Planning to become an NRI? Before you book your tickets and start packing your bags, there’s one thing you shouldn’t overlook—getting your finances in order.

The moment you leave India for employment abroad, your residential status changes under FEMA rules. This isn’t just a technical detail. It directly impacts your bank accounts, investments, taxes, and even the products you’re allowed to hold. For example, continuing to operate a regular savings account after becoming an NRI can attract penalties of up to ₹2 lakh. You also won’t be allowed to open new PPF accounts, though existing ones can continue until maturity.

As a first-time NRI, you’ll need to restructure your finances quickly. Your Indian income must flow through an NRO account, while your overseas earnings should be routed to an NRE account—an option that offers tax-free interest and full repatriation benefits. Add insurance updates, investment compliance, property management, and tax planning to the mix, and the transition can feel overwhelming.

That’s exactly why this checklist exists. Before you start packing, walk through this simple 7-step financial checklist to avoid costly mistakes, stay compliant with Indian regulations, and ensure a smooth financial transition into your NRI life.

Key Takeaway

Becoming an NRI isn’t just a move - it’s a financial reset. Here’s what you need to get right:

- Convert your bank accounts on time to avoid FEMA penalties

- Reassess insurance and investments for NRI compliance

- Understand how NRI taxation and DTAA benefits work

- Organize property, loans, and key documents before you move

1. Convert Your Bank Accounts to NRE/NRO

Converting regular savings accounts to Non-Resident External (NRE) or Non-Resident Ordinary (NRO) accounts should be your top priority when you become an NRI. FEMA regulations state that operating regular savings accounts after becoming an NRI can lead to penalties up to three times your account balance or a fine of ₹2 lakh.

NRE/NRO account purpose and benefits

You need to understand the basic differences between these accounts to manage your finances well:

NRE Account Purpose: NRE accounts let you deposit your foreign earnings in India. These accounts help you manage income from abroad, such as salary or business income, while staying connected to India financially. Your foreign currency gets converted to Indian Rupees when deposited.

NRO Account Purpose: NRO accounts help you manage your India-generated income - like rent, dividends, pensions, and domestic business earnings. You can handle your Indian financial obligations from overseas with these accounts.

These accounts offer financial flexibility that regular savings accounts can't provide for NRIs. Many expatriates maintain both account types - using NRE accounts for salary and NRO accounts for rental income.

How to convert existing savings accounts

You can convert your resident account to an NRO account through these steps:

- Notify your bank: Let your bank know about your residency status change through their online platform or by visiting a branch.

- Submit required documents: You'll need these documents:

- Application form for converting to an NRO account

- Identity proof (passport/Aadhaar/driving license/voter ID)

- Address proof (both Indian and overseas)

- FATCA declaration as applicable

- PAN card (mandatory for current account conversion)

- Passport-sized photographs

- Undergo verification: The bank will check everything to ensure compliance with Indian banking regulations.

- Complete the conversion: Your savings account becomes an NRO account with new banking details after verification.

Note that you can't convert your resident savings account directly to an NRE account—only to an NRO account. When your status changes to NRI, you must also convert your fixed and recurring deposits to NRO deposits.

NRE/NRO account taxation rules

Each account type has different tax implications:

NRE Account Taxation:

- India doesn't tax your interest earnings

- Principal and interest don't attract wealth tax

- You can repatriate principal and interest without tax implications

NRO Account Taxation:

- India taxes interest at 30% plus applicable surcharge and cess

- Tax Deducted at Source (TDS) applies to interest earned

- Double Taxation Avoidance Agreement (DTAA) benefits may apply

DTAA benefits can reduce your tax burden if you submit:

- A self-attested PAN copy

- Tax Residency Certificate from your current country

- Self-declaration Form 10F

DTAA can lower your tax rate from 30% to between 10-15% for most countries.

Not converting your accounts on time can cost you. The penalties include a daily fine of ₹5,000 from the first day until payment.

Make this conversion process your priority when moving abroad to stay compliant and avoid future complications.

2. Review and Update Insurance Policies

You need to check your insurance policies as a most important step before moving abroad. Your residency status change means you must take a fresh look at your insurance coverage to protect you and your family.

Term insurance for NRIs

Most life insurance companies let you keep your existing policies even after you become an NRI. Your policy stays valid with the same premium payments if you bought it before becoming an NRI. But you must tell your insurer about your residency status change because not doing so could create problems during claims.

As an NRI, you have two main ways to buy new term insurance:

- During your visit to India: You can finish all paperwork during your stay, which lets you get the same treatment as resident Indians for insurance.

- From your country of residence: This "Mail Order Business" process lets you get coverage while abroad. The maximum sum assured is limited to ₹3 crore.

Term insurance gives NRIs a most important advantage - global coverage. Your nominees will get the death benefit if something happens to you anywhere in the world. The premiums you pay qualify for tax deductions under Section 80C of the Income Tax Act, 1961, with an overall limit of ₹1.5 lakh.

Health insurance continuation or cancelation

Health insurance needs special attention because most health policies work only within India, unlike term insurance. You'll need to decide whether to keep or cancel your existing health coverage before moving.

Here's what to think about when making your decision:

- Family in India: You should keep health coverage if your family members stay in India. You can buy or continue health insurance for your parents or other family members living in India.

- Return plans: Keeping your health insurance makes sense if you plan to return to India within a few years. The waiting periods for pre-existing conditions will be over by then.

- Coverage overlap: Check if you already have complete health coverage in your host country to avoid paying twice for protection.

NRIs who keep their health insurance in India can pay premiums through NRE accounts. You might get an 18% GST refund on health insurance premiums if you meet certain conditions. These include paying premiums yearly using an NRE account and staying abroad for more than 182 days.

Insurance KYC and address update

Updating your Know Your Customer (KYC) details with insurance providers after moving is crucial. This helps keep your policies valid and makes claim settlements smooth.

Follow these steps to update your insurance KYC as an NRI:

- Tell all insurers about your residency status change and give them your new contact information.

- Submit required documents including:

- Valid identity proof (passport/Aadhaar)

- Current overseas address proof

- Recent photographs

- Updated contact details

- Update nominee details if needed, especially if your nominee stays in India.

KYC updates help insurance companies verify your identity, profession, address, and financial details. Current information ensures your insurance documentation matches your present personal and financial status.

Set up reliable payment methods for premiums to avoid policy lapses. Many insurers accept international debit/credit cards and offer auto-debit options. This way, your premiums get paid on time automatically, and you keep your coverage whatever your global location.

Check your insurance before leaving as part of your NRI financial checklist. This saves time and prevents future problems with coverage or claims.

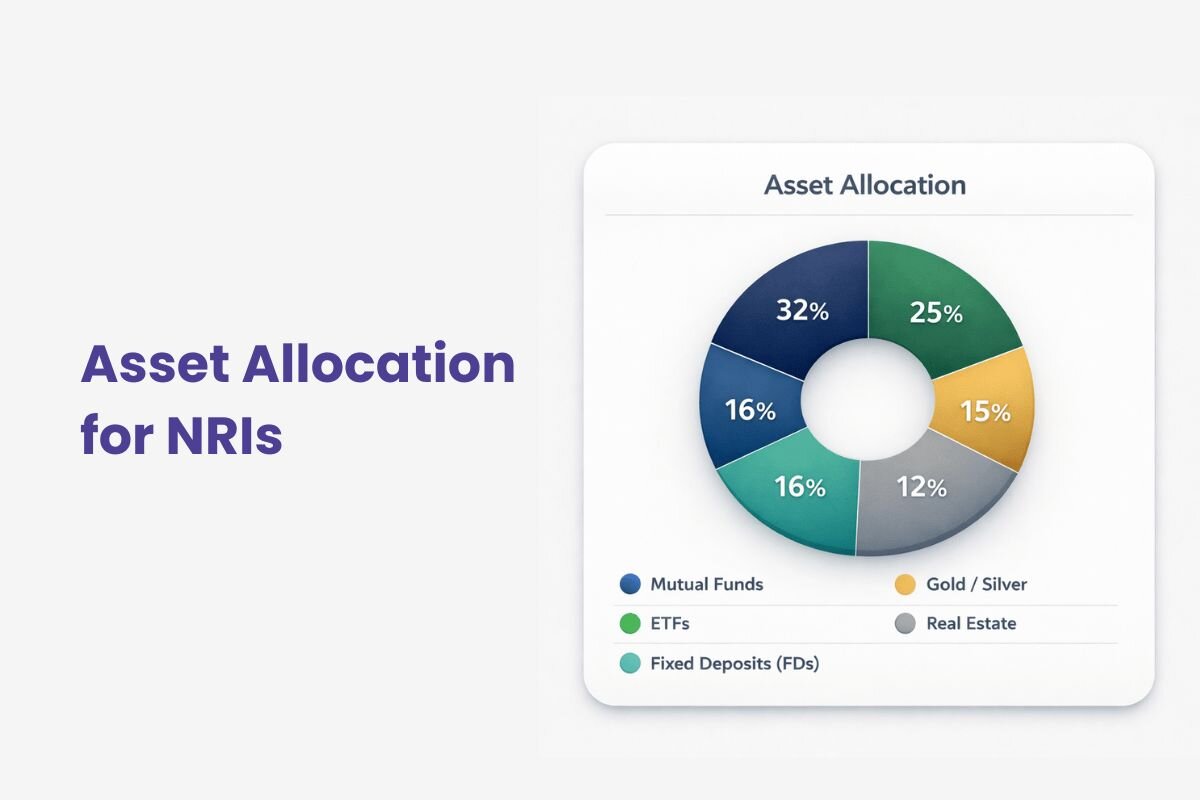

3. Reassess Your Investments

Your NRI financial checklist should prioritize reassessing your investment portfolio after updating bank accounts and insurance policies. A change in residential status means you'll need to update documentation for several investments or think about new investment options.

Mutual fund KYC and FATCA update

SEBI regulations mandate that NRIs must complete a fresh Know Your Customer (KYC) process to invest in Indian mutual funds. This step confirms your identity, address, residency, and tax status.

You have two main options to complete your NRI KYC:

- Online method: Submit documents through CAMS or KFintech platforms

- Offline method: Send notarized physical documents via courier

You'll need these essential documents:

- Passport (photo and address pages)

- Valid visa or OCI card

- PAN card

- Overseas address proof

- Recent passport-sized photograph

Your KYC process isn't complete without FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard) declarations. These frameworks ensure tax transparency between India and your country of residence. FATCA applies mainly to U.S. citizens and residents, while CRS covers NRIs from all other countries.

The KYC verification process takes 7-15 business days. You must then link your NRE/NRO account to invest in mutual funds. NRIs can choose between SIP (Systematic Investment Plan) or lump sum investments based on their financial goals.

SEBI has announced that NRIs can complete re-KYC and KYC modifications digitally from outside India, which eliminates the need to be physically present in India.

PPF and SGB eligibility for NRIs

Your investment options in government schemes face certain restrictions once you become an NRI:

Public Provident Fund (PPF):

- NRIs cannot open new PPF accounts

- You can continue existing PPF accounts opened as a resident Indian until maturity (15 years)

- NRIs cannot extend beyond the initial 15-year period

- Make contributions through NRE, NRO, or FCNR accounts with a minimum deposit of ₹500 per financial year

- PPF interest rate stands at 7.1% per annum (as of 2025)

- The entire amount goes to your NRO account at maturity

Sovereign Gold Bonds (SGB):

- The Foreign Exchange Management Act (FEMA) of 1999 prohibits NRI investments in Sovereign Gold Bonds

NRIs should look at alternatives like NRE/FCNR fixed deposits, equity and debt mutual funds, or the National Pension Scheme (NPS).

Direct equity and PIS account setup

FEMA 2000, Schedule 3 requires NRIs to set up a Portfolio Investment Scheme (PIS) account for Indian stock market investments.

The PIS lets NRIs invest in equity, debt, and other stock exchange instruments through recognized Indian stock exchanges. Here's how to set up your investment framework:

- Open an NRE or NRO account with an RBI-approved bank

- Apply for designating the account under PIS

- Set up a Demat account and trading account with a registered stockbroker

- Link these accounts together

You can also invest in stocks through mutual funds. This gives you proper diversification managed by financial professionals without direct stock ownership complexities.

U.S. and Canadian NRIs face additional considerations due to FATCA compliance. Some Asset Management Companies (AMCs) might restrict these investors from Indian mutual funds.

Make these investment updates a top priority right after your residential status changes. This helps avoid compliance issues and potential investment restrictions. Update your KYC whenever your address, bank details, or residency status changes to maintain smooth access to your investment portfolio.

4. Plan for Real Estate Management

Managing property from thousands of miles away is one of the biggest challenges in your NRI financial checklist. Your property in India needs careful planning to stay compliant with rules and keep generating value.

Power of Attorney for property handling

A Power of Attorney (POA) is a vital legal tool for NRIs who own property in India. This document lets a trusted person handle your property matters when you can't be there physically.

Special Power of Attorney gives better protection to NRIs because it limits the authority given. This reduces chances of misuse. The authority ends once the specific task is done.

You'll need to follow these steps to create a valid POA as an NRI:

- Draft a clear, detailed document specifying exact powers granted

- Get it notarized in your country of residence

- Have it attested by the Indian Consulate or Apostilled under the Hague Convention

- Register it with the Sub-Registrar's office in India after paying appropriate stamp duty

Picking your attorney-in-fact needs careful thought. A family member, trusted friend, or legal professional with no competing interests would be ideal.

Remember, you can cancel a POA anytime through a formal process, especially after completing the intended transaction. This way you retain control.

Rental income and NRO account linkage

Your rental income from Indian properties must go to a Non-Resident Ordinary (NRO) account if you're an NRI. FEMA rules say this account is the right channel to receive India-sourced income.

Here's what you should know about rental income:

- Tenants must deduct Tax at Source (TDS) before paying rent

- Your tenant is responsible for TDS deduction and deposit

- You should check if TDS shows up correctly in Form 26AS

- You'll need to pay advance tax on rental income if your tenant skips TDS

The rental income you earn in a financial year counts as "current income". You can send it abroad that same year if you've paid your taxes. Keep checking your Form 26AS, Annual Information Statement (AIS), and Taxpayer Information Summary (TIS) on the income tax portal.

If another NRI rents your property, they can pay rent to your NRE account. This works only when the rent comes from another NRE account - never from a resident's regular savings account.

Property management services are a great way to get help with rental operations. They handle everything from finding tenants and collecting rent to maintenance and paperwork.

Real estate compliance for NRIs

Your Indian real estate investments need careful documentation to stay within the rules.

Keep these documents ready for FEMA compliance:

- Identity proof (passport, PAN card)

- Address proof (both Indian and overseas)

- Property documents (title deed, sale deed)

- Bank statements related to property transactions

- Tax returns showing property income

Current income like rent can be sent abroad freely. But capital income from property sales has a USD 1 million limit per financial year. Property sale money must first go to your NRO account before you can send it abroad.

Good documentation makes everything easier. Store your property papers, tax returns, and maintenance records in digital lockers so you can access them from anywhere.

India will tax your rental income from properties there. So you'll need to file Income Tax Returns if your total income (including rent) crosses the minimum exemption limit or if you have any tax due or refund after TDS.

Following these property management steps in your moving abroad checklist will help keep your investments legal and profitable while you're overseas.

5. Manage Existing Loans and EMIs

Loan management plays a vital role in your NRI financial transition. Your loan accounts need special attention since they involve ongoing commitments that must continue naturally despite your residency status change.

Home loan repayment from NRO account

NRIs with existing home loans in India need to adapt their repayment process to their new status. You can pay your home loan EMIs through either your NRE or NRO account. Most banks will only accept EMI payments in foreign currency through an NRI account.

NACH or ECS are the quickest ways for NRIs since these systems work smoothly after the original setup. Many NRIs prefer standing instructions because they provide both convenience and control over payments.

Note that your foreign currency income must go to your NRE account before conversion to rupees at the widespread exchange rate. You can then set up automatic payments to your loan account.

Should you prepay your loan?

Your decision to prepay loans as an NRI depends on several factors. Prepayment offers great advantages, mainly through interest savings. Prepayments during the original years of your loan term can lead to substantial savings since much of your EMIs goes toward interest payments during this period.

To cite an instance, see this scenario: A home loan of ₹50,00,000 at 7% interest over 20 years, with a one-time prepayment of ₹5,00,000 after 5 years would reduce your total interest by approximately ₹11,03,560 and shorten your loan term by about 3 years.

In spite of that, these factors need consideration before prepaying:

- Prepayment penalties: Your loan agreement might have charges for early repayment that could offset interest savings

- Loss of liquidity: Surplus funds used for prepayment might deplete emergency reserves

- Tax implications: You might lose tax benefits on interest payments upon prepayment

- Investment alternatives: Your prepayment funds could yield higher returns elsewhere

Credit card loans usually have no prepayment penalty and make good financial sense to pay off completely.

Loan documentation for NRIs

Proper documentation for existing loans helps you comply with banking regulations. Let your lender know about these changes after becoming an NRI:

- Your NRI status change notification

- Updated KYC forms

- Passport and visa copies (valid work visa/permit)

- Proof of income (salary slips or foreign income documentation)

- Bank statements for NRE and NRO accounts

- Foreign Account Tax Compliance Act (FATCA) declaration or Common Reporting Standard (CRS) as applicable

You might want to establish a Power of Attorney (POA) for a trusted person to handle documentation if you can't do it personally. Some banks might need the POA in their specific format with extra verification.

New loans as an NRI require additional documents compared to resident Indians. These include passport copies, visa documentation, employment contracts, and overseas address proof.

Proper loan management is a key part of your NRI financial checklist. Good organization of repayment mechanisms and documentation helps maintain financial stability during your overseas stay.

6. Understand NRI Taxation Rules

Tax implications are the foundations of your financial planning as an NRI. Indian tax laws have different rules for NRIs compared to residents. These rules create opportunities and obligations you just need to understand.

Income taxable in India for NRIs

Your tax liability depends on the source of income, not citizenship. NRIs pay taxes only on income earned or received in India. Foreign income stays exempt from Indian taxation. Here's what gets taxed:

- Salary received for services performed in India

- Rental income from Indian properties

- Capital gains from selling Indian assets

- Interest from NRO accounts

NRE accounts and FCNR deposits offer complete tax exemption. Once you become an NRI, Indian taxes apply only to your India-sourced income, not worldwide earnings.

Double Taxation Avoidance Agreement (DTAA)

India has DTAAs with more than 90 countries to prevent double taxation on the same income. These treaties help you through two methods:

- Exemption method: Income taxed in one country stays exempt in the other

- Tax credit method: Tax paid in one country reduces tax liability in the other

You'll need these documents to claim DTAA benefits:

- Tax Residency Certificate from your current country

- Self-declaration in Form 10F

- Self-attested PAN copy

These documents can reduce your tax rate from 30% to 10-15% for most countries. To cite an instance, see dividend income from U.S. stocks - the DTAA between India and the U.S. sets which country taxes this income and the applicable rate.

Advance tax and ITR filing for NRIs

NRIs must pay advance tax if their estimated tax liability exceeds ₹10,000 after TDS. The payment schedule has four installments:

Missing these deadlines leads to interest charges under Sections 234B and 234C.

NRIs usually file these Income Tax Returns (ITR):

- ITR-2: For income from salary, property, or capital gains

- ITR-3: For business or profession income

You must file returns when your Indian income crosses ₹2.5 lakh or to claim TDS refunds. July 31st is the standard filing deadline, which extends to October 31st if you need an audit.

Tax compliance should top your NRI financial checklist. This helps you avoid penalties and maximize benefits under applicable treaties.

7. Organize Key Documents and Digital Access

Documentation is the foundation of your NRI transition experience. Your access to important paperwork becomes vital after restructuring financial accounts to operate smoothly from overseas.

Compile financial and identity documents

These important documents need to be gathered before you relocate:

- Identity verification: Valid passport copy (accepted as proof of identity), PAN card (mandatory for non-face-to-face cases)

- Residency status proof: Visa, PIO Card, foreign passport with PIO declaration, or resident permit

- Address verification: Both Indian and overseas address proofs including utility bills, driving license, or bank statements

- Tax documentation: Complete FATCA-related details on application forms

Seafarers should keep their Continuous Discharge Certificate with contract letters to prove non-residency status.

Use of digital lockers for safe storage

DigiLocker, the government's cloud-based document repository, provides secure storage for important paperwork. Citizens receive 1GB free cloud space to store:

- Issued documents: E-documents directly from government sources

- Uploaded documents: Personal files (maximum 10MB per file in PDF, JPEG or PNG formats)

You can access Aadhaar, PAN, driving license, and vehicle registration certificates anytime after signing up with your mobile number.

Nominee updates and mobile number setup

NRI account's nominee updates help prevent transfer complications. Nominees act as fund custodians, unlike legal heirs who are end beneficiaries. Your nominees can be:

- Spouse, children, or parents

- Any relatives (Indian residents, NRIs, or minors)

Minor nominees need an appointed guardian until they turn 18. IDFC FIRST Bank allows one nominee per NRI account. The nominee's details should stay updated and they should know about their designation.

Conclusion

Your transition to becoming an NRI needs careful financial planning and quick action. This financial checklist will help you stay compliant with Indian regulations as you build your life abroad. Taking care of these money matters before leaving will save you from penalties and give you a strong start to your life overseas.

Converting your bank accounts should be your first priority. Regular savings accounts can lead to heavy penalties after becoming an NRI. You'll need to review your insurance policies to protect yourself and family members staying in India. Your investment portfolio needs a fresh look too since NRI status affects what you can invest in.

Property management needs extra attention as real estate makes up much of your Indian assets. You'll need a reliable system to handle rental income and stay FEMA compliant. EMI payments for existing loans must go through NRE or NRO accounts to avoid issues.

Your tax situation changes completely as an NRI. You should know which income gets taxed in India and how to use DTAA benefits. This will help you pay less tax while staying compliant. Keep all your documents organized so you can manage your finances smoothly from anywhere.

The checklist might look overwhelming now. Breaking it into smaller steps makes everything easier to handle. Start with the urgent tasks like changing your accounts and updating insurance. Then move on to other things step by step. Getting help from financial advisors who know NRI finances can give you specific guidance for your situation.

Good preparation before you leave will let you focus on your new life abroad without worry. Staying financially compliant helps you keep your Indian connections strong while building your international career. This complete financial plan will help you become an NRI without facing unexpected rules or penalties along the way.

Frequently Asked Questions

What are the key steps for NRIs to manage their finances when moving back to India?

The key steps include converting bank accounts to NRE/NRO, reviewing insurance policies, reassessing investments, planning real estate management, managing existing loans, understanding NRI taxation rules, and organizing important documents. It's crucial to start this process early and consult with financial experts familiar with NRI regulations.

How should NRIs handle their existing bank accounts when becoming non-residents?

NRIs must convert their regular savings accounts to Non-Resident External (NRE) or Non-Resident Ordinary (NRO) accounts. This is mandatory under FEMA regulations, and failure to do so can result in penalties. NRE accounts are for foreign earnings, while NRO accounts are for Indian income sources.

What are the tax implications for NRIs on their Indian income?

For NRIs, only income earned or received in India is taxable. This includes salary for services performed in India, rental income from Indian properties, capital gains from selling Indian assets, and interest from NRO accounts. Income from NRE accounts and FCNR deposits is tax-exempt. Double Taxation Avoidance Agreements (DTAAs) can help reduce tax liability.

Can NRIs continue their existing investments in India?

NRIs need to reassess their investment portfolio. They must complete a fresh KYC process for mutual funds and update FATCA declarations. NRIs cannot open new PPF accounts but can continue existing ones until maturity. For direct equity investments, setting up a Portfolio Investment Scheme (PIS) account is mandatory.

About the Author

By Prakash

CEO & Founder of InvestMates

Prakash is the CEO & Founder of InvestMates, a digital wealth management platform built for the global Indian community. With leadership experience at Microsoft, HCL, and Accenture across multiple countries, he witnessed firsthand challenges of managing cross-border wealth. Drawing from his expertise in engineering, product management, and business leadership, Prakash founded InvestMates to democratize financial planning and make professional wealth management accessible, affordable, and transparent for every global Indian.