% in foreign currencies. AIFs typically require minimum $150,000 investment.

Real Example: $100,000 in a GIFT City equity fund growing at 10% for 5 years becomes $161,051. Regular Indian mutual funds would charge 12.5% tax on the $61,051 gain ($7,631), but GIFT City charges zero, saving thousands.

Who Should Invest: High net worth NRIs in US, UAE, Singapore, or UK seeking tax-efficient Indian market exposure.

How to Invest: Invest through registered fund houses in GIFT City via AIFs, mutual funds, or banking units.

Pros: Zero capital gains tax, lower dividend tax, invest in foreign currency, no TDS, fully repatriable

Cons: High minimum investment, relatively new ecosystem, limited fund options, additional paperwork

4. National Pension Scheme

National Pension Scheme offers something PPF never could: exposure to equity markets with the potential for double-digit returns. NPS allows you to allocate up to 75% of your funds to equities, with the rest in corporate bonds and government securities, creating a diversified retirement corpus.

Historical returns from NPS equity funds range from 9% to 12% annually, significantly outpacing PPF's fixed 7.1%. You can choose between active allocation (where you decide the asset mix) or auto allocation (where the system gradually shifts from equity to debt as you age).

Tax benefits are substantial too. Contributions up to ₹1.5 lakhs qualify for deduction under Section 80C, and an additional ₹50,000 qualifies under Section 80CCD(1B). Upon retirement at age 60, you can withdraw up to 60% of your corpus tax-free in India.

Real Example: If you invest ₹1 lakh annually in NPS for 20 years with an average return of 10%, your corpus would grow to approximately ₹63.0 lakhs. With PPF at 7.1%, the same investment would yield only ₹43.5 lakhs. That's a difference of nearly ₹20 lakhs.

Who Should Invest: NRIs between 18 and 60 years old planning to retire in India or those who want a structured, long-term retirement vehicle with equity exposure. This works best if you have at least 10 to 15 years until retirement.

How to Invest: Register on the eNPS portal, select "Non-Resident of India" as your status, and complete the KYC process. You can contribute through your NRE or NRO account. More details on NPS for NRIs are available.

Pros:

- Higher return potential (9% to 12%)

- Tax benefits up to ₹2 lakhs

- Professional fund management

- Flexibility to choose asset allocation

- 60% withdrawal is tax-free at maturity

Cons:

- Locked until age 60 (limited partial withdrawals)

- 40% must be used to purchase annuity

- Market risk if equity allocation is high

- Annuity income is taxable

- NRIs can only open Tier-I accounts

5. Equity Mutual Funds

Equity Mutual Funds offer the highest growth potential among PPF alternatives, with long-term returns typically ranging from 10% to 15% annually. Large-cap funds invest in established companies for stability, while mid-cap and small-cap funds target higher growth with increased volatility.

You can invest through Systematic Investment Plans (SIPs) or lump sum amounts using your NRE or NRO accounts. The funds are professionally managed, and you get the benefit of diversification across multiple stocks without having to pick individual companies.

However, there's one critical consideration for US and Canada-based NRIs: the PFIC (Passive Foreign Investment Company) rules. Indian mutual funds are classified as PFICs by the IRS, leading to complex tax reporting and potentially punitive taxation. If you're based in the US or Canada, consult a tax advisor before investing in mutual funds.

Real Example: A monthly SIP of ₹50,000 in a diversified equity fund averaging 12% returns over 10 years would grow to approximately ₹1.16 crores. Your total investment would be ₹60 lakhs, giving you gains of ₹56 lakhs. After paying 12.5% long-term capital gains tax, your net profit would be around ₹49 lakhs.

Who Should Invest: Moderate to high-risk investors with a long-term horizon (at least 5 to 7 years) who can tolerate market volatility. Best suited for NRIs not based in the US or Canada, or those willing to navigate PFIC compliance.

How to Invest: Complete your KYC through any mutual fund house or online investment platform. You'll need your PAN card, address proof, and NRE or NRO account details.

Pros:

- High return potential (10% to 15%)

- Professional fund management

- Liquidity (can redeem anytime after exit load period)

- SIP option for disciplined investing

- Diversification across stocks

Cons:

- Market risk, returns not guaranteed

- PFIC complications for US and Canada NRIs

- Capital gains tax (12.5% LTCG, 20% STCG)

- Requires monitoring and rebalancing

- Returns can be negative in short term

6. Debt Mutual Funds

Debt Mutual Funds strike a balance between the safety of fixed deposits and the growth potential of equity funds. These funds invest primarily in bonds, government securities, and corporate debt, offering returns typically between 7% and 9% annually.

Unlike PPF or fixed deposits, debt funds provide much better liquidity. You can redeem your investment anytime without penalties, though gains held for more than 2 years attract 12.5% long-term capital gains tax. Funds held for less than 2 years are taxed as short-term capital gains at 20%.

Categories include liquid funds (for parking money for a few days to months), short-term debt funds (1 to 3 years), and long-term debt funds (3+ years). Each serves different investment horizons while maintaining relatively low risk compared to equity investments.

Real Example: Investing ₹5 lakhs in a short-term debt fund yielding 8% for 3 years would grow to approximately ₹6.30 lakhs. After paying 12.5% LTCG tax on the ₹1.30 lakh gain, you'd net approximately ₹6.14 lakhs.

Who Should Invest: Conservative investors wanting better returns than fixed deposits with reasonable liquidity. This works well for emergency funds or money you might need in 1 to 3 years.

How to Invest: Use the same process as equity mutual funds through any AMC or investment platform. Your NRE or NRO account can be used for investments.

Pros:

- Better returns than fixed deposits (7% to 9%)

- High liquidity, can redeem anytime

- Lower risk than equity funds

- Professional management

- No TDS, only capital gains tax on redemption

Cons:

- Returns not guaranteed

- Interest rate risk (if rates rise, NAV falls)

- LTCG tax of 12.5%

- Lower returns than equity funds

- Some funds have exit loads

7. Tax-Saving Bonds and Government Securities

Tax-Saving Bonds and Government Securities represent the most conservative alternative to PPF, offering government-backed safety with modest returns. Options include RBI Floating Rate Savings Bonds, 54EC Capital Gains Bonds, and Infrastructure Bonds.

RBI Floating Rate Savings Bonds currently offer 7.15% interest, slightly higher than PPF, with interest paid every 6 months. These bonds have a 7-year lock-in period and are only available to resident Indians and NRIs. The interest is taxable, unlike PPF, but the principal is completely secure.

Infrastructure Bonds and other tax-saving bonds offer Section 80C deductions, though investment limits and availability vary. These bonds typically come with 5 to 10-year lock-in periods and fixed interest rates around 7% to 8%.

Real Example: Investing ₹1.5 lakhs in RBI Floating Rate Bonds at 7.15% for 7 years would yield approximately ₹2.36 lakhs at maturity. The interest earned (₹86,000) would be taxable based on your income tax slab.

Who Should Invest: Ultra-conservative investors who prioritize capital safety over returns. This suits those who want government-backed security similar to PPF but can accept slightly lower post-tax returns.

How to Invest: RBI bonds can be purchased through designated banks. Infrastructure bonds and other tax-saving bonds are available through bond platforms and some banks during specific issue periods.

Pros:

- Government-backed, zero default risk

- Competitive interest rates (7% to 8%)

- Some offer Section 80C tax benefits

- Fixed returns, no market volatility

- Suitable for conservative portfolios

Cons:

- Interest is taxable (unlike PPF)

- Long lock-in periods (5 to 10 years)

- Lower liquidity than mutual funds

- Limited availability (some bonds only during issue periods)

- Returns may not beat inflation after tax

Conclusion

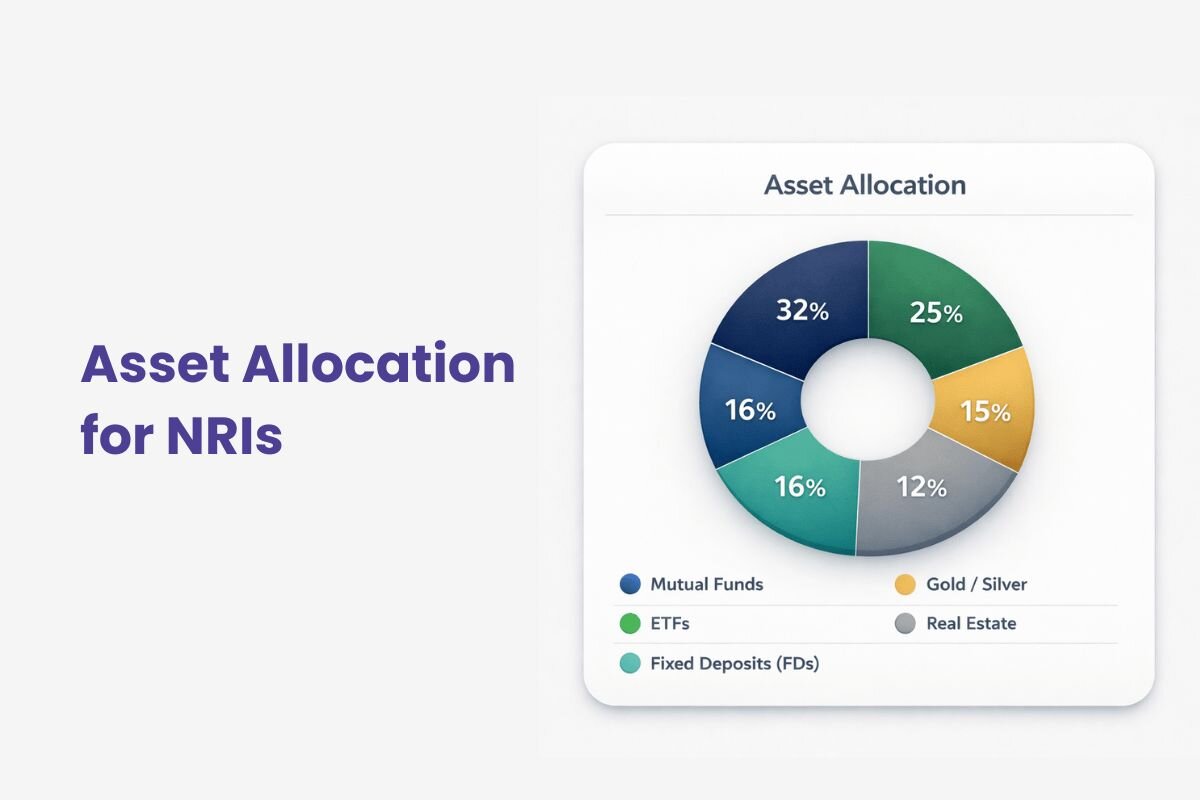

PPF's era for NRIs has ended, but better opportunities have emerged. NRE Fixed Deposits offer safety and tax-free returns comparable to PPF. GIFT City provides unmatched tax efficiency with zero capital gains.

NPS delivers market-linked growth for retirement planning. Your best choice depends on your risk appetite, investment horizon, and whether you plan to return to India. Start by opening an NRE account and exploring these alternatives based on your financial goals. For questions about repatriation of your funds, consult a financial advisor familiar with NRI investments.

Frequently Asked Questions

Can NRIs still invest in PPF?

No, NRIs cannot open new PPF accounts. If you opened a PPF account before becoming an NRI, you can continue contributing until the original 15-year maturity period ends. However, you cannot extend the account beyond this period.

Any NRI PPF accounts that were extended beyond maturity stopped earning interest from October 1, 2024, and are now classified as irregular accounts.

Which is better for NRIs: NRE FD or GIFT City funds?

It depends on your investment amount and goals. NRE FDs are better if you want guaranteed, risk-free returns with complete liquidity and investments below ₹25 lakhs.

GIFT City funds work better if you have higher investable capital (minimum $150,000 for AIFs), want equity exposure, and can benefit from zero capital gains tax. GIFT City is ideal for financial planning for NRIs in the USA due to tax efficiency.

What happens to my existing PPF account now that I'm an NRI?

Your existing PPF account can continue until the original 15-year maturity period. You can keep making contributions between ₹500 and ₹1.5 lakhs annually through your NRE, NRO, or FCNR accounts. However, once the account matures, you must close it. You cannot extend the account for additional 5-year blocks like resident Indians can. The maturity proceeds will be credited to your NRO account, and you can repatriate up to USD 1 million per financial year.

Are there any completely tax-free alternatives to PPF for NRIs?

Yes, NRE Fixed Deposits and FCNR Fixed Deposits offer completely tax-free interest in India, just like PPF. Additionally, GIFT City investments provide zero capital gains tax on specified instruments. However, remember that "tax-free in India" doesn't mean tax-free globally. You must check the tax implications in your country of residence. For instance, US-based NRIs must report all global income to the IRS, even if it's tax-free in India.

Do US-based NRIs need to pay taxes on these Indian investments?

Yes, US-based NRIs must report all worldwide income to the IRS, including interest, dividends, and capital gains from Indian investments. Even though NRE FD interest is tax-free in India, it's taxable in the US. You may be able to claim Foreign Tax Credit for taxes paid in India to avoid double taxation. Indian mutual funds face PFIC rules, which can lead to complex reporting and higher taxes.

For detailed guidance, read about how to file NRI tax returns. Always consult a cross-border tax advisor familiar with both Indian and US tax laws.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.